Calendar Year Proration Method

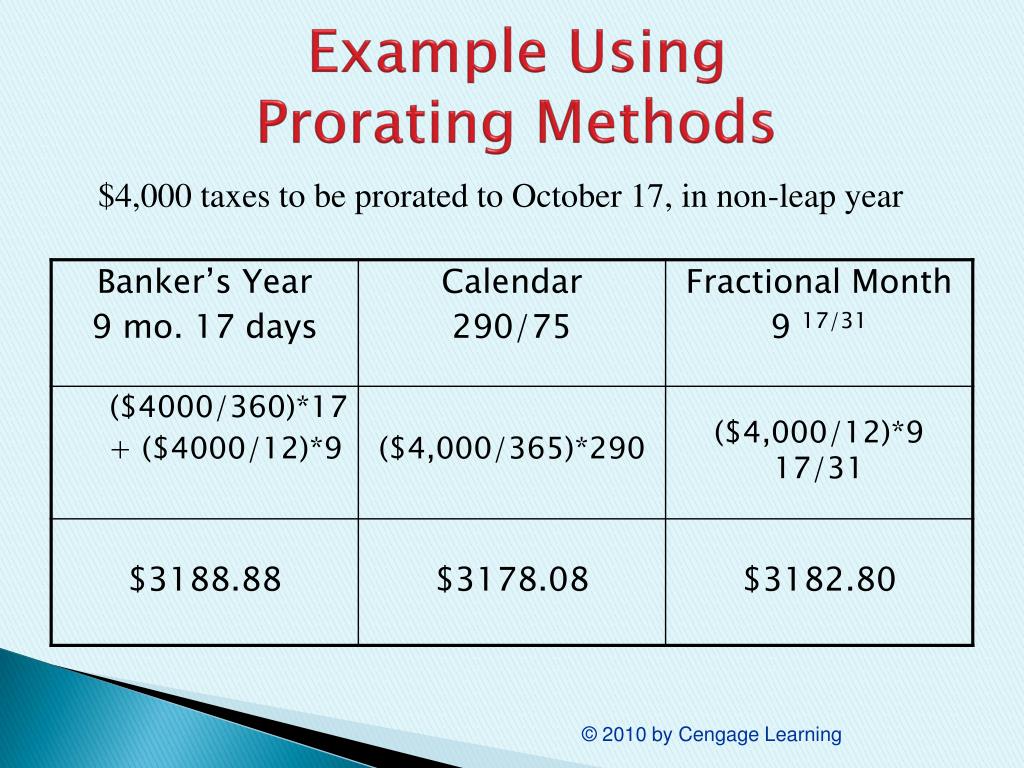

Calendar Year Proration Method - Web best real estate career. ($1,350 ÷ 365 = $3.70) 195 days (days from. Using the calendar year proration method (assume that it's. Assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller. Credit of $1,350 and debit of. First, in counting the number of days, remember that. The buyer reimburses the seller from and including june 1st to. Web one approach is to divide the annual expense by 365 days, resulting in a daily proration rate. Click the card to flip 👆. Web this section provides rules for determining the partners' distributive shares of partnership items when a partner's interest in a partnership varies during the taxable year. Click the card to flip 👆. Proration, interim closing of the books,. The seller occupied the home from january 1st to may 31st or 151 days. In real estate transactions, calculating prorations accurately ensures fairness between the real estate buyer and seller. Web four methods for pro rating rent are actual days in the month, average days in the month,. Credit of $1,350 and debit of. Web using the calendar year proration method (assume that it's. When using the previous calendar year’s taxes to prorate, the taxes are calculated based on the total amount of taxes paid for the previous year,. The seller occupied the home from january 1st to may 31st or 151 days. Click the card to flip. $565 ÷ 360 = $1.5694444, or $1.569 per day 28. Web this section provides rules for determining the partners' distributive shares of partnership items when a partner's interest in a partnership varies during the taxable year. Click the card to flip 👆. First, in counting the number of days, remember that. Web prorate a specified amount over a specified portion. Proration, interim closing of the books,. Proration is inclusive of both specified dates. The seller occupied the home from january 1st to may 31st or 151 days. 490 views 1 year ago keller williams avenues realty, llc. Web closing is set for july 31, and the buyers own the day of closing (pay prorated expenses through the day of closing). Click the card to flip 👆. ($1,350 ÷ 365 = $3.70) 195 days (days from. 490 views 1 year ago keller williams avenues realty, llc. Usually, these taxes will be. Proration, interim closing of the books,. Proration, interim closing of the books,. Web real estate proration is most often used when discussing how annual taxes will be divided between the new homeowner and the seller. Web four methods for pro rating rent are actual days in the month, average days in the month, banker’s month, and days in the calendar year. Proration is inclusive of both. In real estate transactions, calculating prorations accurately ensures fairness between the real estate buyer and seller. Click the card to flip 👆. Web one approach is to divide the annual expense by 365 days, resulting in a daily proration rate. This method is suitable for costs like property taxes and homeowners. ($1,350 ÷ 365 = $3.70) 195 days (days from. $1,055 at closing, ______ is. ($1,350 ÷ 365 = $3.70) 195 days (days from. $565 ÷ 360 = $1.5694444, or $1.569 per day 28. The seller occupied the home from january 1st to may 31st or 151 days. So, let’s break this down a little more. The buyer reimburses the seller from and including june 1st to. Click the card to flip 👆. Proration, interim closing of the books,. Web using the calendar year proration method (assume that it's. Amount of pro rated rent varies. So, let’s break this down a little more. $1,055 at closing, ______ is. When using the previous calendar year’s taxes to prorate, the taxes are calculated based on the total amount of taxes paid for the previous year,. Credit of $1,350 and debit of. Web using the calendar year proration method (assume that it's. Web best real estate career. One of the most confusing types of real. Click the card to flip 👆. Web learn how to allocate partnership tax items between a departing partner and the remaining partners using three methods: Web this section provides rules for determining the partners' distributive shares of partnership items when a partner's interest in a partnership varies during the taxable year. Using the calendar year proration method (assume that it's. Web the primary methods of calculating prorations are the. The buyer reimburses the seller from and including june 1st to. Web using the calendar year proration method (assume that it's. Assuming the buyer owns the property on closing day, and the seller hasn't made any payments, what will the seller. Web methods to calculate proration. Web calendar year proration: Amount of pro rated rent varies. $565 ÷ 360 = $1.5694444, or $1.569 per day 28. Web one approach is to divide the annual expense by 365 days, resulting in a daily proration rate. Usually, these taxes will be.

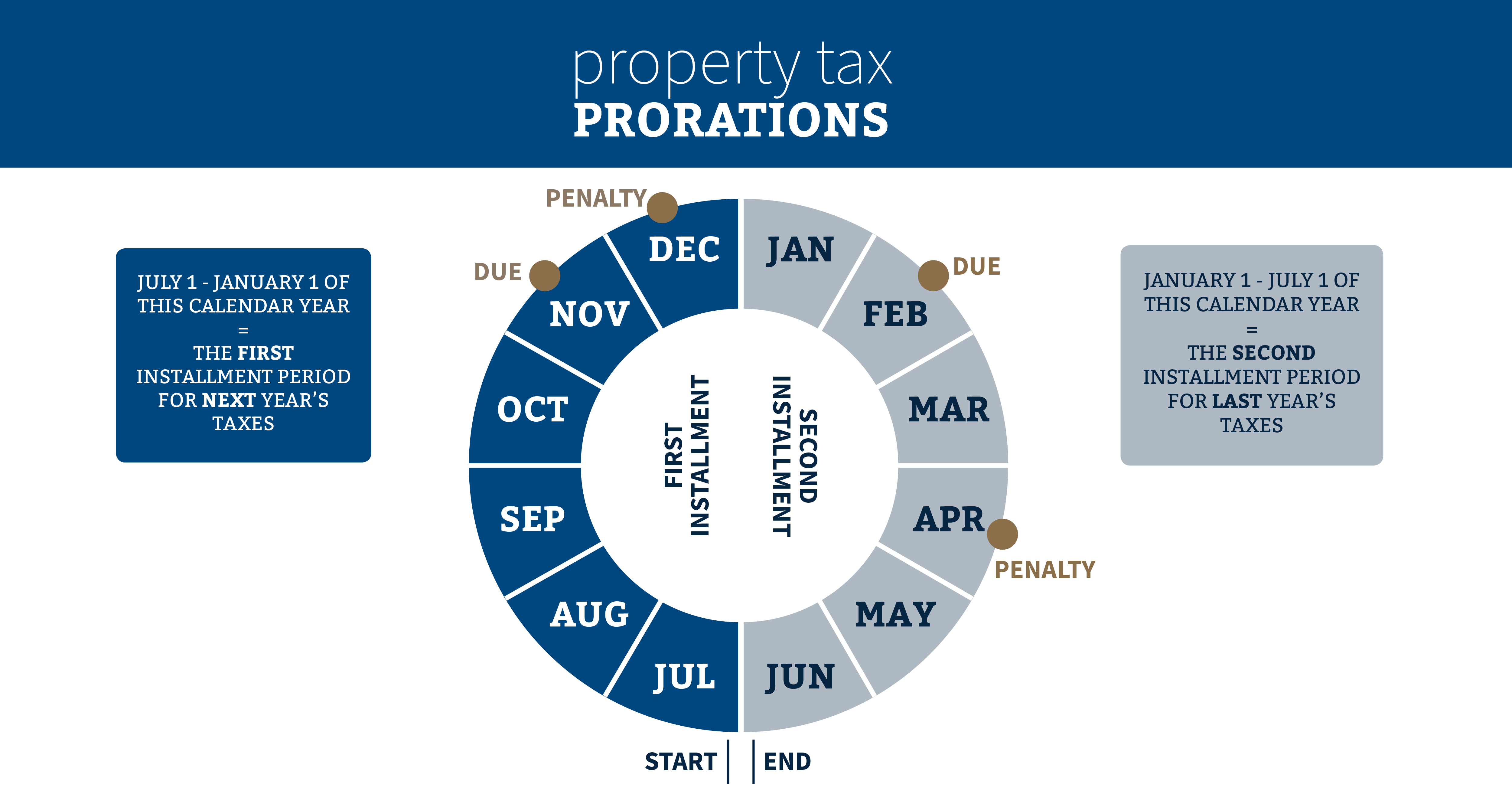

Property Tax Prorations Case Escrow

How To Calculate Yearly Depreciation Expense Haiper

PPT Chapter 16 ________________ Title Closing and Escrow PowerPoint

Calendar Year Proration Method Real Estate 2024 Calendar 2024 All

Depreciation Calculation for Table and Calculated Methods (Oracle

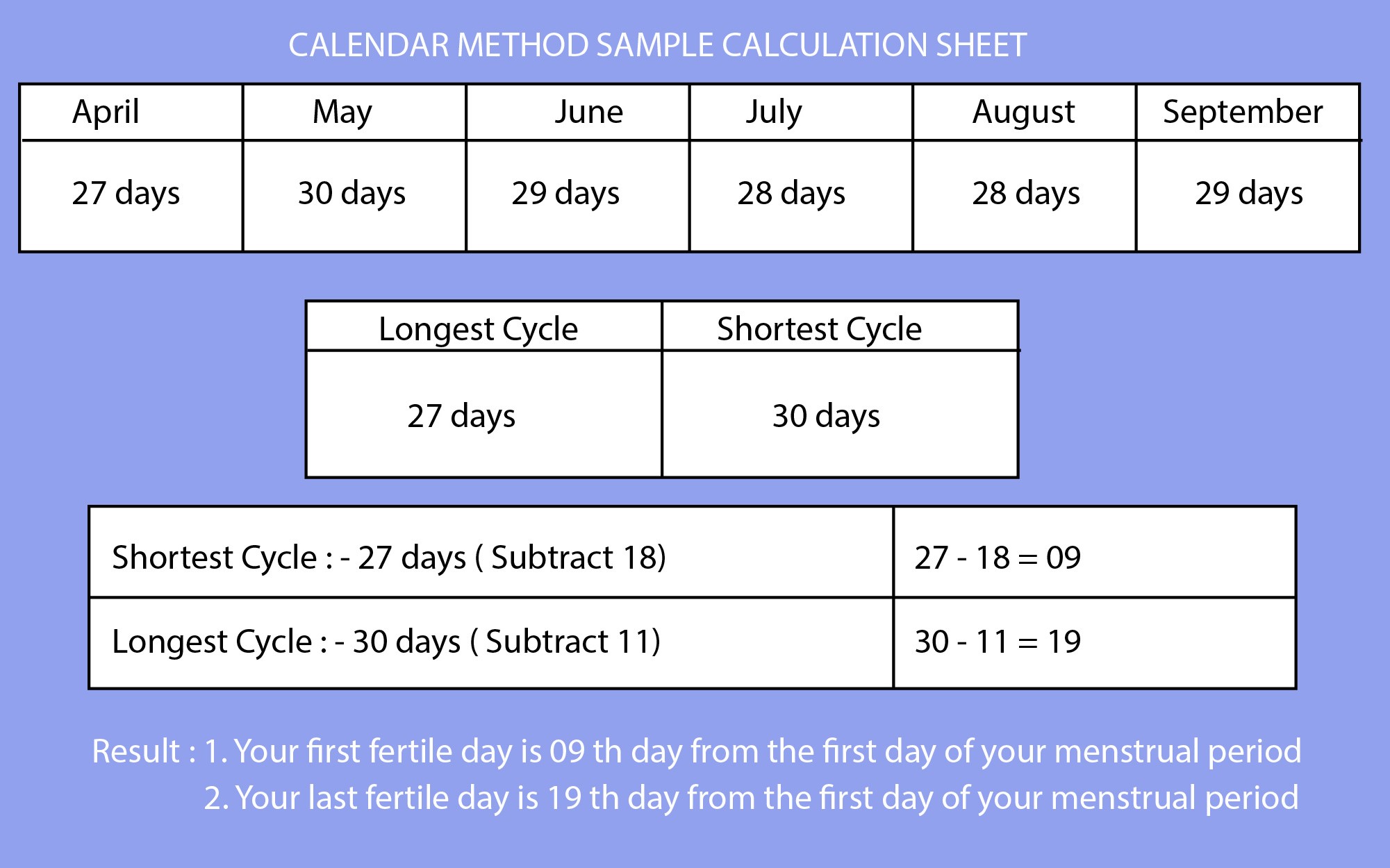

PPT Contraception PowerPoint Presentation, free download ID6573279

What are the different types of contraception? Medicszone

.png?1614945017)

Adjusting Overhead with the Proration Method Wize University

SSA POMS DI 52170.055 Calendars for Proration (19642028) 09/25/2008

What Are the Benefits of Using a Calendar Method to prevent pregnancy

Credit Of $1,350 And Debit Of.

Web Four Methods For Pro Rating Rent Are Actual Days In The Month, Average Days In The Month, Banker’s Month, And Days In The Calendar Year.

In Real Estate Transactions, Calculating Prorations Accurately Ensures Fairness Between The Real Estate Buyer And Seller.

490 Views 1 Year Ago Keller Williams Avenues Realty, Llc.

Related Post: