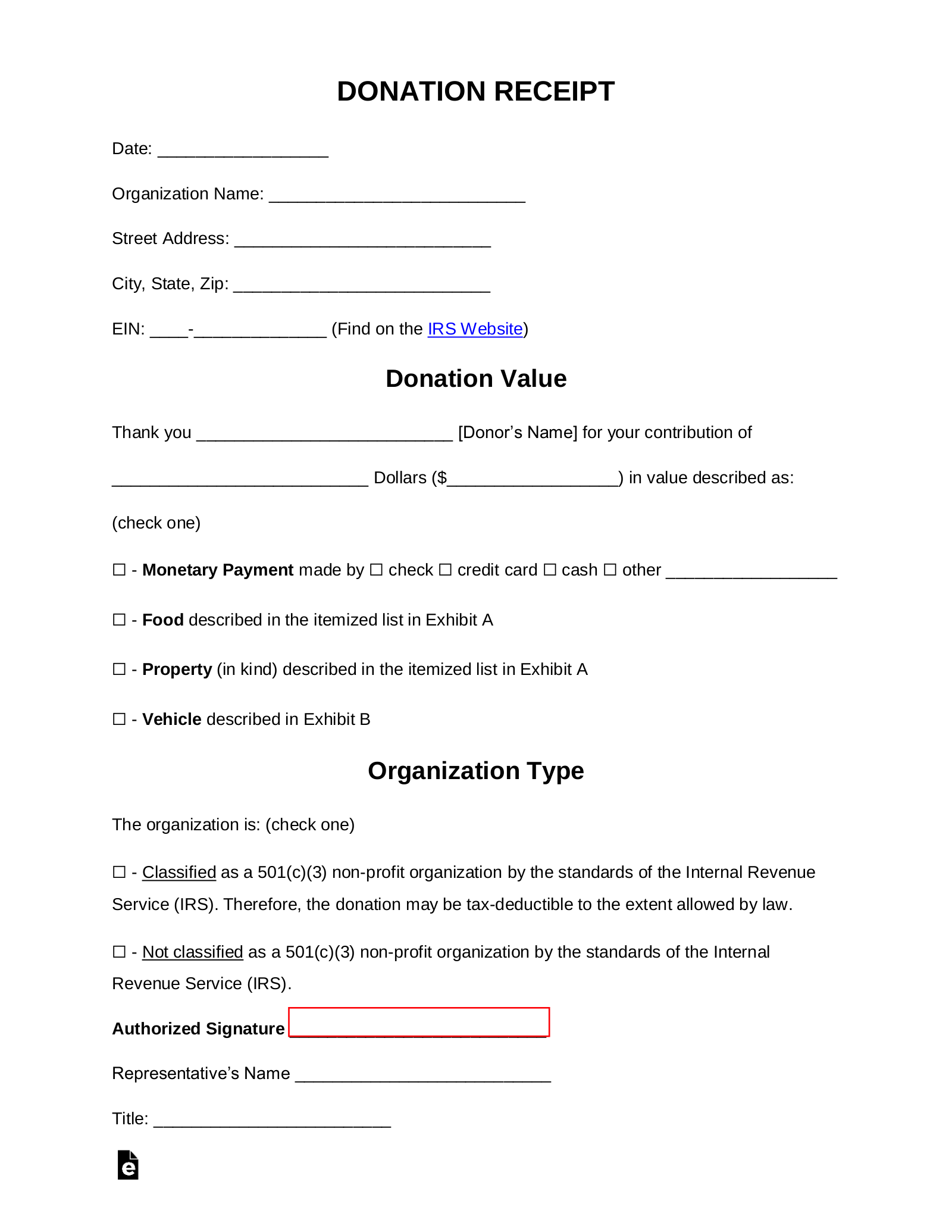

Donation Receipt Word Template

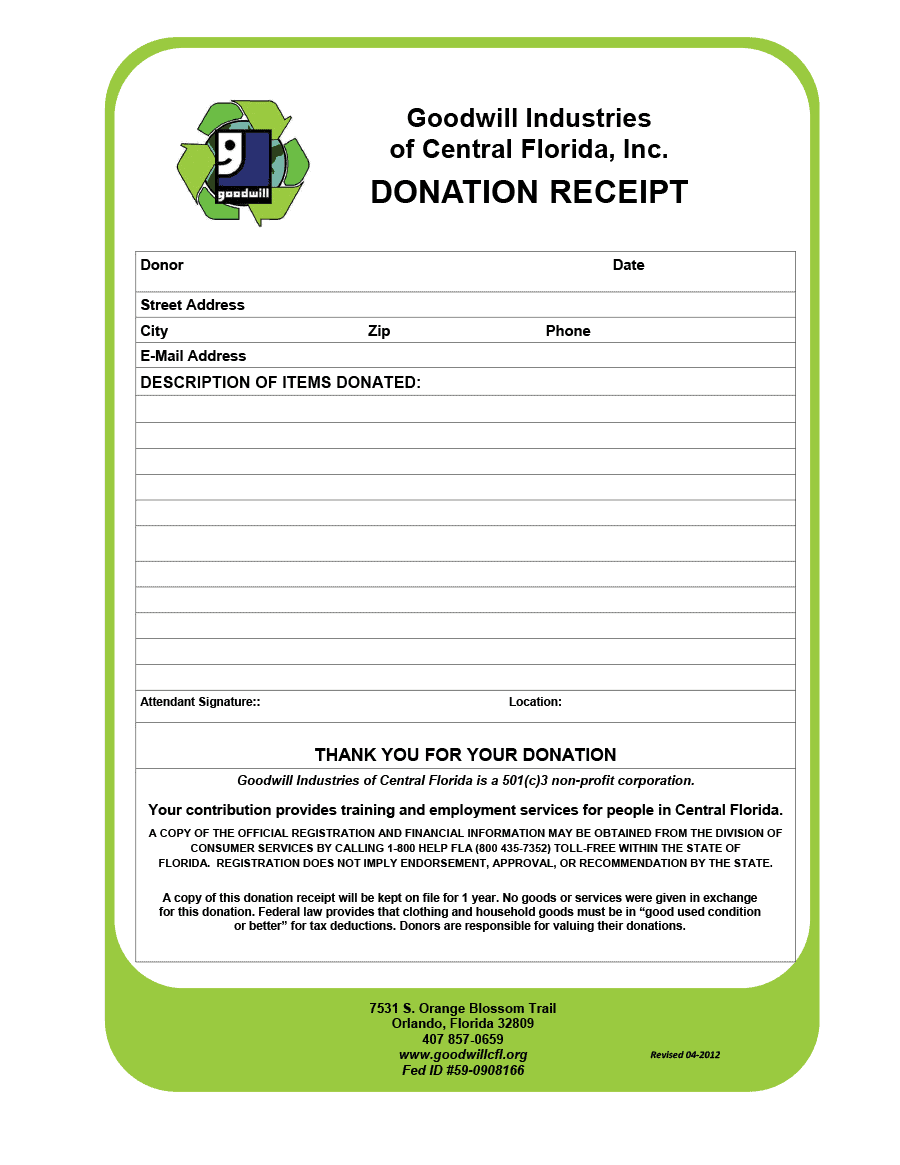

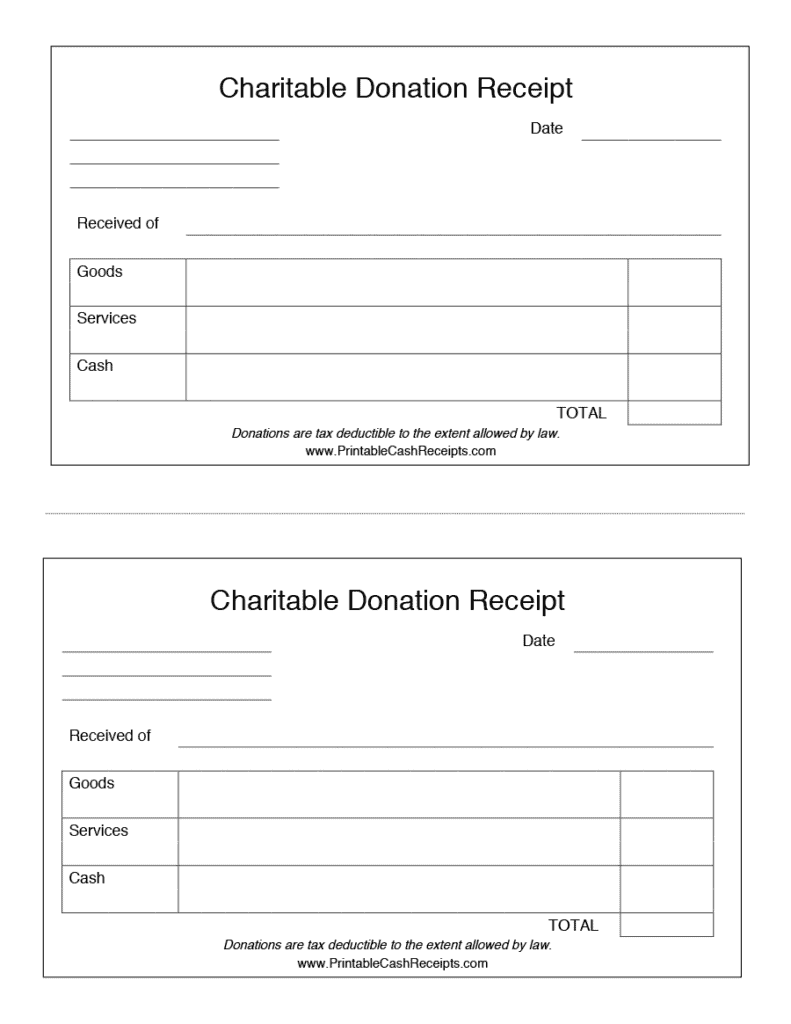

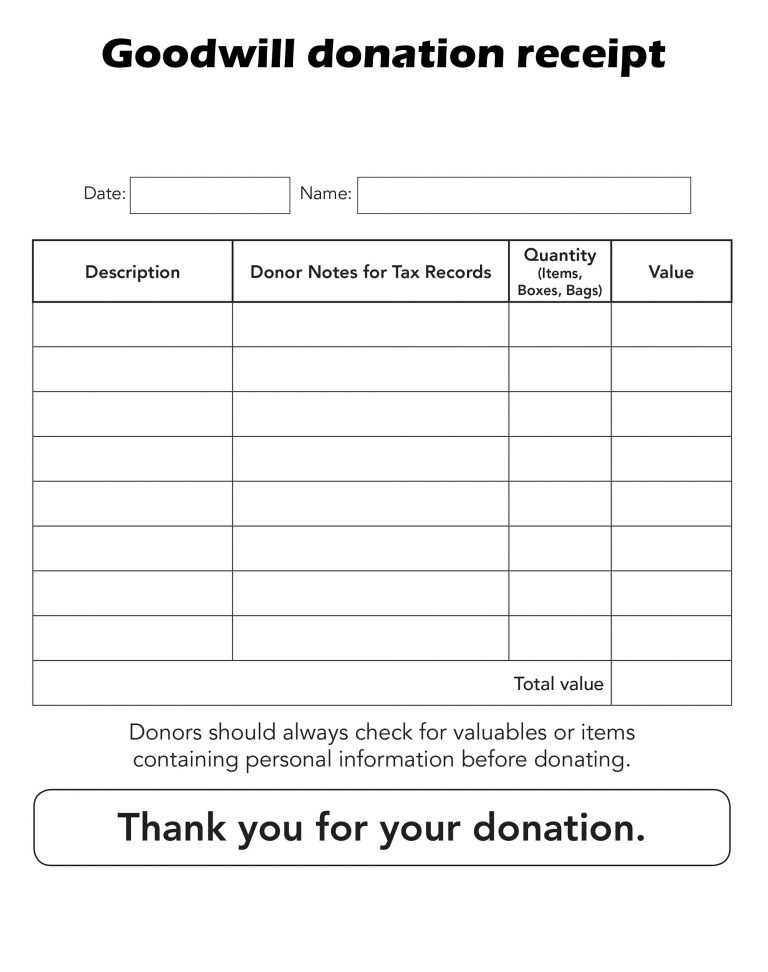

Donation Receipt Word Template - Templates offer a structured way to acknowledge contributions, reinforcing transparency, trust, and accountability in the world of philanthropy. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? The receipt also needs to list the amount that was donated. If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on your website. How to create donation receipts (plus, real examples!) use givebutter’s free donation receipt templates for smooth donor appreciation. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Online donation receipts template canada. For donations that are not cash, you will need to provide a bit more detail regarding what has been donated. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. (click image to download in word format) For donations that are not cash, you will need to provide a bit more detail regarding what has been donated. If so, you would have received a donation receipt that details your contributions. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Have you. What is a donation receipt? Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. The receipt also needs to. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Use an online donation receipt template for anyone who’s made. Such as books or clothing. Templates offer a structured way to acknowledge contributions, reinforcing transparency, trust, and accountability in the world of philanthropy. If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on your website. A donation receipt is used by companies and individuals in order to provide proof that. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Have you ever donated to your favorite charities. The receipt also needs to list the amount that was donated. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. (click image to download in word format) What is a. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Web updated december 18, 2023. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Web a donation receipt. With donations made in cash, the conation receipt should note that cash was received. What is a donation receipt? Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. Use an online donation receipt template for anyone who’s made a donate on your website. A. Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. If so, you would have received a donation receipt that details your contributions. They bridge the gap between donors and organizations and ensure compliance with tax regulations. A donation receipt is used by companies and individuals in order to. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Such as books or clothing. Web donation receipt templates are indispensable. What to include in a donation receipt. The receipt also needs to list the amount that was donated. If so, you would have received a donation receipt that details your contributions. Use an online donation receipt template for anyone who’s made a donate on your website. If you’re using sumac nonprofit crm, you can setup your receipts to send automatically after someone makes a donation on your website. Online donation receipts template canada. How to create donation receipts (plus, real examples!) use givebutter’s free donation receipt templates for smooth donor appreciation. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Templates offer a structured way to acknowledge contributions, reinforcing transparency, trust, and accountability in the world of philanthropy. Web these free printable templates in pdf and word format simplify the process of giving and receiving charitable contributions, benefiting both donors and organizations alike. It basically stands as a proof that you made a contribution. Web donation receipt templates are indispensable. (click image to download in word format) When should you send a donation receipt? Web a donation receipt is an official document that provides evidence of donations or gifts given to an organization by donors. What is a donation receipt? Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? For donations that are not cash, you will need to provide a bit more detail regarding what has been donated.

Free Donation Receipt Templates Samples PDF Word eForms

20 Best Free Microsoft Word Receipt Templates to Download

Donation Receipt Template download free documents for PDF, Word and Excel

Free Donation Receipt Templates Free Word Templates

6+ Free Donation Receipt Templates

FREE 5+ Donation Receipt Forms in PDF MS Word

6+ Free Donation Receipt Templates Word Excel Formats

5 Free Donation Receipt Templates in MS Word Templates

Donation Receipt Template in Microsoft Word

Free Sample Printable Donation Receipt Template Form

Web Updated December 18, 2023.

A 501 (C) (3) Donation Receipt Is Required To Be Completed By Charitable Organizations When Receiving Gifts In A Value Of $250 Or More.

What To Include In A Donation Receipt.

Primarily, The Receipt Is Used By Organizations For Filing Purposes And Individual Taxpayers To Provide A Deduction On Their State And Federal (Irs) Income Tax.

Related Post: