Business Valuation Template

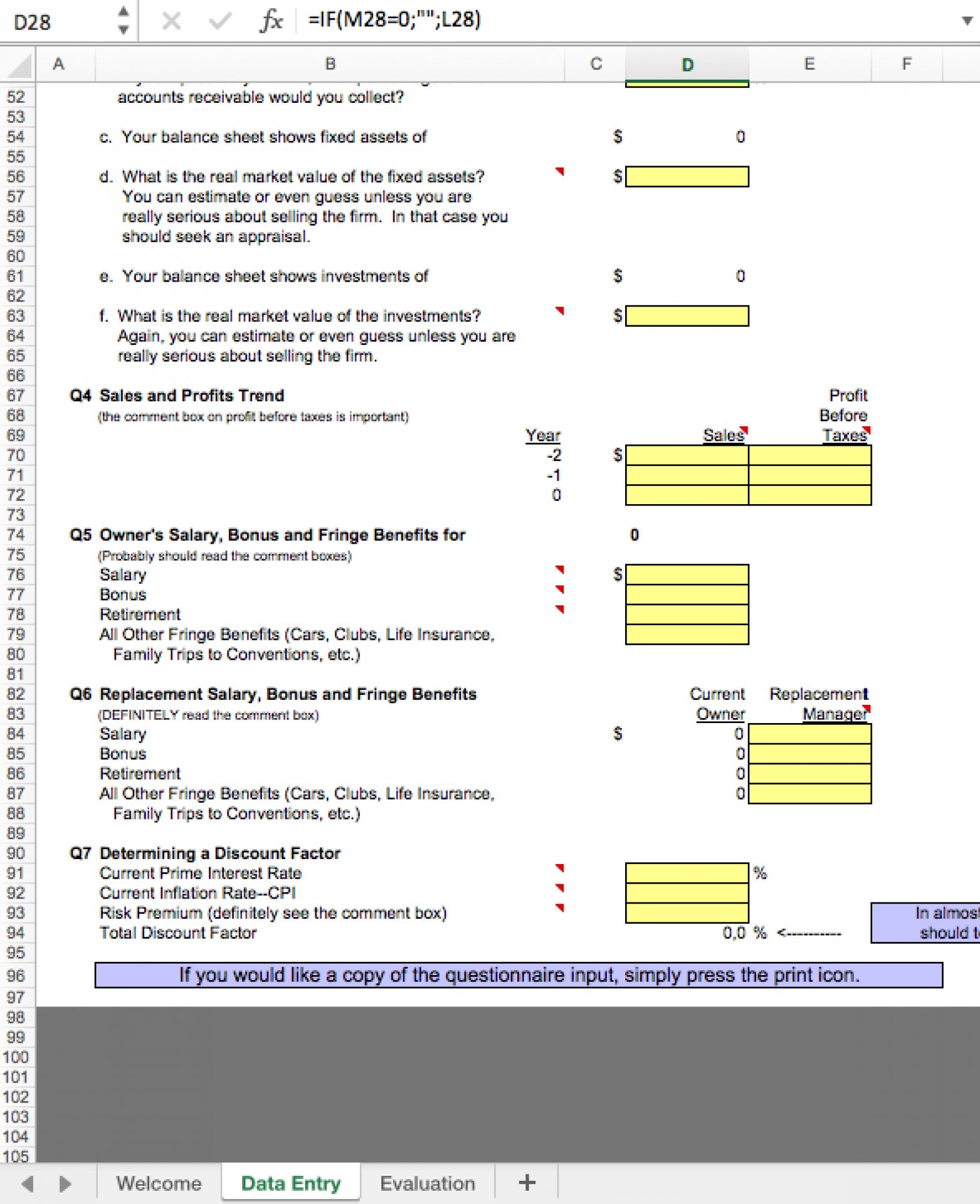

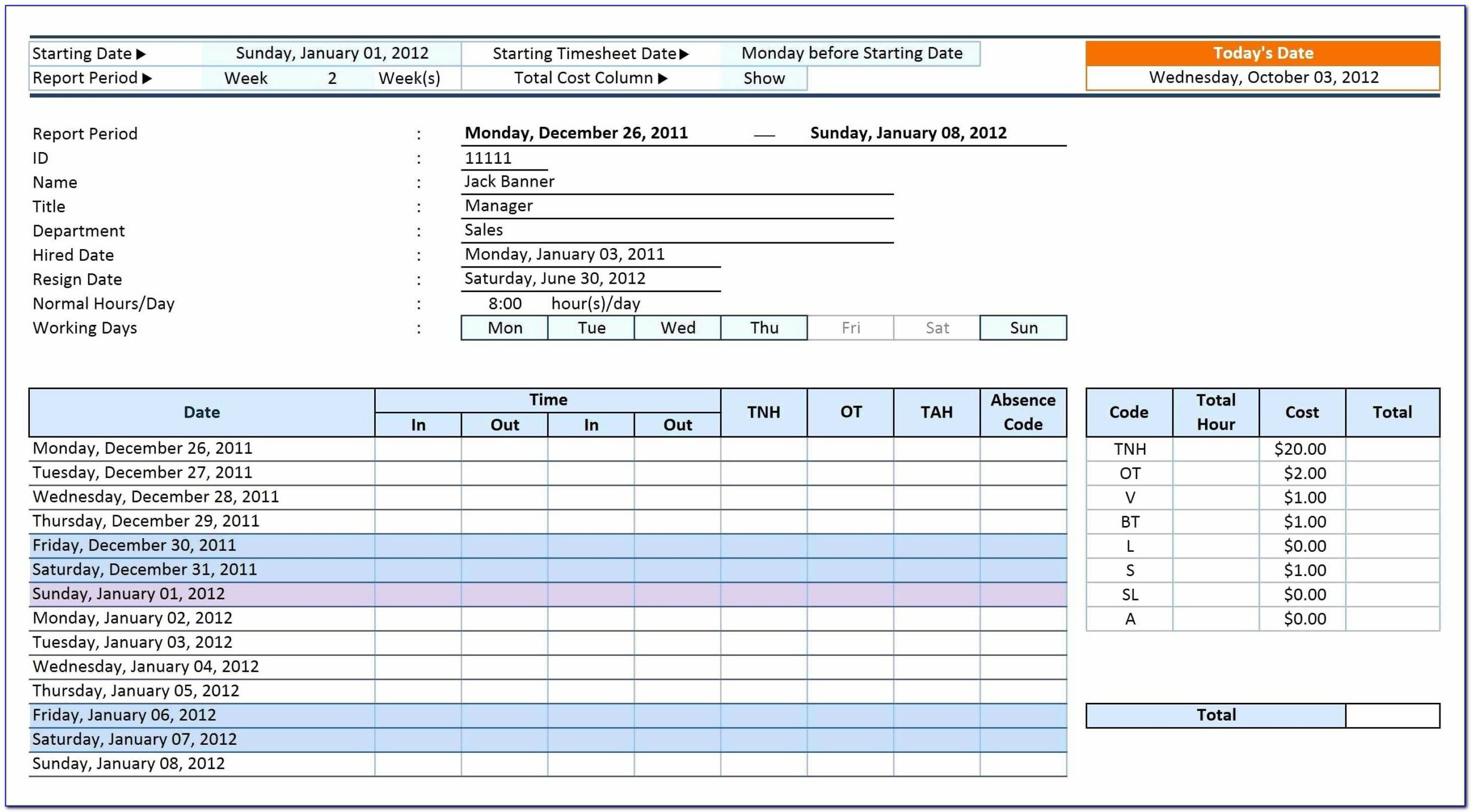

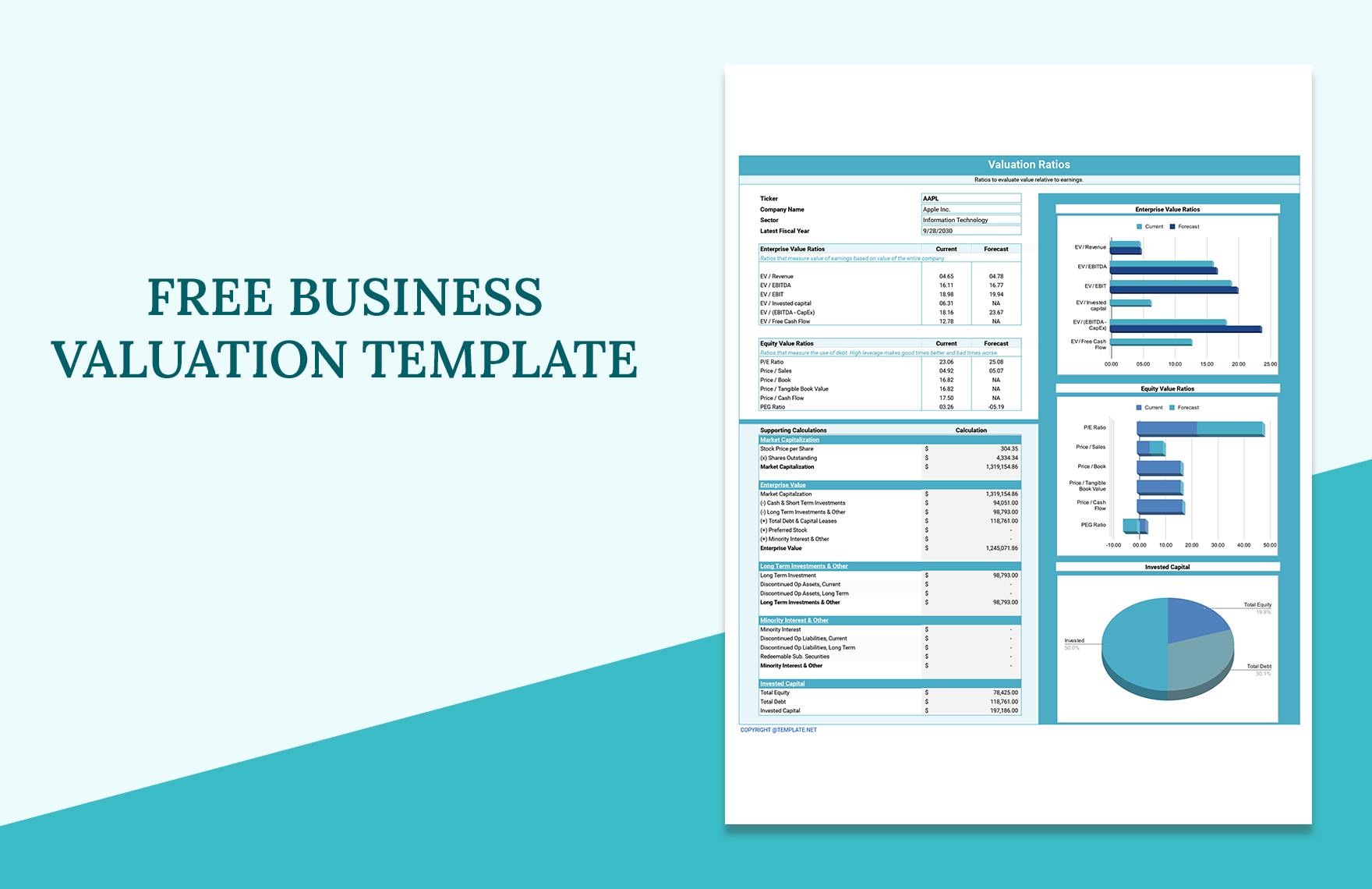

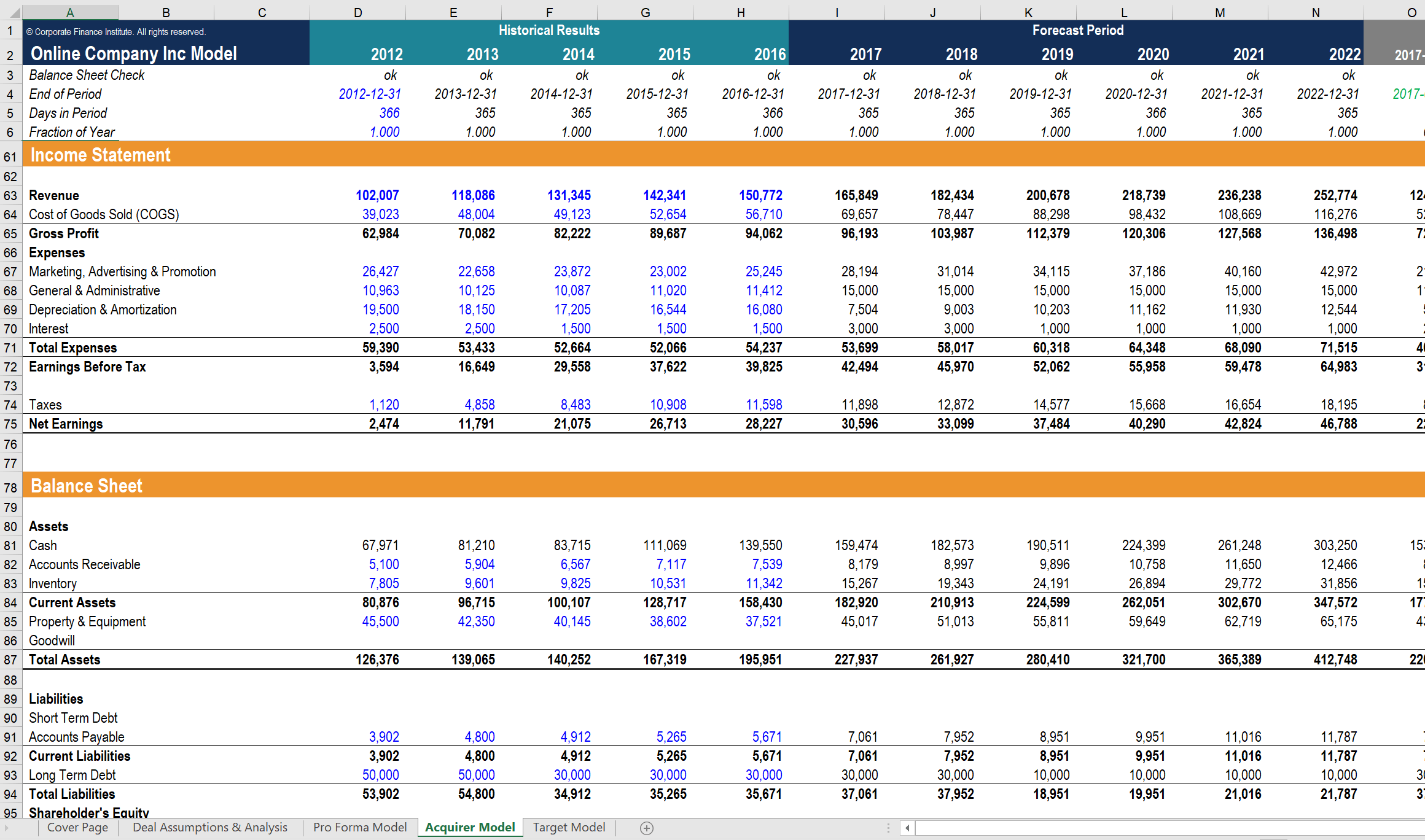

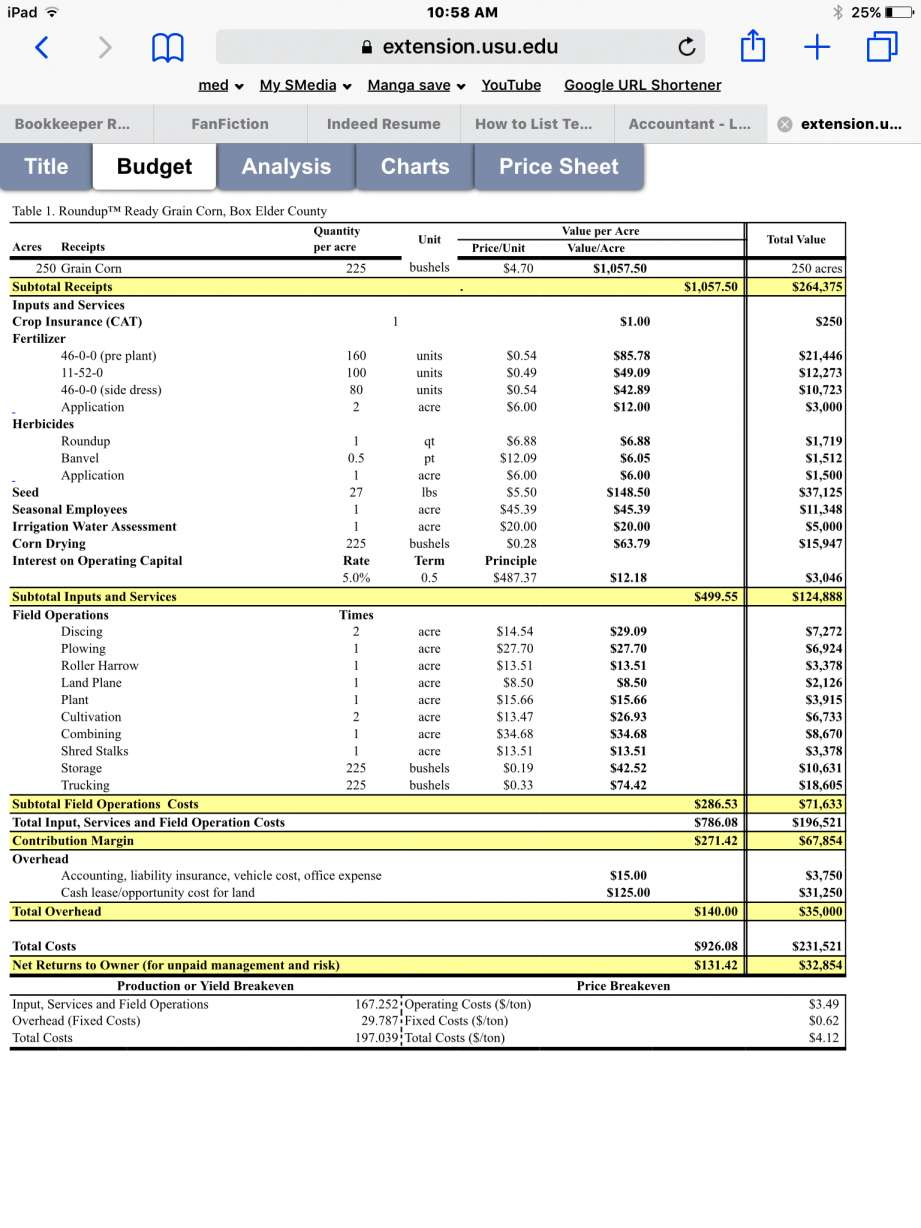

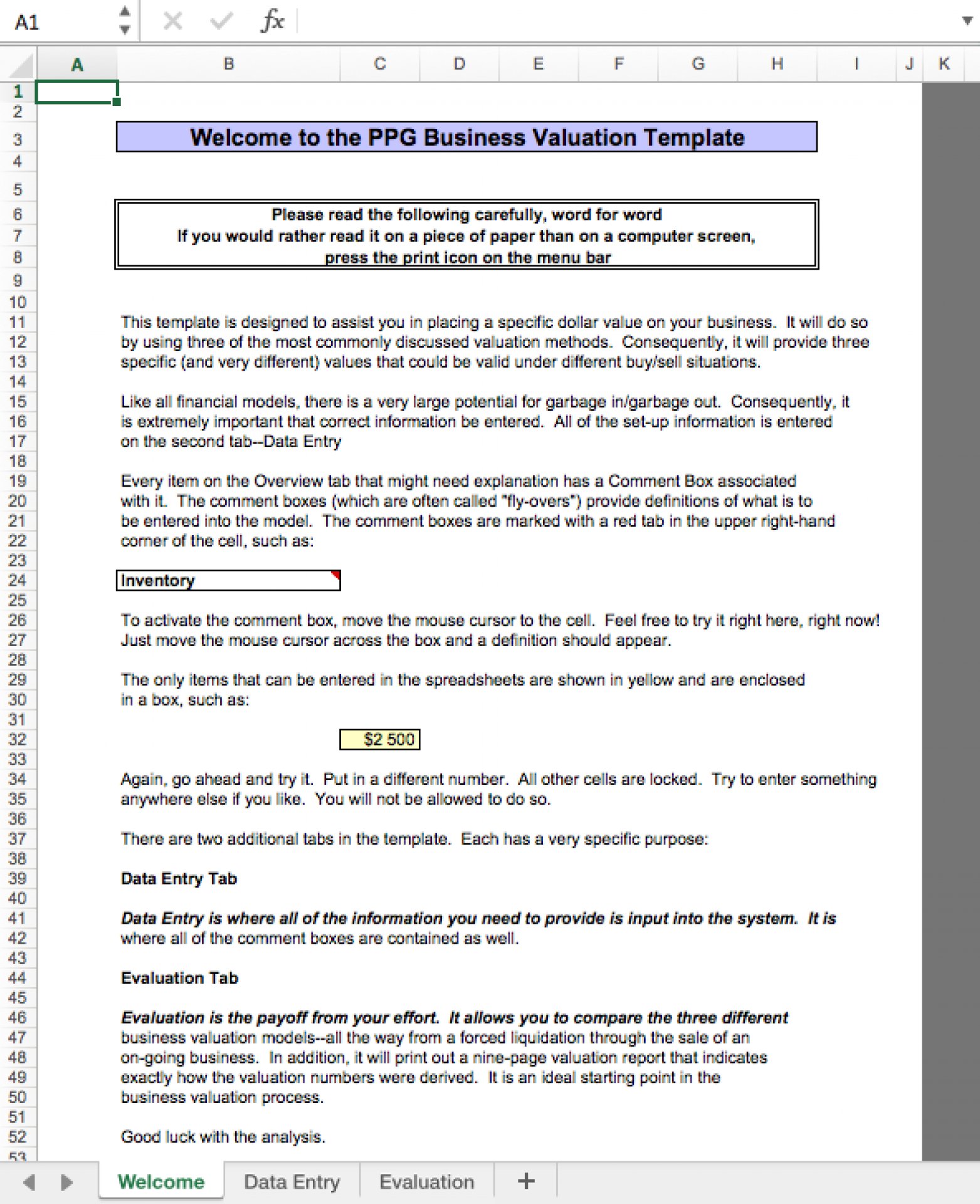

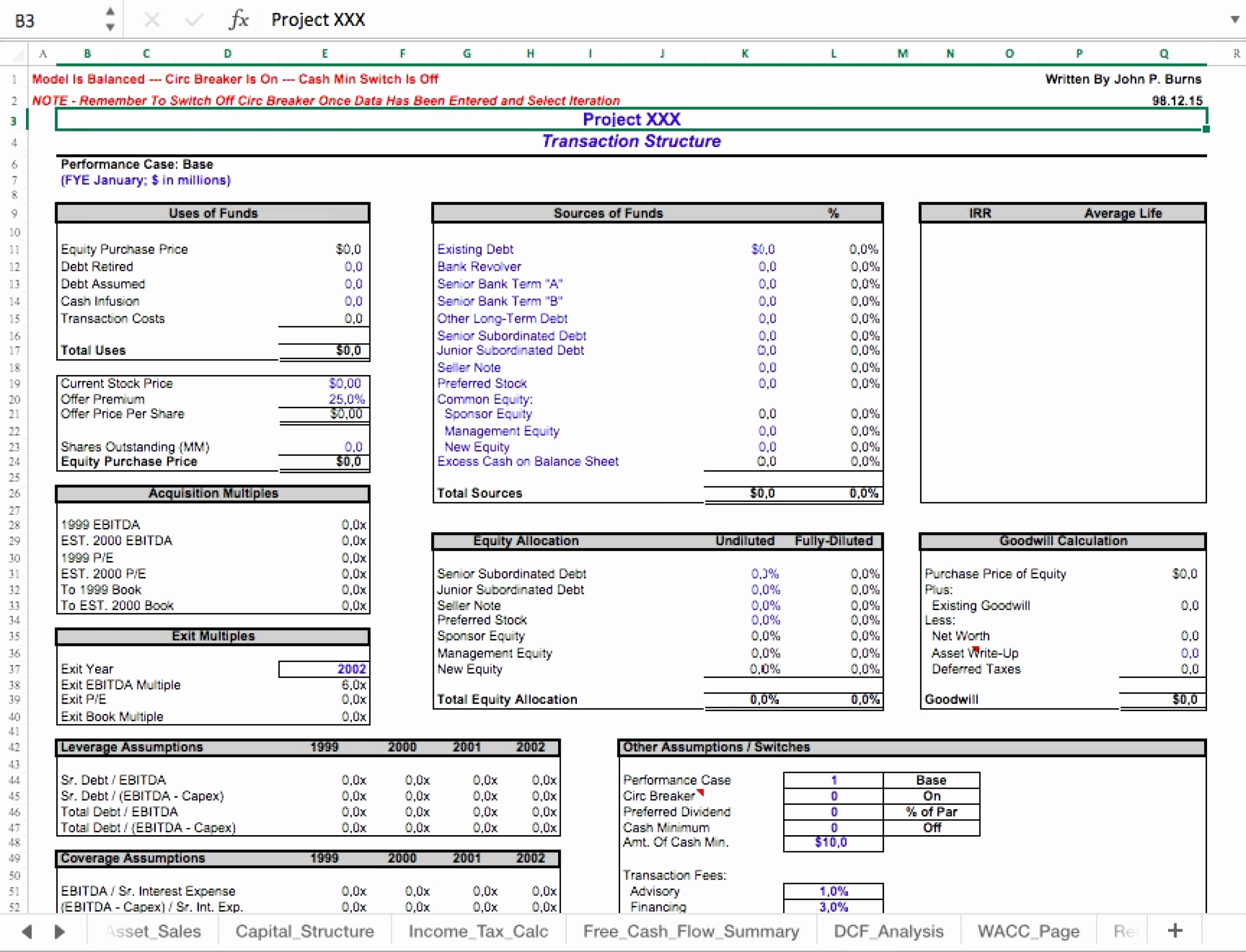

Business Valuation Template - Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. The sample table of contents below shows all the information that might need to be covered in a report. Valuation assumptions are logically set out to provide flexibility for business dynamics and facilitate input flow. (click here to download your excel template now.) this excel template uses a market approach by looking at comparable public company and comparable transaction multiples. Web excel and google sheets template. Gather financial reports and business history details. Web valuation report template. Calculate different revenue scenarios, such as pessimistic and optimistic, for insights into upside and risk. What is valuation modeling in excel? Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed business investments and entire companies. The sample table of contents below shows all the information that might need to be covered in a report. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. Gather previous years' financial statements. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based. Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. It will provide you with an estimate of the value of your business give or take 15 percent. Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary. Gather financial reports and business history details. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods.. (click here to download your excel template now.) this excel template uses a market approach by looking at comparable public company and comparable transaction multiples. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost. Calculate different revenue scenarios, such as pessimistic and optimistic, for insights into upside and risk. (click here to download your excel template now.) this excel template uses a market approach by looking at comparable public company and comparable transaction multiples. What is valuation modeling in excel? Web maximize your business value with our comprehensive free business valuation template, a strategic. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. Valuation assumptions are logically set out to provide flexibility for business dynamics and facilitate input flow. Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary earnings), multiplied by an industry multiple. (click here to. Valuation assumptions are logically set out to provide flexibility for business dynamics and facilitate input flow. Web excel and google sheets template. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc). Gather previous years' financial statements. What is valuation modeling in excel? Web excel and google sheets template. Improve your business valuation process with our comprehensive template, offering financial analysis, value assessment, reporting, and client delivery. Web a business valuation calculator helps buyers and sellers determine a rough estimate of a business’s value. The sample table of contents below shows all the information that might need to be covered in a report. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount. Web excel and google sheets template. Valuation assumptions are logically set out to provide flexibility for business dynamics and facilitate input flow. (click here to download your excel template now.) this excel template uses a market approach by looking at comparable public company and comparable transaction multiples. What is valuation modeling in excel? Two of the most common business valuation. Web maximize your business value with our comprehensive free business valuation template, a strategic tool for reliable financial analysis & forecasting. Web valuation report template. This template enables business owners and buyers or sellers of businesses to calculate an estimated valuation of a business or company based on the discounted cash flow (dcf) method by using the weighted average cost of capital (wacc) as a discount rate for future cash flow projections over three and five year periods. Two of the most common business valuation formulas begin with either annual sales or annual profits (also known as seller discretionary earnings), multiplied by an industry multiple. Web excel and google sheets template. Valuation modeling in excel may refer to several different types of analysis, including discounted cash flow (dcf) analysis, comparable trading multiples, precedent transactions, and ratios such as vertical and horizontal analysis. Improve your business valuation process with our comprehensive template, offering financial analysis, value assessment, reporting, and client delivery. For a large or small business valuation report, this template will cover all the elements that factor into. What is valuation modeling in excel? The sample table of contents below shows all the information that might need to be covered in a report. Web the excel investment and business valuation template provides an easy and accurate solution for calculating the valuation of proposed business investments and entire companies. Web a business valuation calculator helps buyers and sellers determine a rough estimate of a business’s value. Extract key figures including revenue, cost of goods sold, operating expenses, assets, and liabilities. Calculate different revenue scenarios, such as pessimistic and optimistic, for insights into upside and risk. It will provide you with an estimate of the value of your business give or take 15 percent. (click here to download your excel template now.) this excel template uses a market approach by looking at comparable public company and comparable transaction multiples.

Business Valuation Excel Template for Private Equity Eloquens

Business Valuation Model Excel Free Download Printable Templates

Free Business Valuation Template Google Sheets, Excel

Business Valuation Template Xls

You May Download Shareware Here BUSINESS VALUATION EXCEL TEMPLATE

Business Valuation Excel and Google Sheets Template Simple Sheets

Free Excel Business Valuation Spreadsheet within Business Valuation

Business Valuation Excel Template for Private Equity Eloquens

FREE Valuation Report , Designs & Documents Template Download in Word

Business Valuation Template Excel Free Printable Templates

Gather Previous Years' Financial Statements.

Identify The Purpose Of The Business Valuation.

Identify A Business' Health And Future Based On Profitability And Other Key Metrics With Our Business Valuation Excel Template.

Web Here’s A Look At Six Business Valuation Methods That Provide Insight Into A Company’s Financial Standing, Including Book Value, Discounted Cash Flow Analysis, Market Capitalization, Enterprise Value, Earnings, And The Present.

Related Post: