Discounted Cash Flow Template Excel

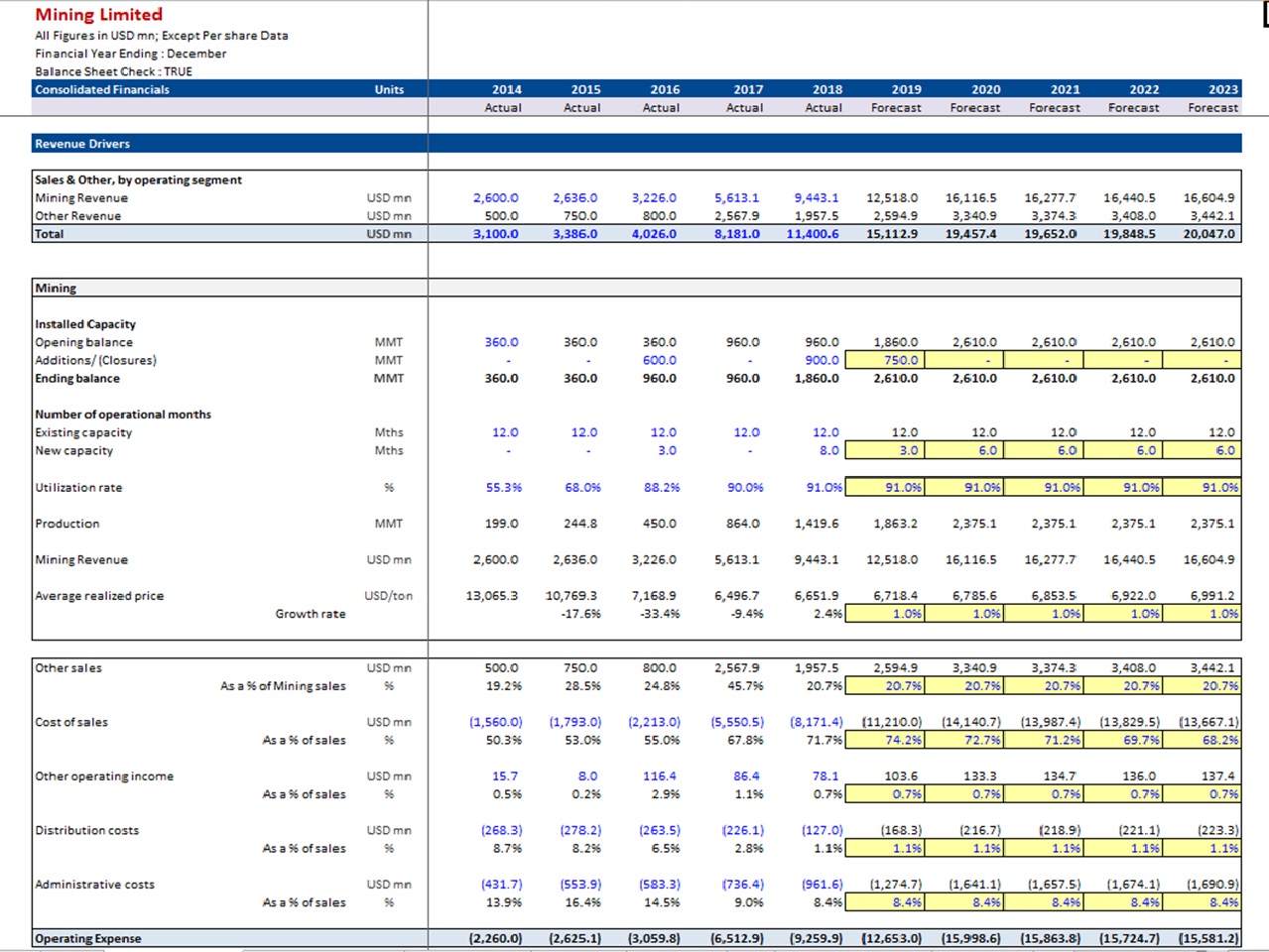

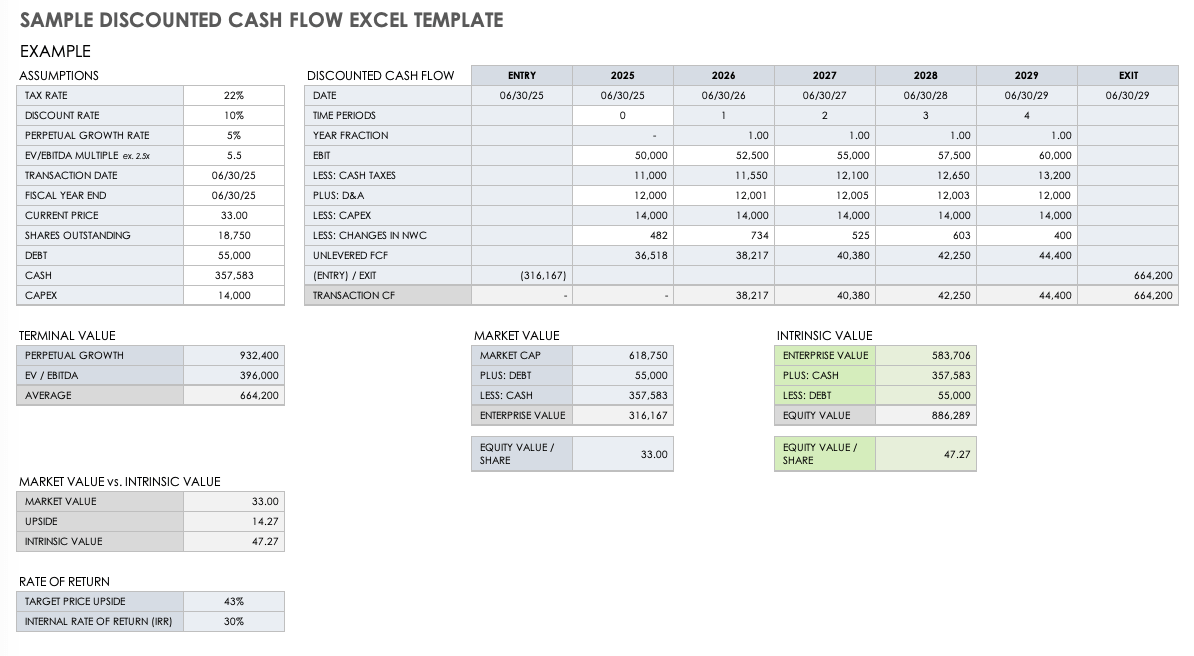

Discounted Cash Flow Template Excel - Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Web the formula for discounted cash flow (dcf) in excel is: Web discounted cash flow valuation model: Web discounted cash flow (dcf) excel model template. Detailed instructions guide you through inputting appropriate figures like operating costs, expected revenues, capital expenditures, and discount rates. Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. Web discounted cash flow (dcf) model template. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Understand discounted cash flow principles and perform accurate valuations in excel. Enter your estimated cash inflows and outflows into the template. Updated on january 11, 2024. A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Discounted cash flow analysis template; This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Dcf = cf1. It comes complete with an example of a dcf model so even beginners can get started quickly and accurately. Web discounted cash flow (dcf) model template. Cfn is the last year in the forecast.) r = the discount rate. The first step in calculating discounted cash flows is to gather the necessary cash flow data. Web the formula for discounted. Below is a preview of the dcf model template: Web a discounted cash flow analysis is a cornerstone technique that considers the time value of money by discounting expected future cash flows to their present value. Discounted cash flow is actually a valuation method that is used to forecast future gainings based on the present investment. Dive into the world. Web an editable excel template on discounted cash flow (dcf) is a tool that can help individuals and businesses evaluate the present value of an investment based on its expected future cash flows. Dcf is a widely used method for valuation, particularly for evaluating companies with strong projected future cash flow. Download wso's free discounted cash flow (dcf) model template. Web here, cft = cash flow in period t (time) r = discount rate. A discounted cash flow (dcf) analysis is one of the most important tools an investor can use to determine the intrinsic value of a stock. Cf = the cash flow in a given year (cf1 is year one. Web basic discounted cash flow formula: Het biedt. This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n. Use our dcf model template for your financial valuations. Web this dcf model template. Web elevate your investment analysis with our free dcf model template. Build dcf models with different assumptions. Understand discounted cash flow principles and perform accurate valuations in excel. The cheat sheet below includes important discounted cash flow formulas. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free. Basic discounted cash flow valuation template ;. Discounted cash flow analysis template; This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Dive into the world of discounted cash flow analysis effortlessly. We'll also review how to use the template to make informed investment decisions. This includes identifying the time periods for which cash flows will occur and determining the amount of cash flow for each period. Read this excel tutorial to find out how you can easily estimate the net present value of your holdings with our free template, step by step. Web our discounted cash flow valuation template is designed to assist you. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Updated on january 11, 2024. Web excel financial modeling templates. Discounted cash flow cheat sheet. Use the form below to. Web basic discounted cash flow formula: Web excel financial modeling templates. Web our discounted cash flow valuation template is designed to assist you through the journey of valuation. Web this dcf model template provides you with a foundation to build your own discounted cash flow model with different assumptions. Discounted cash flow analysis template; Download wso's free discounted cash flow (dcf) model template below! Use the form below to. Dcf = cf1 / (1 + r)1 + cf2 / (1 + r)2 + cf3 / (1 + r)3+ cfn / (1 + r)n. This valuation method helps investors assess the potential profitability of an investment by considering the time value of money. Web the big idea behind a dcf model. Using discounted cash flow formula in excel to calculate free cashflow to firm (fcff) in this example, we will calculate the free cashflow to firm ( fcff) with discounted cash flow ( dcf) formula. Enter your estimated cash inflows and outflows into the template. T = period of time (1,2,3,……,n) we can easily calculate the discounted cash flow and validate it, just follow the steps: Web here, cft = cash flow in period t (time) r = discount rate. Sample discounted cash flow excel template; Cf = the cash flow in a given year (cf1 is year one.

Cash Flow Model Template

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Discounted Cash Flow Excel Template cescl.edu.br

Single Sheet DCF (Discounted Cash Flow) Excel Template

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Discounted Cash Flow Valuation Excel » The Spreadsheet Page

discounted cash flow excel template —

Discounted Cash Flow Template Business Tools Excel Templates DCF

How To Build Dcf Model Excel Structures?

Updated On January 11, 2024.

Web Elevate Your Investment Analysis With Our Free Dcf Model Template.

Excel, With Its Robust Set Of Functions, Serves As An Excellent Tool For.

Related Post: