Debt Payment Plan Printable

Debt Payment Plan Printable - Automate both your minimum payments and the extra payment you’re making towards whichever debt you’re prioritizing first. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. Unlike a monthly fee, payment plans have an interest rate that is added to the monthly pay installment, making the final price more expensive than if paid in full. Log into each account to get the actual balance (don’t just guestimate). Web written by sara hostelley | reviewed by brooke davis. If you are struggling to pay off your credit card debt and keep track of how much money you owe, it’s time to take control of your financial situation. Each time you pay off a debt, you free up more money to tackle the other accounts. Web print out a debt repayment plan printable for each individual debt you have. Then, go over your monthly budget to determine how much money you have available for debt. Need help repairing your credit? You can use the paymentschedule tab to figure out exactly what those amounts should be. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. Web written by. Find extra money to pay your debts. Need help repairing your credit? Web use this debt worksheet to see all your bills and plan what you owe. Grab a whole array of free pdfs from debt free charts, a site that’s aiming to give away 300,000 of their debt tracker printables. Updated on november 15, 2021. This debt planner will allow you to see the big picture of what your debt looks like and help you manage your finances better. Circle any debts in collections. This is the main printable you’ll be updating month after month as you work to pay down each debt. A payment plan agreement is a legal contract that outlines how a. Web debt repayment template. Circle any debts in collections. I purposely left the line at the top blank so you can write in. Web updated april 14, 2023. Add up all your minimum monthly payments. List all the debts you have. Web choose from 35 unique debt trackers that include debt snowball worksheets, debt payoff planners, and more. This debt snowball calculator is meant to gather information on all your debts. Are you using the debt snowball method to get out of debt? If you are struggling to pay off your credit card debt and. Web last updated on january 13th, 2024 at 09:37 pm. Make a list of all your debts. Add up all your minimum monthly payments. This is the main printable you’ll be updating month after month as you work to pay down each debt. Also record the interest rate and minimum payment requirement for each debt. Web print out a debt repayment plan printable for each individual debt you have. List all your debts in the first column. Then, go over your monthly budget to determine how much money you have available for debt. Web this new budget should include a fixed monthly amount for debt repayment, beyond any monthly payments for student, auto, or home. Web you can use the debt snowball or the debt avalanche: Web updated april 14, 2023. Also record the interest rate and minimum payment requirement for each debt. Web use this debt worksheet to see all your bills and plan what you owe. This is common when an amount is too much to pay for a debtor in a single. Add up all your minimum monthly payments. Find extra money to pay your debts. You can either use it on a monthly basis or keep a running log for the year. What is the debt avalanche strategy? Make a list of all your debts. Circle any debts in collections. It feels great to watch that ending balance go down each month. All pages are 100% free. Web you can use the debt snowball or the debt avalanche: This comprehensive template is designed to help you understand your current debt situation and make a plan to pay it off. Web this is a debt payoff printable that will simply allow you to track your payments. Find extra money to pay your debts. Grab a whole array of free pdfs from debt free charts, a site that’s aiming to give away 300,000 of their debt tracker printables. It feels great to watch that ending balance go down each month. This is common when an amount is too much to pay for a debtor in a single payment. Choose the ‘snowball’ or the ‘avalanche’ style of debt reduction. Add up all your minimum monthly payments. Web last updated on january 13th, 2024 at 09:37 pm. Automate both your minimum payments and the extra payment you’re making towards whichever debt you’re prioritizing first. Web download free debt payoff trackers for excel® and pdf | updated 8/18/2021. It includes a balance, interest rates, and you pay off goal date so you can focus on knocking your debts out one by one. A creditor can set up a payment plan agreement to make the debtor’s repayments more manageable, improving their chances of receiving the total debt amount back. Also record the interest rate and minimum payment requirement for each debt. What is the debt snowball strategy? If you have outstanding debt (and who doesn’t?), then record the key details on this worksheet and use it as a tool to get ahead with your budgeting. All pages are 100% free.

Free Printable Debt Repayment Plan

Debt Repayment Printables Get organized and focused on improving your

Debt Payment Tracker Printable

Debt Payment Plan Budget Planner Printable Planner Debt Etsy

Debt Payment Plan Printable PDF Digital Download. Etsy

Debt Tracker Printable, Debt Payoff Log, Debt Tracker Sheets Etsy

Debt Avalanche Payment Tracker Printable in 2021 Debt payoff

Debt Payment Tracker Printable Debt Payoff Planner Debt Etsy

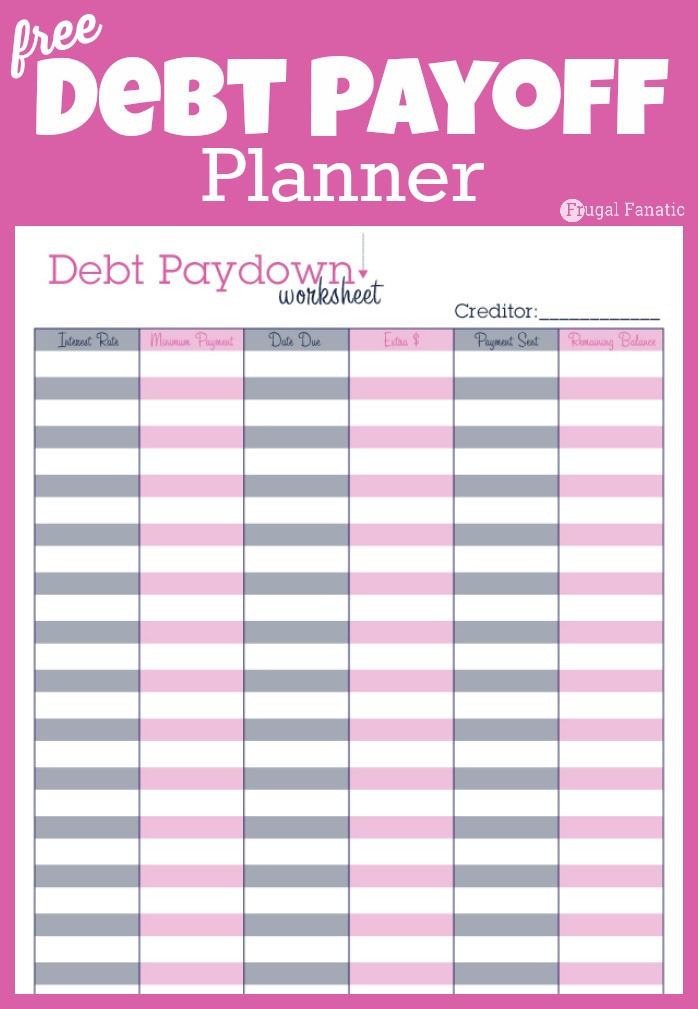

Debt Payoff Planner Free Printable

Debt Repayment Printables Simply Stacie

Focus On One Debt At A Time.

Web Free Printable Debt Payoff Planner Template.

If You Are Struggling To Pay Off Your Credit Card Debt And Keep Track Of How Much Money You Owe, It’s Time To Take Control Of Your Financial Situation.

Web Use This Debt Worksheet To See All Your Bills And Plan What You Owe.

Related Post: