Accident Year Vs Calendar Year

Accident Year Vs Calendar Year - Web accident year vs calendar year month calendar printable. Web updated october 1, 2019. Web combined ratio formula. Web two other cost accounting terms used in sorting loss experience are calendar year and policy (underwriting) year. Web the policy year results provide the most exact matching of premium and losses, but the latest policy year is older than the latest accident year. Web accident year (ay), development year (dy), and payment/calendar year (cy). Web by contrast, the calendar year experience measures the performance of all policies held by an insurer, regardless of when those policies were initiated. Per calendar year, often abbreviated as pcy, is a term used. Accident year experience is a term used in the insurance industry to describe the premiums earned and losses incurred during a specific period of time, typically 12. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have. Reserve reductions from previous years and prior investments maturing can influence. Web two basic methods exist for calculating calendar year loss ratios. Per calendar year, often abbreviated as pcy, is a term used. The calendar year cr is what ncci measures and. Web accident year vs calendar year insurance terminology actuarial 101, two primary calculation methods exist:. Web accident year vs calendar year month calendar printable. Web accident year (ay), development year (dy), and payment/calendar year (cy). Reserve reductions from previous years and prior investments maturing can influence. Web combined ratio formula. Web by contrast, the calendar year experience measures the performance of all policies held by an insurer, regardless of when those policies were initiated. A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Accident year experience is a term used in the insurance industry to describe the premiums earned and losses incurred during a specific period of time, typically 12. Web accident year data refers to a method of. Web combined ratio formula. What is calendar year experience? Web two basic methods exist for calculating calendar year loss ratios. Web what is the difference between accident year experience (aye) and calendar year experience (cye)? A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Web two other cost accounting terms used in sorting loss experience are calendar year and policy (underwriting) year. Web accident year (ay), development year (dy), and payment/calendar year (cy). The combined ratio formula is cr = (losses + expenses) / earned premium. Web also known as an underwriting year experience or accident year experience, it is the difference between the. Web combined ratio formula. The accident year experience or accident year is any 12. Web learn the differences among policy year, accident year, and calendar year for workers compensation insurance. Most reserving methodologies assume that the ay and dy directions are independent. Calendar year data track claims paid. Reserve reductions from previous years and prior investments maturing can influence. Web two other cost accounting terms used in sorting loss experience are calendar year and policy (underwriting) year. They are the standard calendar year loss ratio and the calendar year loss ratio by policy year contribution. Web updated october 1, 2019. Web the policy year results provide the most. Web updated october 1, 2019. Per calendar year, often abbreviated as pcy, is a term used. Reserve reductions from previous years and prior investments maturing can influence. Reserve reductions from previous years and prior investments maturing can influence. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will. Web accident year vs calendar year insurance terminology actuarial 101, two primary calculation methods exist:. A calendar year experience, also referred to as an underwriting year experience or accident year experience, is a crucial metric in the insurance sector. Web updated october 1, 2019. Web combined ratio formula. Web accident year data refers to a method of arranging loss and. Web what is the difference between accident year experience (aye) and calendar year experience (cye)? Web by contrast, the calendar year experience measures the performance of all policies held by an insurer, regardless of when those policies were initiated. Reserve reductions from previous years and prior investments maturing can influence. Web the 87% ratio is based on calendar year figures. Web hence, the standard calendar year approach is superior when the amount of incurred loss adequacy has not changed because it will then match the accident year loss ratio exactly. Per calendar year, often abbreviated as pcy, is a term used. The calendar year cr is what ncci measures and. Web also known as an underwriting year experience or accident year experience, it is the difference between the premiums earned and the losses that have. Reserve reductions from previous years and prior investments maturing can influence. The combined ratio formula is cr = (losses + expenses) / earned premium. Web by contrast, the calendar year experience measures the performance of all policies held by an insurer, regardless of when those policies were initiated. The accident year experience or accident year is any 12. Policy year data reflects an actuarial perspective of what has happened to a policy over time, while accident year data reflects a financial. Web accident year vs calendar year insurance terminology actuarial 101, two primary calculation methods exist:. Accident year experience (aye) focuses on. Web the 87% ratio is based on calendar year figures and not accident year. What is calendar year experience? Web the policy year results provide the most exact matching of premium and losses, but the latest policy year is older than the latest accident year. Web accident year (ay), development year (dy), and payment/calendar year (cy). Reserve reductions from previous years and prior investments maturing can influence.

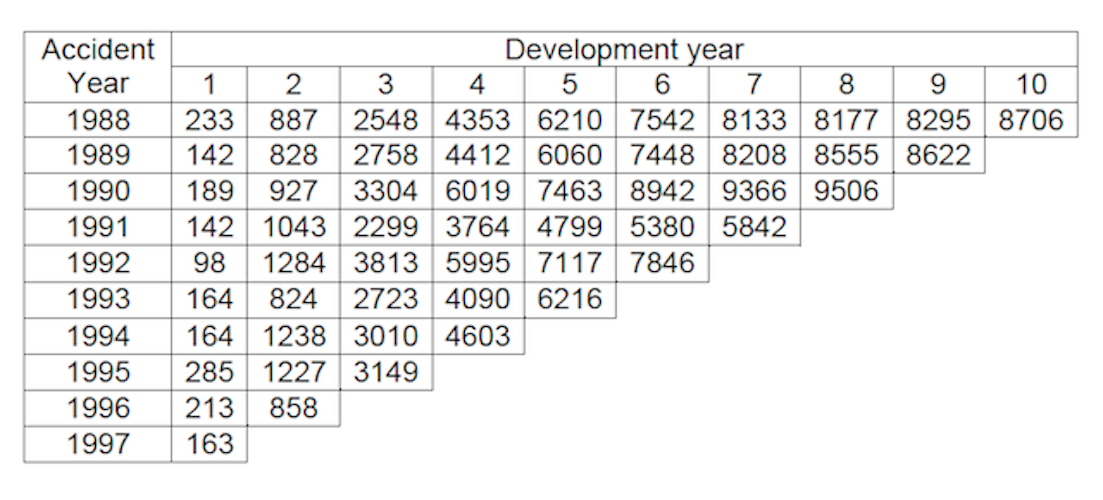

Claims_reserving

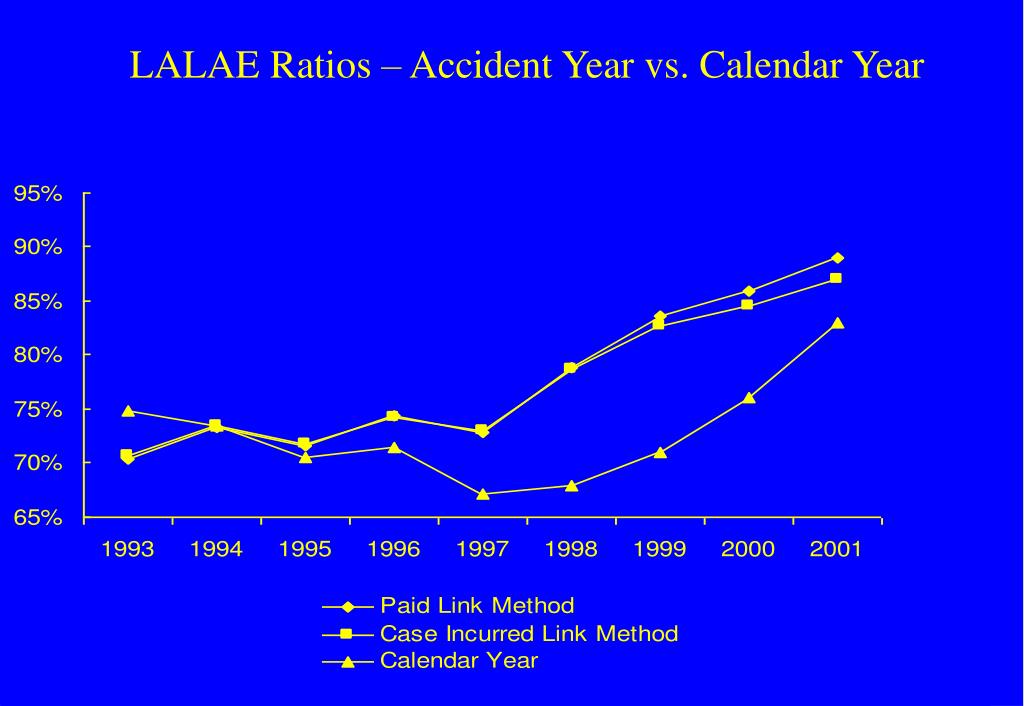

Combined Ratio Difference Debate Calendar vs. Accident Year

Accident Year Experience AwesomeFinTech Blog

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Trends ASAP by Actuarial Services and Programs Evaluating Changes in

Accident Year Vs Calendar Year

Policy Year, Calendar Year, & Accident Year Insurance Terminology

PPT ISO Study of Industry Loss and Loss Adjustment Expense Reserve s

Car Accident Deaths Per Year Us / How Many Car Accidents Per Year In

Ministry of Road Transport and Highways released the ‘Road Accidents in

Web Accident Year Vs Calendar Year Month Calendar Printable.

Web Accident Year Data Refers To A Method Of Arranging Loss And Exposure Data Of An Insurer Or Group Of Insurers Or Within A Book Of Business, So That All Losses Associated With.

Calendar Year Data Track Claims Paid.

Web Two Other Cost Accounting Terms Used In Sorting Loss Experience Are Calendar Year And Policy (Underwriting) Year.

Related Post: