Asc 842 Template

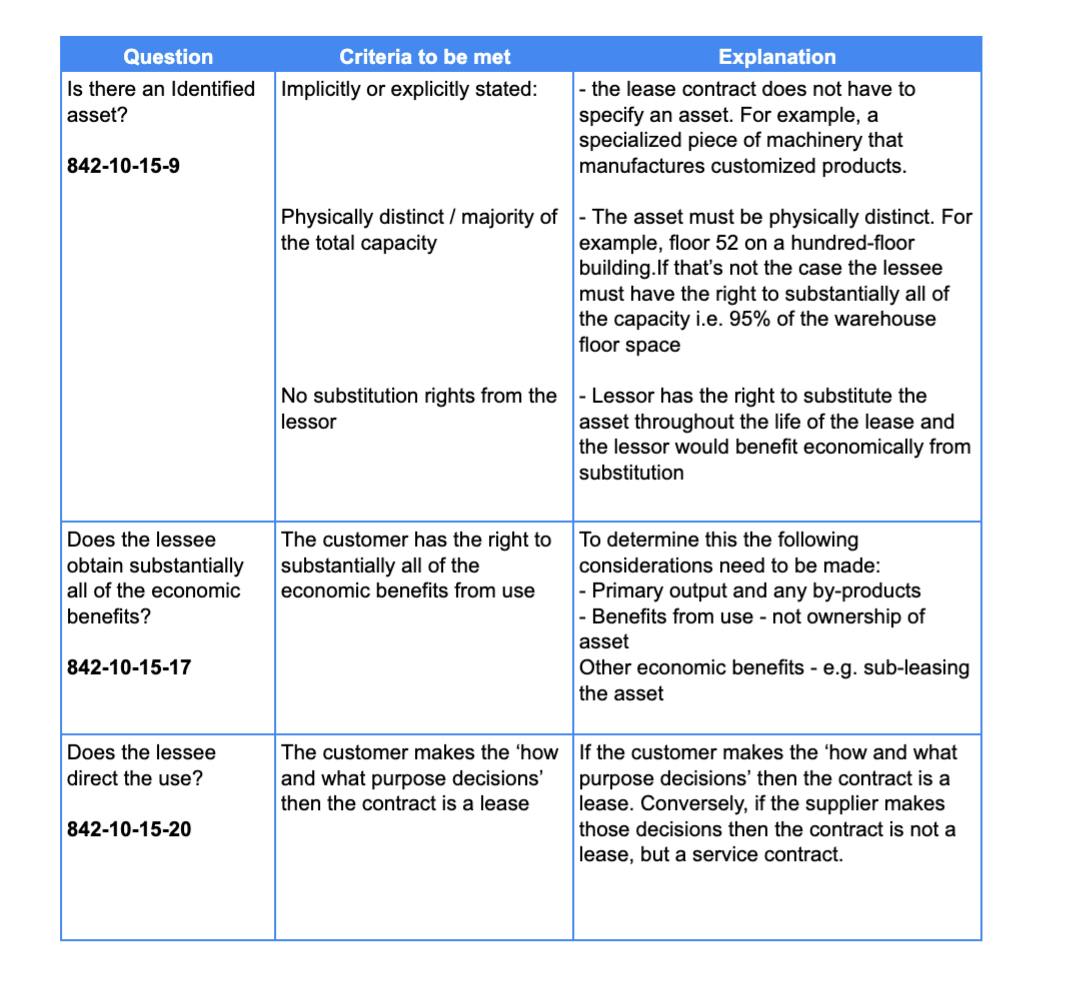

Asc 842 Template - Sign up for our newsletter. Web asc 842 requires lessees to bring all leases on the balance sheet. Common control arrangements, on november 30, 2022, and received 29 comment letters in response to the amendments in that proposed update. Operating leases or finance leases. In the new excel spreadsheet and name the five columns: (“the company”) will adopt accounting standards update (asu) no. Web asc 842 transition disclosure template full text. Web asc 842 review template. Lessee’s financial statement presentation of leasesasc 842: Asc 842 lease accounting policy. Download this asc 842 lease accounting spreadsheet template as we walk you through creating an operating lease schedule that meets the requirements under asc 842, whether financing or operating. Asc 842 leases calculation template. The fasb’s new standard on leases, asc 842, is effective for all entities. Web under the asc 842 lease accounting standard, leases are classified as either:. Lessee’s financial statement presentation of leases. Transitioning to specialized lease accounting software like visual lease offers several advantages over excel templates: Lease accounting focus areas—watch the videos. Download this asc 842 lease accounting spreadsheet template as we walk you through creating an operating lease schedule that meets the requirements under asc 842, whether financing or operating. Web how to calculate. Web how to calculate your lease amortization. Web by visual lease september 8, 2021 lease accounting. Web asc 842 review template. Lessee’s financial statement presentation of leases. Lease accounting software automates data entry and calculations, reducing the risk of errors and ensuring compliance with. Web asc 842 review template. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Transitioning to specialized lease accounting software like visual lease offers several advantages over excel templates: So what does this mean? At a high level, this is a document that outlines an organization’s policies and procedures. Among the many changes introduced with asc 842 and ifrs 16, the new lease accounting standards, is the lease accounting policy memo. Lessee’s financial statement presentation of leases. By clicking on the accept button, you confirm that you have read and understand the fasb website terms and conditions. Lease accounting focus areas—watch the videos. For a comprehensive discussion of the. Lg 10, effective date and transition the content in lg 10 was moved to lg 9. Sign up for our newsletter. The free excel template from contavio helps you understand the leases rules and shows you how to calculate contracts. Operating leases or finance leases. Web asc 842 lease amortization schedule templates int excel | free downloaded. Leases guide (pdf 3.7mb) pwc is pleased to offer our updated leases guide. Web most companies have recently adopted asc 842, leases. Lessee’s financial statement presentation of leases. The fasb’s new standard on leases, asc 842, is effective for all entities. Create five columns within the excel worksheet. With our excel template, you will be guided on how to calculate your lease amortization schedules for both lease types. Web asc 842 lease amortization schedule templates in excel | free download. The only exception is if at lease commencement, the lease term of 12 months or less. Among the many changes introduced with asc 842 and ifrs 16, the. In the new excel spreadsheet and name the five columns: Transitioning to specialized lease accounting software like visual lease offers several advantages over excel templates: Web excel templates vs lease accounting software for asc 842. Sign up for our newsletter. Asc 842 led to changes in the accounting of lease contracts and is a challenge for many companies. Web asc 842 lease amortization schedule templates in excel | free download. Lessee’s financial statement presentation of leases. The fasb’s new standard on leases, asc 842, is effective for all entities. The only exception is if at lease commencement, the lease term of 12 months or less. Web by visual lease september 8, 2021 lease accounting. Web the overall disclosure objective for lessees in fasb asc 842 is to provide information that enables users of the financial statements to assess the effects leases have on the amount, timing, and uncertainly of cash flows. Web last updated on june 22, 2023 by morgan beard. Asc 842 lease accounting policy. Asc 842 leases calculation template. Jun 15, 2021 · 213.7 kb download. The board issued proposed accounting standards update, leases (topic 842): Web asc 842 lease amortization schedule templates in excel | free download. Operating leases are those where the terms do not mimic the purchase of an asset, while finance leases have characteristics that are similar to purchasing an underlying asset. Create five columns within the excel worksheet. It's essentially like accounting for all your leases as if they were capital leases under asc 840. (“the company”) will adopt accounting standards update (asu) no. Each row will include the date of the payment and the payment amount for the life of the lease. Lg 10, effective date and transition the content in lg 10 was moved to lg 9. The fasb’s new standard on leases, asc 842, is effective for all entities. Lessee’s financial statement presentation of leasesasc 842: Under asc 842, an operating lease you now recognize:

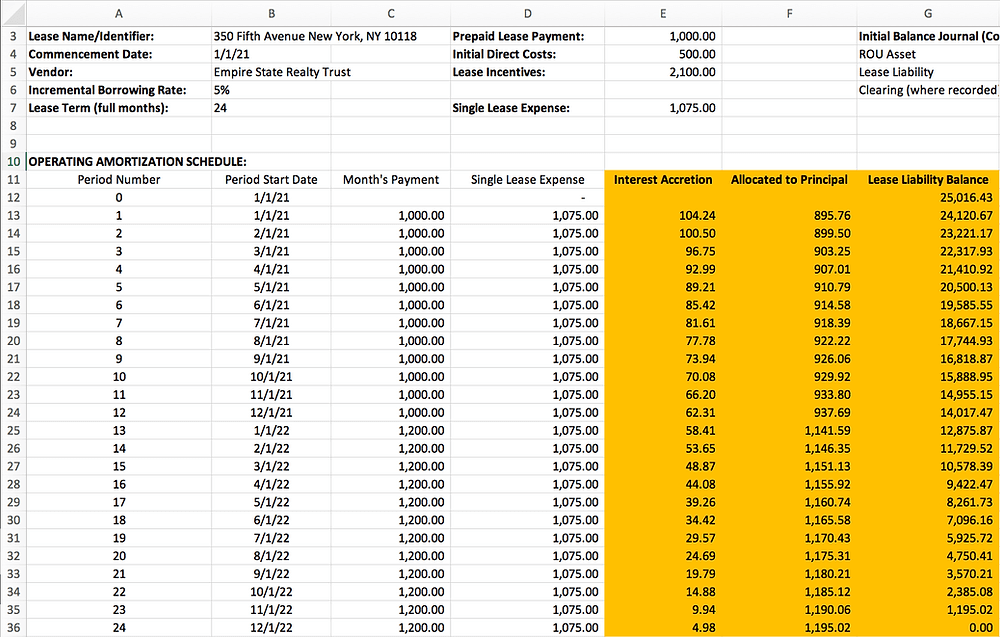

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Asc 842 Lease Amortization Schedule Template

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

ASC 842 Lease Classification Template For Lessees

Asc 842 Lease Amortization Schedule Template

Asc 842 Lease Amortization Schedule Template

15 Things to know about FASB ASC 842 ASC 842 basics

Asc 842 Excel Template Free

Asc 842 Excel Template Free

Asc 842 Lease Accounting Excel Template

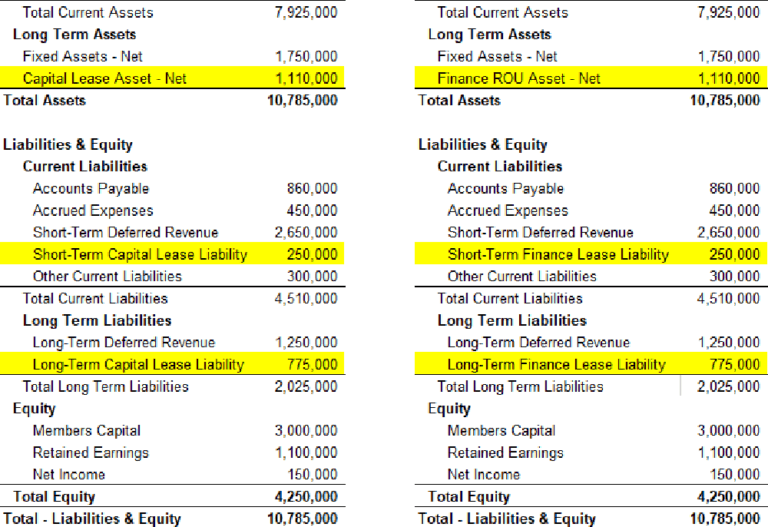

Asc 842 Lease Accounting Balance Sheet Examples.

The Federal Accounting And Standards Board (Fasb) Created The New Lease Accounting Standard (Asc 842), Which Has Raised Questions About How Balance Sheets Are Affected.

Under Asc 842, Operating Leases And Financial Leases Have Different Amortization Calculations.

Asc 842 Led To Changes In The Accounting Of Lease Contracts And Is A Challenge For Many Companies.

Related Post: