Credit Card Payoff Excel Template

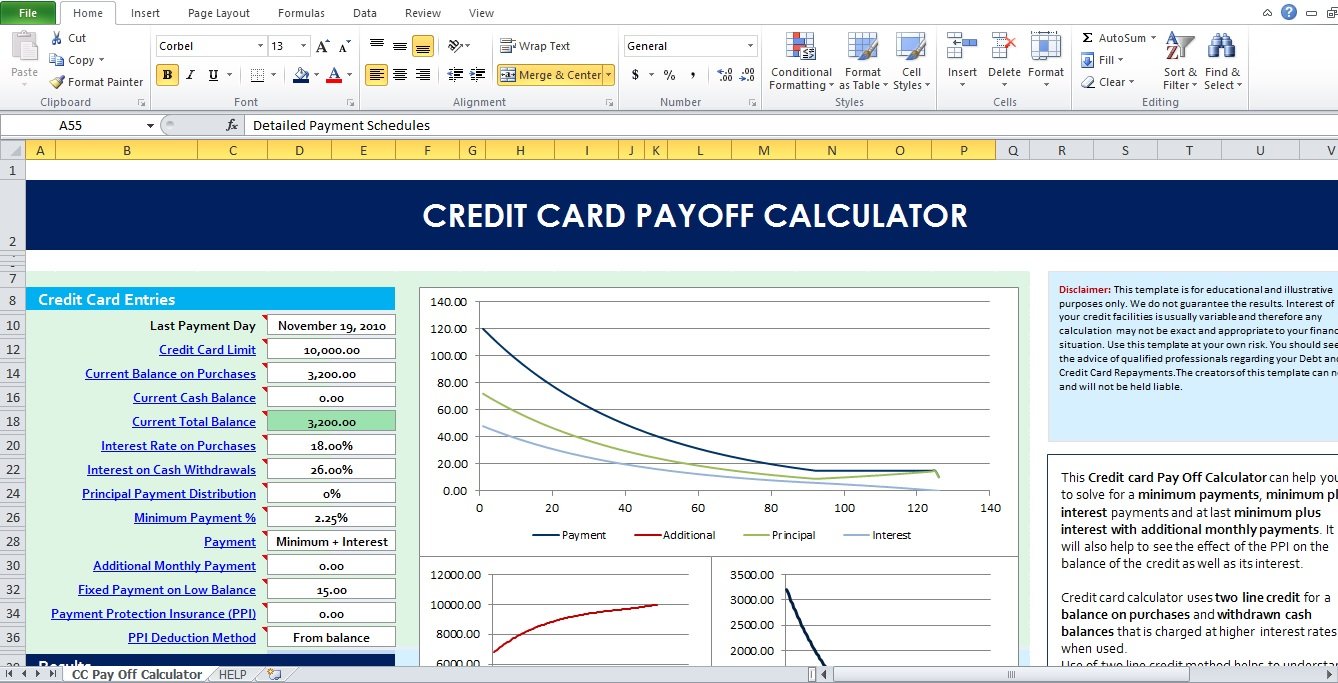

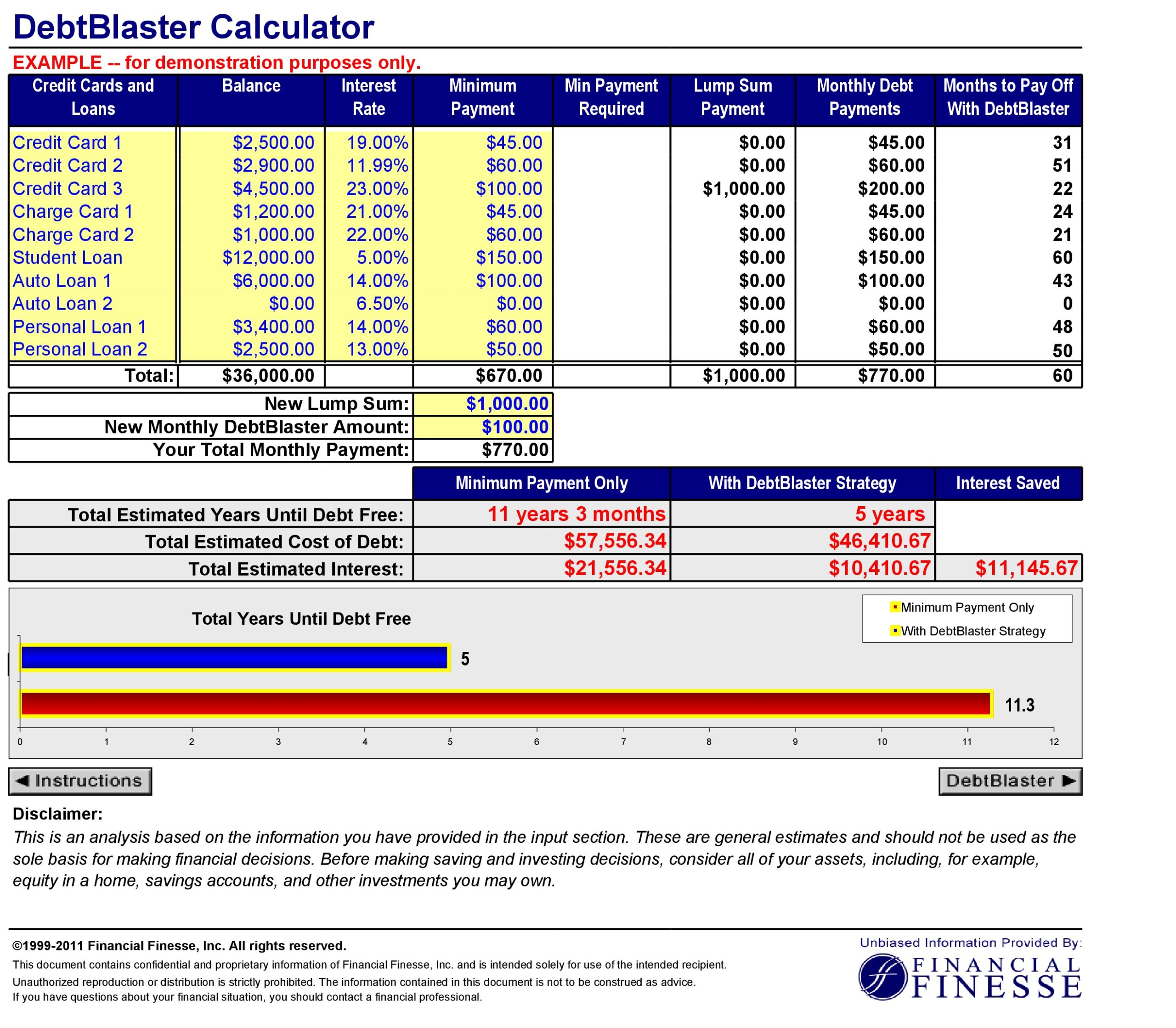

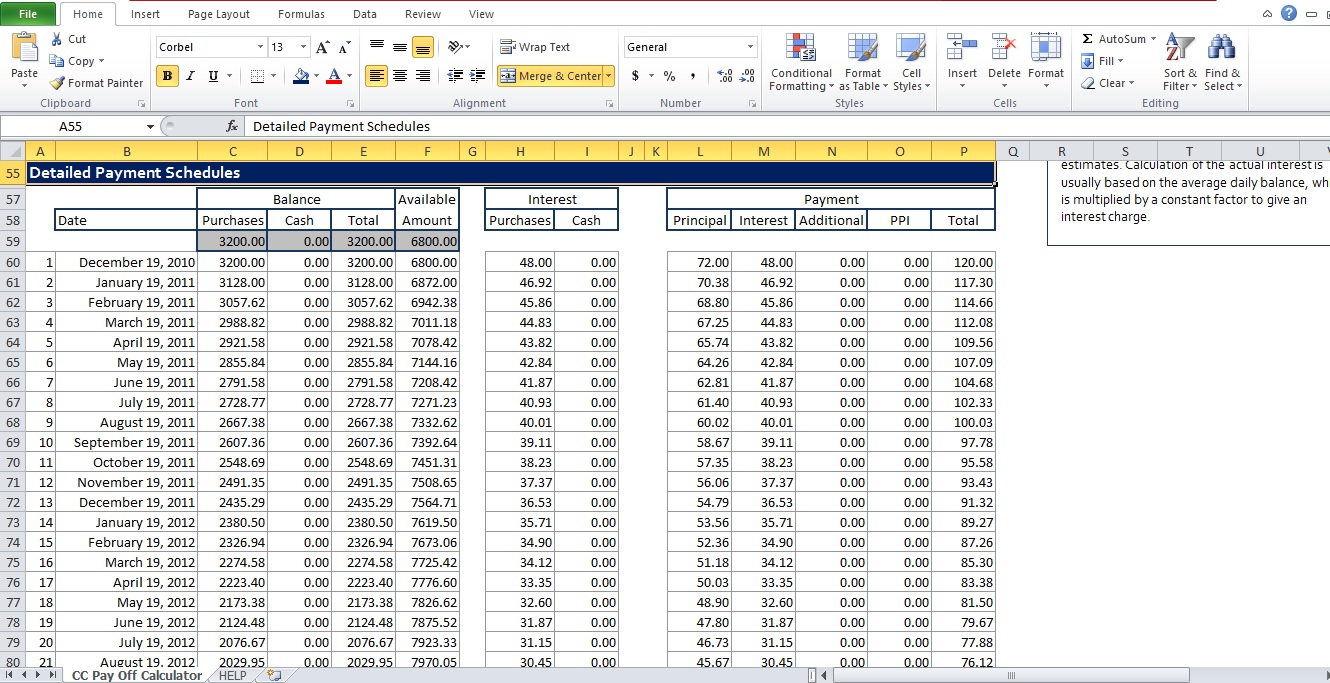

Credit Card Payoff Excel Template - Financial analysis doesn’t have to be a list of accounting ratios that assess your company’s profitability. Web 6 favorite free debt snowball spreadsheets for 2024. This credit card payoff spreadsheet offers a simple way to track your credit card payments. Debt payoff template from medium for google sheets. Web download a free credit card payoff calculator for microsoft excel or google sheets that will calculate the payment required to pay off your credit card in a specified number of years, or calculate how long it will take to pay off your card given a. Get rid of your credit card debt asap with our excel tools. Microsoft excel® 2003 or higher (pc & mac) macros. Firstly, type the following fields related to the credit card payoff: 2) list your debts across the top with your balance, minimum payment, and interest rates. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. Firstly, type the following fields related to the credit card payoff: 4) be sure to have columns for “payment amount” and “balance amount” for each debt. Trying to find a multiple credit card payoff calculator? This technique allows the repayment of the smaller debts faster. Web this credit card payoff calculator will help you figure out how long it will. Web paying your credit card in full possibly saves you some money in interest and keeps your credit record healthy. Web download free credit card payoff and debt reduction calculators for excel. Looking for a credit card payoff calculator with extra payments? Track and map your credit card payments with our credit card payoff calculator excel template. Track multiple debts. You can use a debt calculator excel to make computation and tracking tasks much easier. This credit card payoff spreadsheet offers a simple way to track your credit card payments. Trying to find a multiple credit card payoff calculator? By paying the minimum amount. Ideally, there are 3 ways to make payments: Get rid of your credit card debt asap with our excel tools. Excel and google sheets template. Insert the current balance and interest rate of the card. Web written by rafiul haq. Nobody wants to pay 25% interest. Web this credit card minimum payment calculator is a simple excel spreadsheet that calculates your minimum payment, total interest, and time to pay off. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Web free credit card payoff calculator: Looking for a credit card payoff calculator with. Trying to find a multiple credit card payoff calculator? Web this article will show you two quick ways to create a credit card payoff spreadsheet in excel. Free credit card payment calculator template in excel. Looking for a credit card payoff calculator with extra payments? In this first step, we will create the fields where the basic info about the. Some of the options listed also present schemes for dealing with your loans, a multiple credit card payoff calculator, and recommendations for paying down other debt. 4) be sure to have columns for “payment amount” and “balance amount” for each debt. Web figure out the monthly payments to pay off a credit card debt. Web this credit card payoff calculator. Make a plan to get out of debt and estimate how much you can save. Select cell c8 and insert the following formula to calculate interest only payment. Built with smart formulas, formatting, and dynamic tables, you can view credit payoff performance to stay on top of your personal finances. Web this credit card minimum payment calculator is a simple. If you have any debts, you need to pay them back. Web with this free credit card payment calculator template, you can plug in your balance, interest rate, and your expected monthly payment (either fixed or as a percentage of the balance) to determine just how long it may take you to pay off your debt. Excel and google sheets. Edit the labels for each column and then enter the minimum payment (min) and start debt (sd) amounts. You can use a debt calculator excel to make computation and tracking tasks much easier. When a borrower returns money by putting emphasis on the smallest amount, we call this technique the “snowball” method. Ideally, there are 3 ways to make payments:. If you’re a visual learner, use excel to create pie. If you have any debts, you need to pay them back. Debt payoff template from medium for google sheets. Get rid of your credit card debt asap with our excel tools. Ideally, there are 3 ways to make payments: Financial analysis doesn’t have to be a list of accounting ratios that assess your company’s profitability. Easily compare different payoff strategies to find the best way to pay off your credit card debt faster. Web download free credit card payoff and debt reduction calculators for excel. Trying to find a multiple credit card payoff calculator? In this first step, we will create the fields where the basic info about the debt will be inserted. Insert the current balance and interest rate of the card. Firstly, type the following fields related to the credit card payoff: Web 1) open a blank page in google sheets or excel. Nobody wants to pay 25% interest. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. This is applicable when we have more than one debt.

Multiple Credit Card Payoff Calculator Spreadsheet —

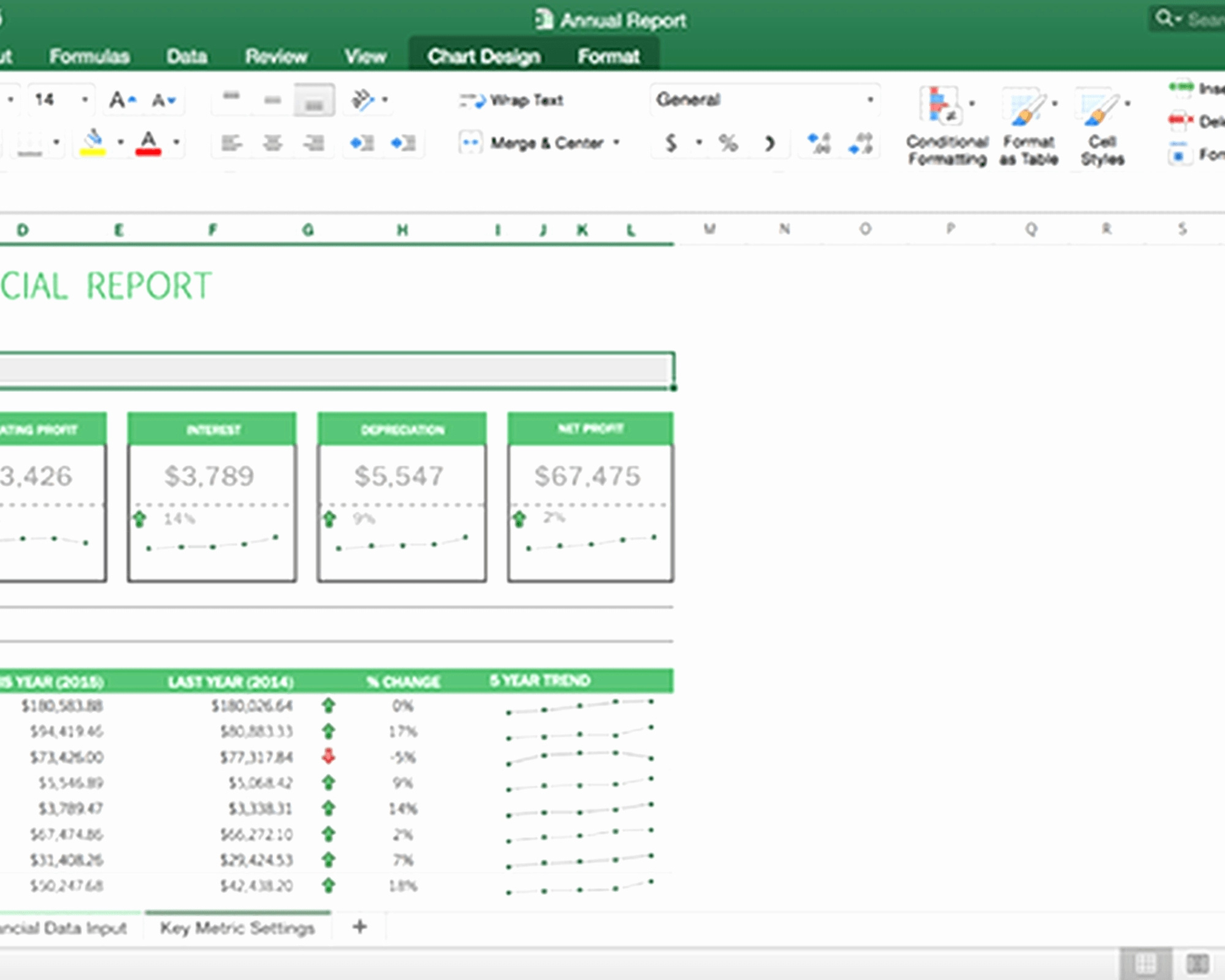

Credit Card Payoff Calculator Excel Template Excel TMP

Excel Credit Card Payment Tracker Template

Credit Card Debt Payoff Calculator — Spreadsheet Man

Credit Card Payment Spreadsheet Template

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Paying your debt can be a challenging job and it requires money

30 Credit Card Payoff Spreadsheets (Excel) TemplateArchive

Free Credit Card Payoff Calculator for Excel

Credit Card Payoff Calculator Excel Template Excel TMP

Assume That The Balance Due Is $5,400 At A 17% Annual Interest Rate.

Web 6 Favorite Free Debt Snowball Spreadsheets For 2024.

Select Cell C8 And Insert The Following Formula To Calculate Interest Only Payment.

When A Borrower Returns Money By Putting Emphasis On The Smallest Amount, We Call This Technique The “Snowball” Method.

Related Post: