Difference Between Calendar Year And Fiscal Year

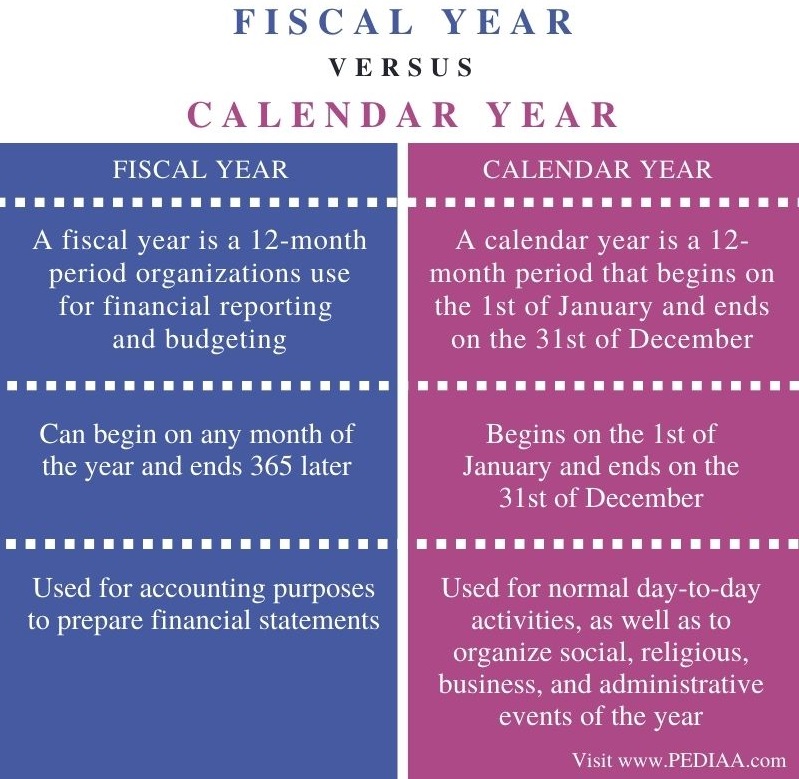

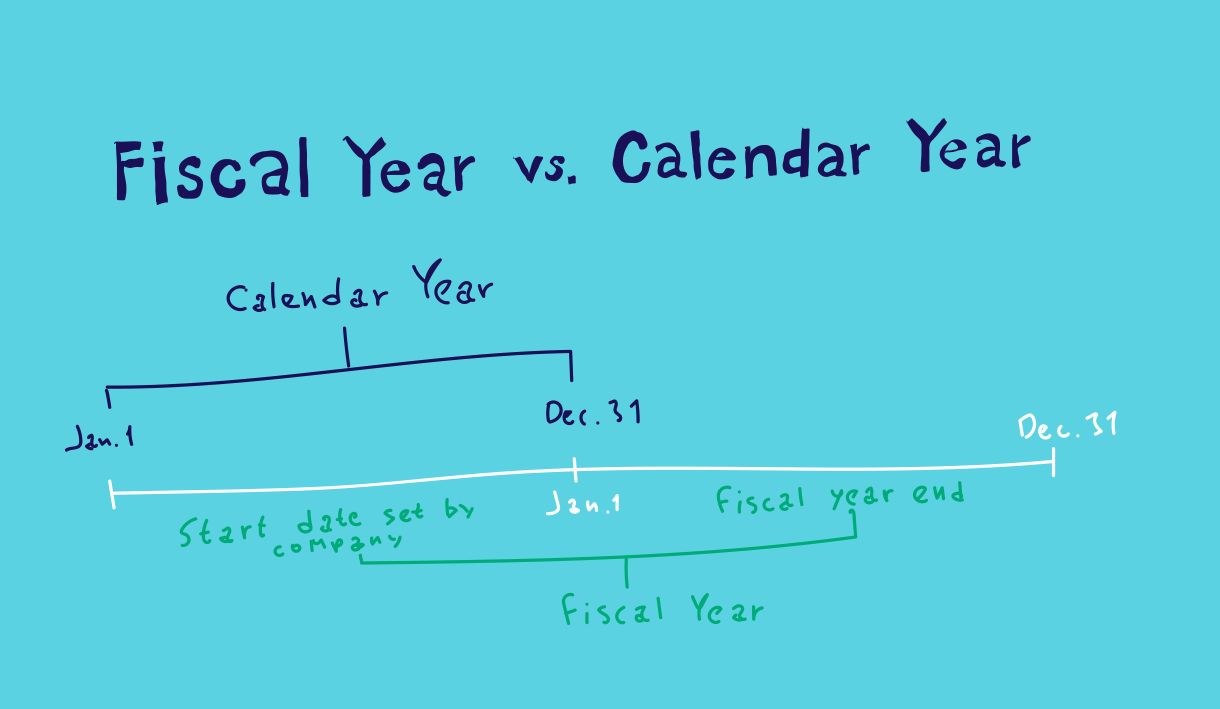

Difference Between Calendar Year And Fiscal Year - Web the fiscal year is a period of 1 year period which ends on the last day of any month. Web unc press briefing featuring dr roodal moonilal, mp and saddam hosein, mp Web the irs distinguishes a fiscal tax year from the calendar year, defined as either 12 consecutive months ending on the last day of any month except december or a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a. The challenge of a fiscal year is that you have to be mindful of the impact of not using a calendar year. In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the plan,. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. A calendar year always runs from january 1 to december 31. More specifically, a fiscal year is often differentiated from a calendar year for accounting. Web a fiscal year is a period that a company designates as its annual financial reporting period. Web what is the difference between a fiscal year and calendar year? Web when a calendar year makes sense. Though the length of time is the same, the start. A calendar year always runs from january 1 to december 31. Calendar year vs fiscal year top 6 differences you should know, in general terms, the fiscal year is the 12. Web unc press briefing featuring dr roodal moonilal, mp and saddam hosein, mp Fiscal year meaning, difference with assessment year, benefits, and, how to create a fiscal year calendar in power bi. Web the fiscal year is a period of 1 year period which ends on the last day of any month. All individual plans now have the calendar year. Web answers (1) 0819. Also known as a financial year, it’s a span of 12 consecutive months at the end of which the company closes its books and calculates profit or loss before preparing and filing financial reports. How to choose between fiscal year and calendar year. Web fiscal year calendar july 2023 to june 2023 get calendar 2023 update,. It’s the financial reporting cycle business uses for tax purposes. Web unc press briefing featuring dr roodal moonilal, mp and saddam hosein, mp The fiscal year covers 12 consecutive months, for instance, a fiscal year can start on the 1st of april and ends on the 31st of march of the next year. The challenge of a fiscal year is. Web in general terms, the fiscal year is the 12 consecutive months for a which a company prepares their financial statements. In this article, we define a fiscal and calendar year, list the benefits of both, compare their differences and help you determine which you should follow. The internal revenue service (irs) defines a fiscal year as 12 consecutive months. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the last day of any. Web calendar year vs. Web while the fiscal year is a 12 month period whereby businesses choose the preferred start and end of the period, the calendar year is a set period of 12 consecutive months that follow the structure. Web in general terms, the fiscal year is the 12 consecutive months for a which a company prepares their financial statements. Though the length of time is the same, the start. Governments and organizations can choose fiscal years to align with their budgeting and tax requirements. It can be any date as long as the. Difference between fiscal year and. Web the fiscal year is a period of 1 year period which ends on the last day of any month. More specifically, a fiscal year is often differentiated from a calendar year for accounting purposes. Web a fiscal year keeps income and expenses together on the same tax return, while a calendar year splits them into two. Web what is. Web the irs distinguishes a fiscal tax year from the calendar year, defined as either 12 consecutive months ending on the last day of any month except december or a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a. It can be any date as long as. Web a fiscal year can cater to specific. So the 2018 fiscal year would begin on october 1, 2017, and finish september 1, 2018. Web a period that is set from january 1 to december 31 is called a calendar year. Governments and organizations can choose fiscal years to align with their budgeting and tax requirements. Though the length of. Fiscal year meaning, difference with assessment year, benefits, and, how to create a fiscal year calendar in power bi. All individuals and many businesses use the calendar year for financial reporting. Web a period that is set from january 1 to december 31 is called a calendar year. Web the critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the 365th day. Web a fiscal year can cater to specific. A fiscal year is often the period. Web unc press briefing featuring dr roodal moonilal, mp and saddam hosein, mp Web understanding what each involves can help you determine which to use for accounting or tax purposes. Web when a calendar year makes sense. Web a fiscal year is a period that a company designates as its annual financial reporting period. All individual plans now have the calendar year match the plan year, meaning no matter when you buy the plan,. Web what is the difference between fiscal year and calendar year, the assessment year is the year after the financial year in which the prior year's revenue is assessed, tax is collected, and the itr is filed. Unless you have a required tax year, you adopt a tax year by filing your first income tax return using that tax year. Governments and organizations can choose fiscal years to align with their budgeting and tax requirements. Federal government starts its fiscal year on october 1, and ends its fiscal year on september 30. Web fiscal years can differ from a calendar year and are an important concern for accounting purposes because they are involved in federal tax filings, budgeting, and financial reporting.

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Difference Between Fiscal Year and Calendar Year Difference Between

What is the Difference Between Fiscal Year and Calendar Year

Tax Talk Tuesday What's the Difference Between Calendar Year & Fiscal

The Differences Between Calendar Year And Fiscal Year www.vrogue.co

Difference Between Fiscal Year and Calendar Year Difference Between

Fiscal Year vs Calendar Year Difference and Comparison

What is a Fiscal Year? Your GoTo Guide

Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

A Calendar Year Always Runs From January 1 To December 31.

It Can Be Any Date As Long As The.

A Fiscal Year (Fy) Does Not Necessarily Follow The Calendar Year.

More Specifically, A Fiscal Year Is Often Differentiated From A Calendar Year For Accounting Purposes.

Related Post: