Calendar Year Vs

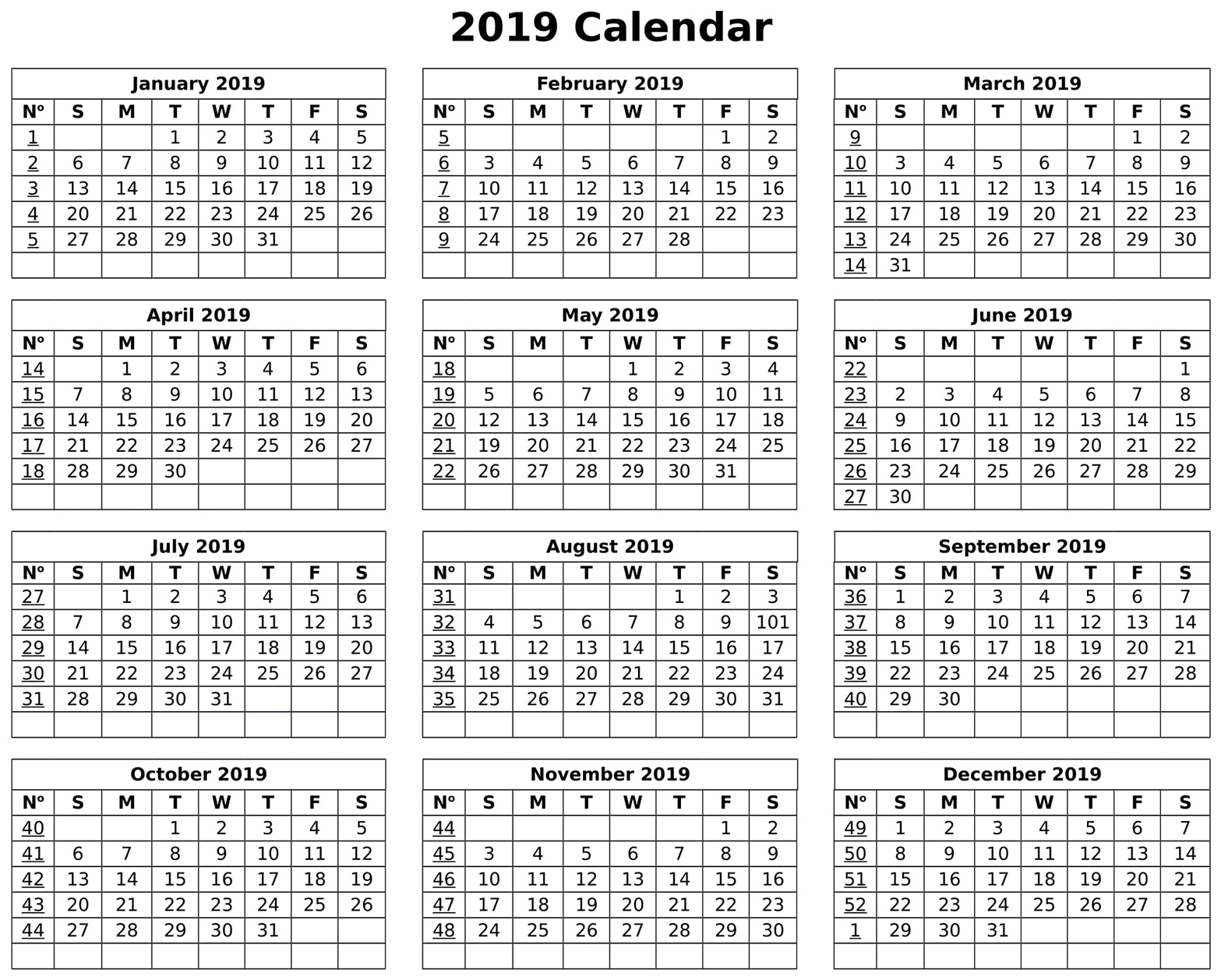

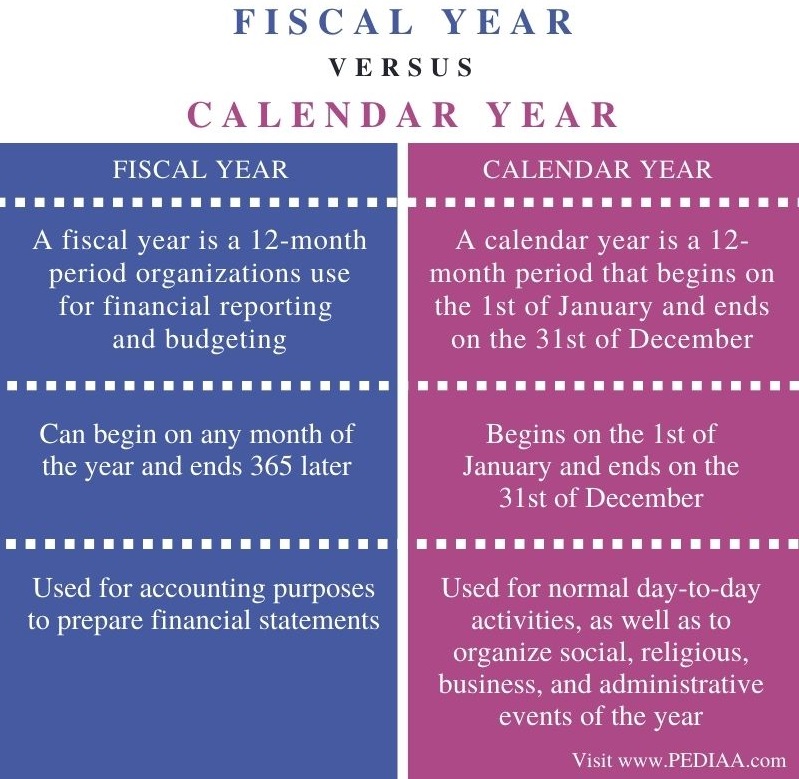

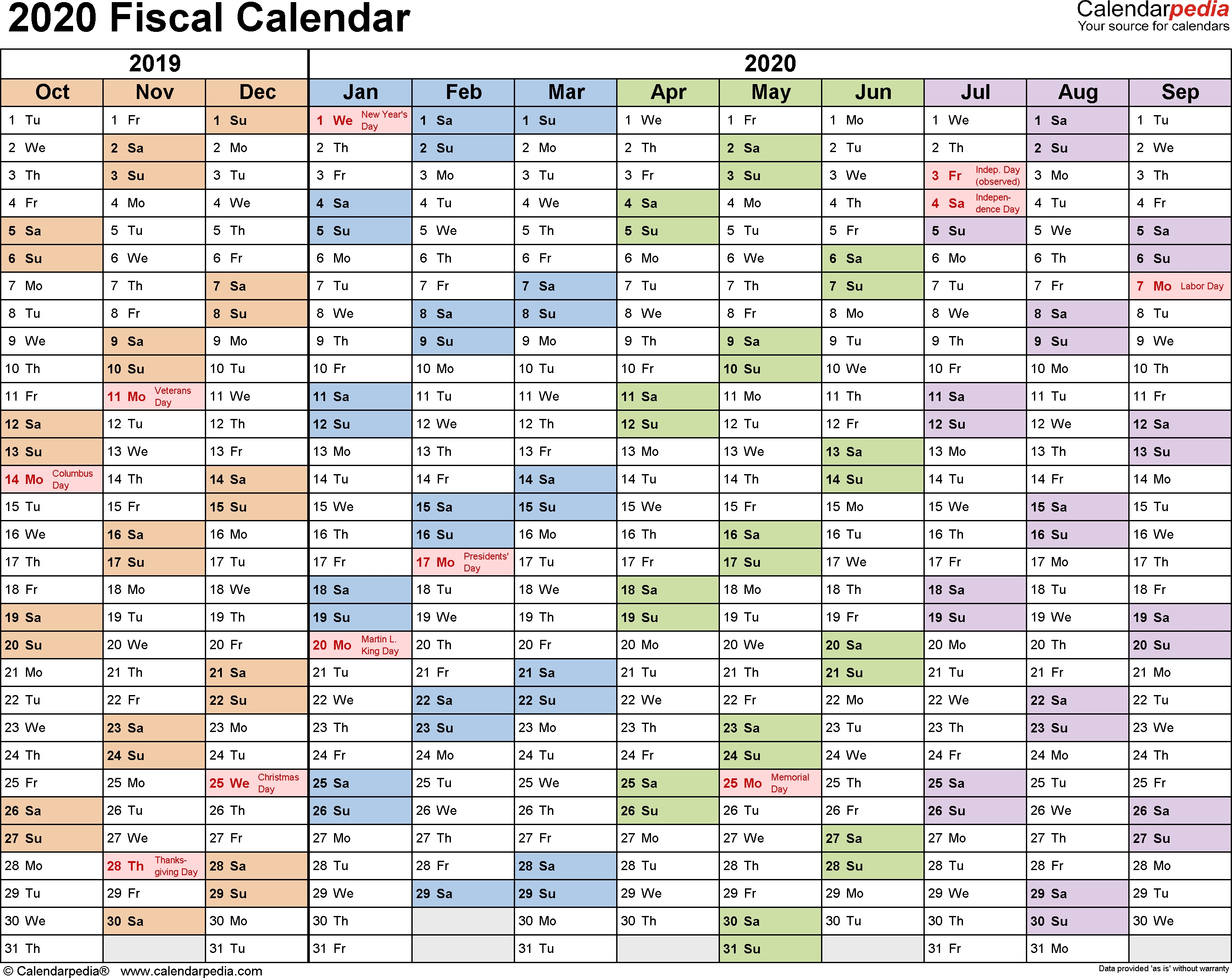

Calendar Year Vs - Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Panthers 3, lightning 2 game 2: Web there are different types of fiscal years a company can choose from: That’s correct of course—but it’s not the only correct. Web earlier this month we announced that the new microsoft planner has begun rolling out to general availability. (for detailed definitions, see cbo’s glossary.) what’s the difference. Find out the advantages and disadvantages of each type of year, and see examples of common fiscal years. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. A tax year is a calendar year, but a calendar year isn’t. Calendar year is the period from january 1st to december 31st. A fiscal year is a period lasting one year but not necessarily starting at the beginning of the calendar year. Fiscal year variant is not maintained for calendar year message show when display. Web a calendar year, obviously, runs from january 1 to december 31, just like the calendar. Panthers 3, lightning 2 game 2: Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web learn the difference between a calendar year and a fiscal year, and how they affect taxation and accounting. It is common for organizations to use a calendar year, as opposed to. (for detailed definitions, see cbo’s glossary.) what’s the difference. Panthers 3, lightning 2 game 2: Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. Web learn the difference between a calendar year and a fiscal year, and how they affect taxation and accounting. A fiscal year. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. Panthers 3, lightning 2 game 2: (for detailed definitions, see. Generally, taxpayers filing a version of form 1040. Using a calendar year as a company’s tax year is often the simplest approach. Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. Web by froehling anderson | oct 19, 2018. The choice is made easy but its. Web when a calendar year makes sense. A fiscal year can start. Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. Web what is the difference between a fiscal year and calendar year? Web this guide briefly explains—in plain language—the differences between some common budgetary terms. Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. Web when a calendar year makes sense. Web this guide briefly explains—in plain language—the differences between some common budgetary terms. Web a fiscal and a calendar year are two different things. As part of the new planner,. Using a calendar year as a company’s tax year is often the simplest approach. Web what is the difference between a fiscal year and calendar year? Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. Web a fiscal and a calendar year are two different things.. Panthers 3, lightning 2 (ot) game 3: Ask someone to define a year and they’ll probably say january 1 to december 31. Web when a calendar year makes sense. Web a fiscal year is 12 months chosen by a business or organization for accounting purposes, while a calendar year refers to the standard january 1 to december 31 period. Web. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. It's used differently by the government and businesses, and does need to correspond to a. A fiscal year can start. Web what is the difference between a fiscal year and calendar year? A tax year is a calendar. The choice is made easy but its. A fiscal year can start. Web by froehling anderson | oct 19, 2018. Web learn the differences between fiscal year and calendar year, how they affect financial reporting and analysis, and see examples from various sectors. (for detailed definitions, see cbo’s glossary.) what’s the difference. Web a fiscal and a calendar year are two different things. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day. That’s correct of course—but it’s not the only correct. It's used differently by the government and businesses, and does need to correspond to a. Fiscal year variant is not maintained for calendar year message show when display. Calendar year is the period from january 1st to december 31st. Generally, taxpayers filing a version of form 1040. The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. Ask someone to define a year and they’ll probably say january 1 to december 31. Web learn the difference between a fiscal year and a calendar year, and how they affect accounting, tax and budgeting. It is common for organizations to use a calendar year, as opposed to a fiscal year, as the tax year calendar for their company.

Fiscal Year vs Calendar Year What’s Right for Your Business?

Fiscal Year Vs Calendar Year

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year Vs Calendar Year

Fiscal Year Definition for Business Bookkeeping

Calendar Year Vs. Fiscal Year

Fiscal Year vs Calendar Year What's The Difference?

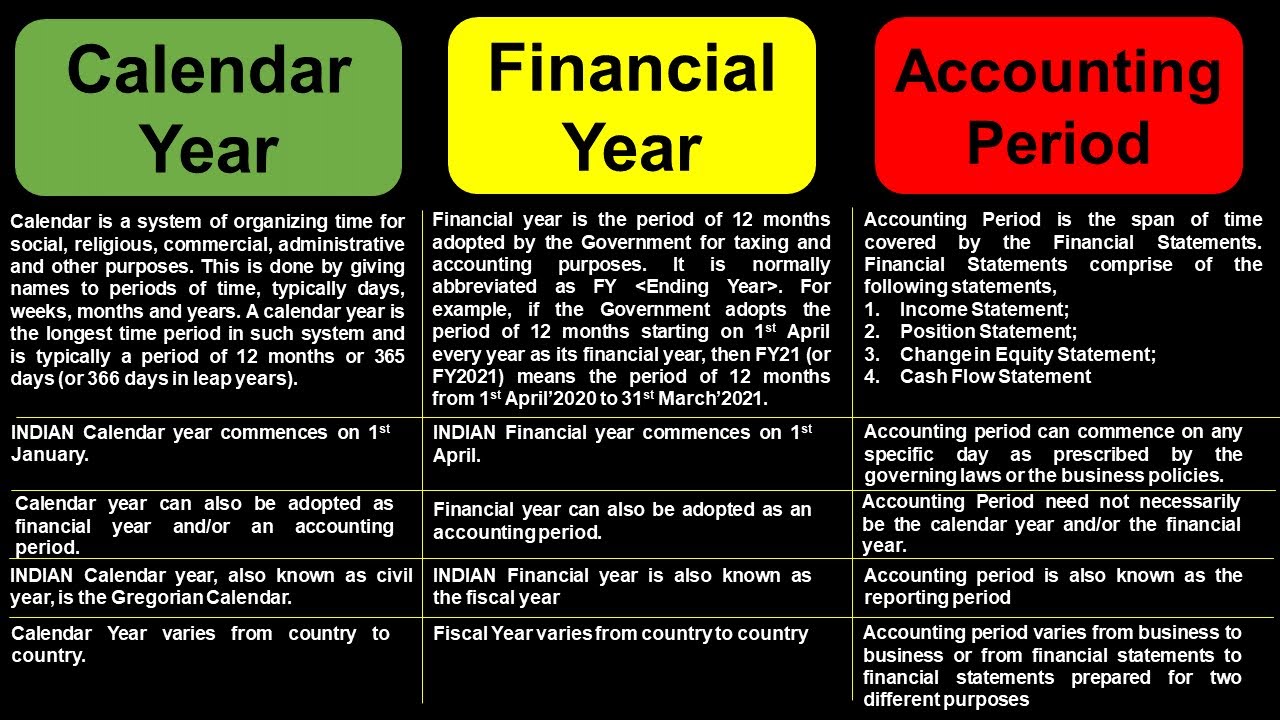

What is Calendar Year What is Financial Year What is Accounting

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

A Tax Year Is A Calendar Year, But A Calendar Year Isn’t.

Web A Fiscal Year Keeps Income And Expenses Together On The Same Tax Return, While A Calendar Year Splits Them Into Two.

Using A Calendar Year As A Company’s Tax Year Is Often The Simplest Approach.

What Is A Fiscal Year?

Related Post: