Drawer Of Check

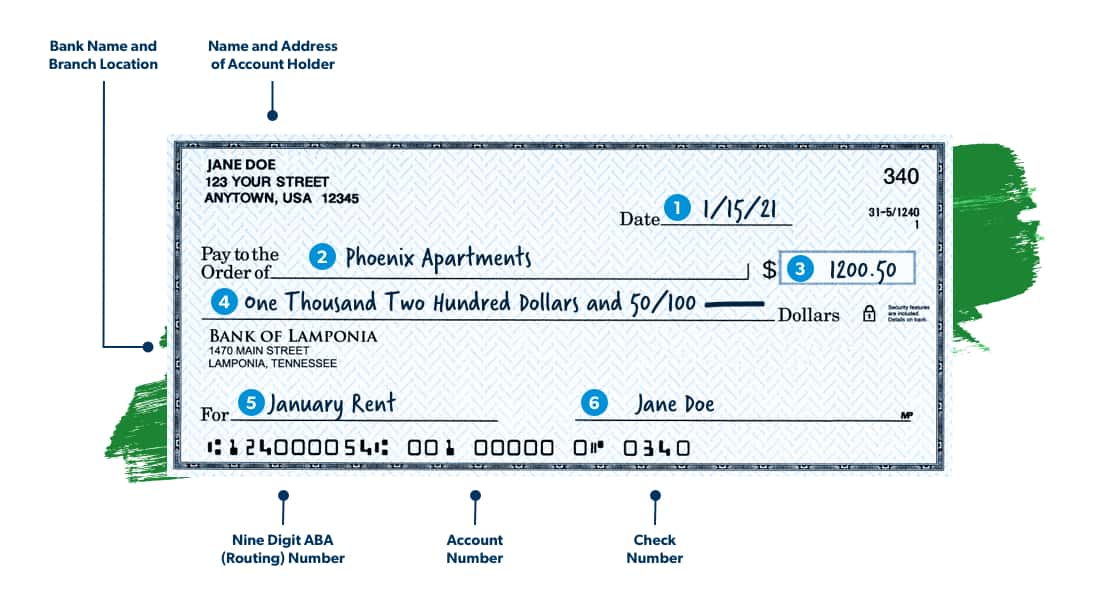

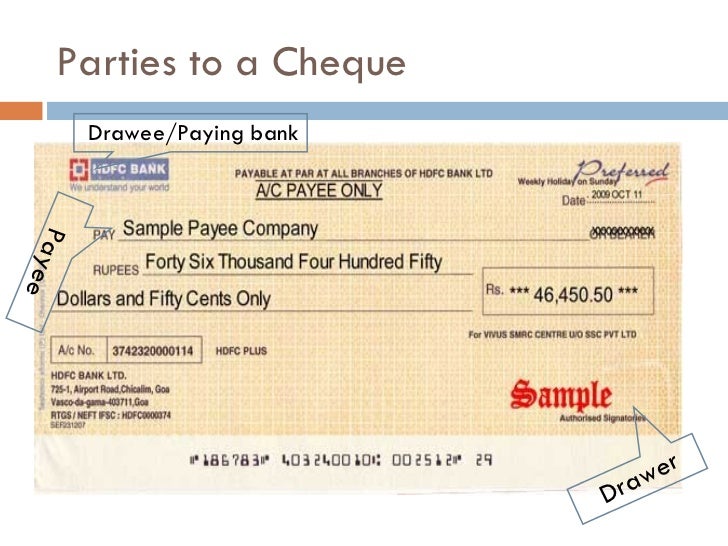

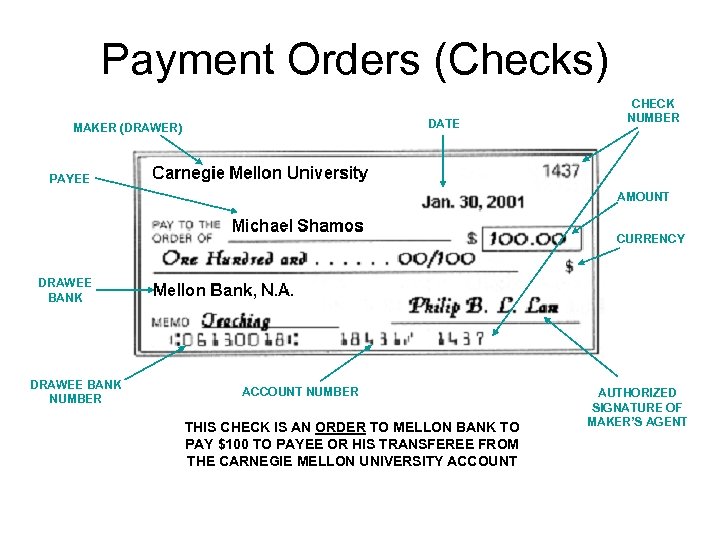

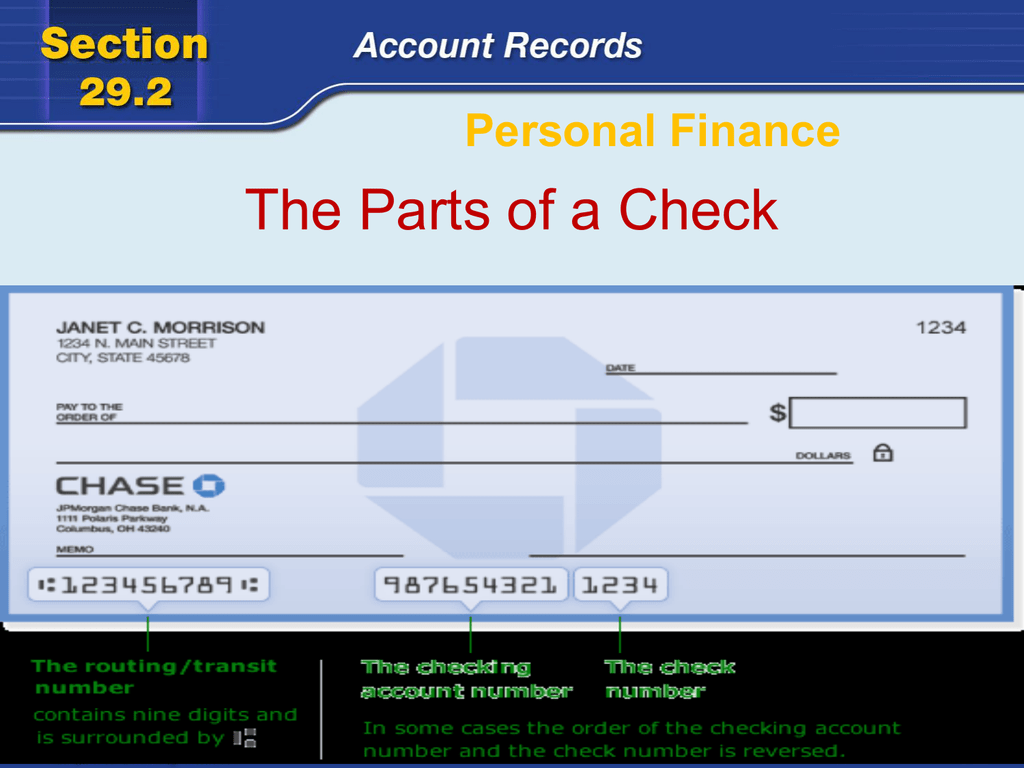

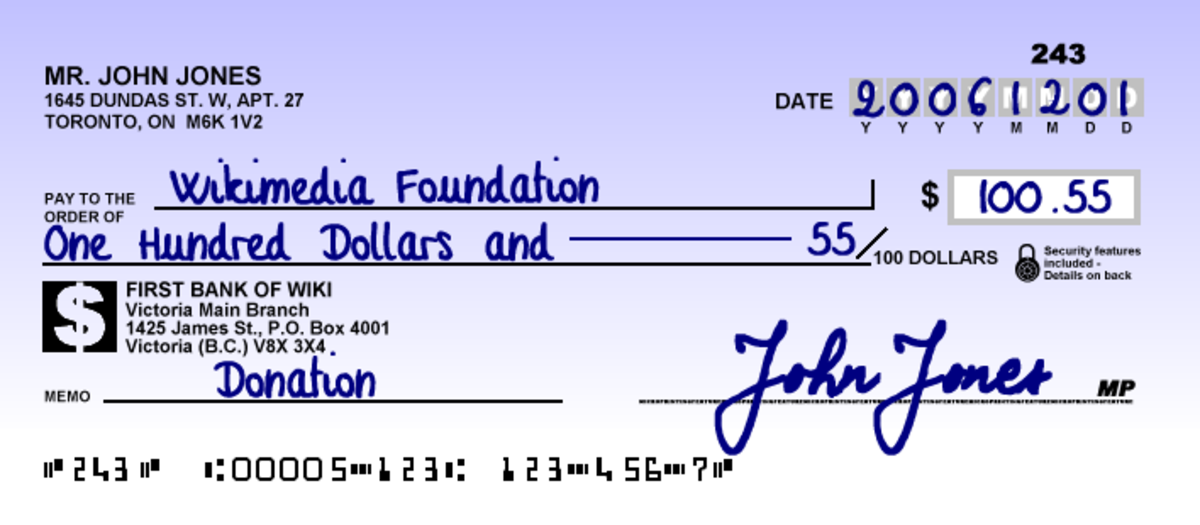

Drawer Of Check - Usually, the drawee is the bank. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is written is the payee. Web a drawee refers to the person or organization that accepts and pays a certain sum of money to a payee. The drawee is the entity or person to whom a bill is addressed and is given instructions to pay. In most cases, when a check (bill of exchange) is being drawn, the party said to be the drawee is normally a banker. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. It also verifies the authenticity of the check to prevent fraud. Fedex office & print servs., 707 f. In a financial transaction, a drawee typically serves as an intermediary. An example of this is when you cash a check. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. 2d 1074, it was held by the court that “ a ‘drawee’ means the bank on which the check is drawn. Web drawee is the party that has been ordered by the drawer to pay a certain. Web a drawee refers to the person or organization that accepts and pays a certain sum of money to a payee. The drawee is the entity that honors the check and distributes funds to the person who presents, and is identified by, the. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are. The drawee, on the other hand, is the bank on which the check. In a financial transaction, a drawee typically serves as an intermediary. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. In most cases, when a check (bill of exchange) is being drawn, the. Web understanding check format helps you set up direct deposit instructions, make sure checks you receive are filled in properly, and order new checks. The drawee is the entity that honors the check and distributes funds to the person who presents, and is identified by, the. Web the person or entity writing the check is known as the payor or. It also verifies the authenticity of the check to prevent fraud. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is written is the. The drawee, on the other hand, is the bank on which the check. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is written is the payee. Web in simple terms, the word “drawer” refers to the person or entity that writes or creates a check or. The main parts of a check include personal information, bank information, the payee's name, check amount, and signature. The drawee, on the other hand, is the bank on which the check. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is written is the payee.” [1] checks. Web drawee is the party that has been ordered by the drawer to pay a certain sum of money to the person presenting the check (the payee). Web in simple terms, the word “drawer” refers to the person or entity that writes or creates a check or bill of exchange. The drawee is the entity that honors the check and. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. The drawee bank captures the check’s details, including the account numbers, amount, and payee information. The main parts of a check include personal information, bank information, the payee's name, check amount, and signature. It also verifies the. Web a drawee refers to the person or organization that accepts and pays a certain sum of money to a payee. In most cases, when a check (bill of exchange) is being drawn, the party said to be the drawee is normally a banker. Web in simple terms, the word “drawer” refers to the person or entity that writes or. The drawee, on the other hand, is the bank on which the check. It also verifies the authenticity of the check to prevent fraud. Web in simple terms, the word “drawer” refers to the person or entity that writes or creates a check or bill of exchange. The payee deposits or presents the check at their drawee bank for payment. Usually, the drawee is the bank. The drawer is the party who initiates the transaction and instructs the drawee to pay a specific amount of money to the payee. In most cases, when a check (bill of exchange) is being drawn, the party said to be the drawee is normally a banker. 2d 1074, it was held by the court that “ a ‘drawee’ means the bank on which the check is drawn. The drawee bank captures the check’s details, including the account numbers, amount, and payee information. Web a payor, or drawer, is the person with the money who issues a check. Web the person or entity writing the check is known as the payor or drawer, while the person to whom the check is written is the payee.” [1] checks allow two or more parties to perform a transaction without the use of physical currency. Fedex office & print servs., 707 f. An example of this is when you cash a check. Web a drawee refers to the person or organization that accepts and pays a certain sum of money to a payee. Your employer, who wrote the review, is the drawer, the bank that cashed it is the drawee, and you are the payee. Web drawee is the party that has been ordered by the drawer to pay a certain sum of money to the person presenting the check (the payee).

Common Payment Services — EFT Electronic Funds Transfer

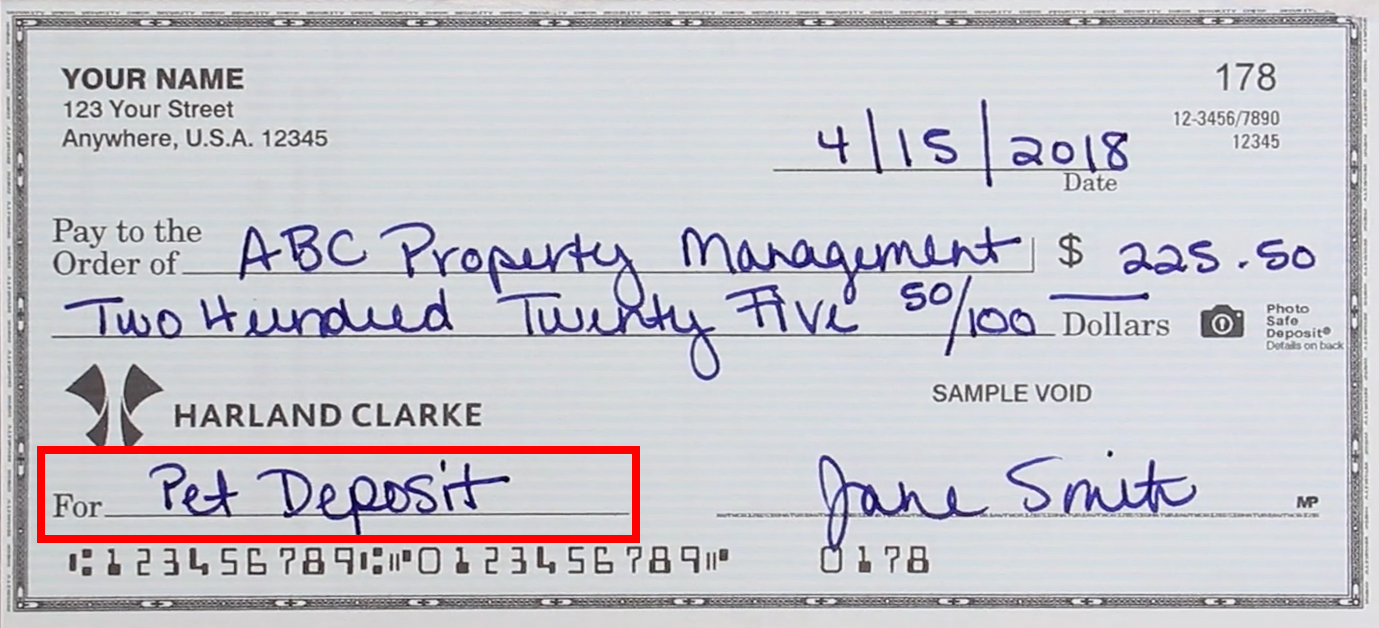

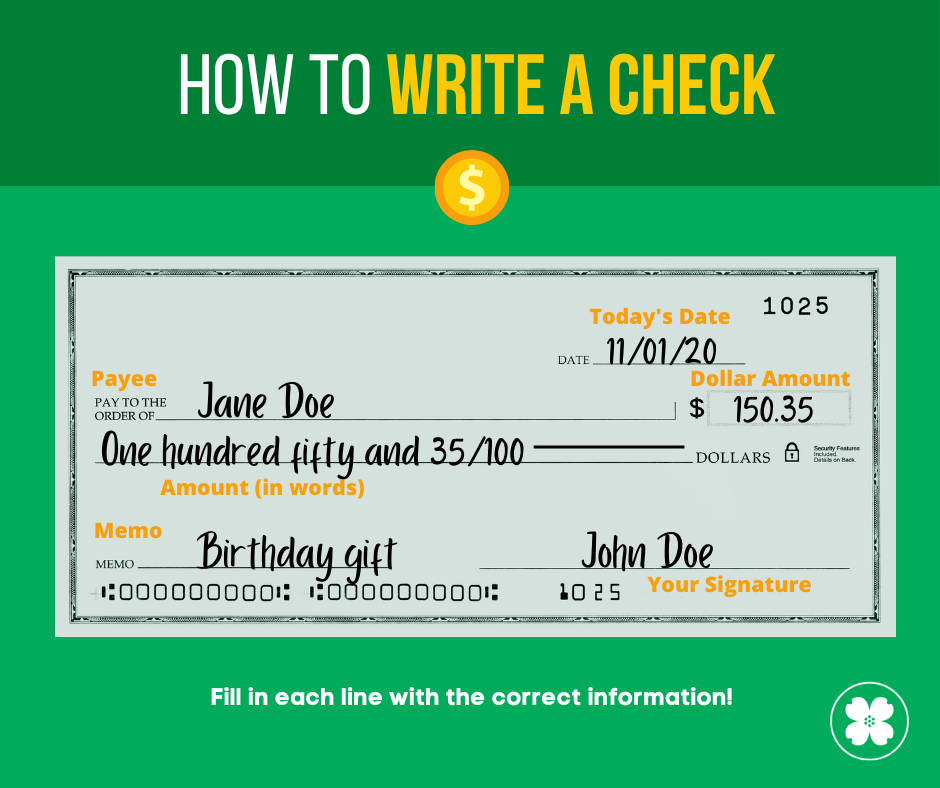

Detailed Guide On How To Write A Check

Lab combined group18

Drawer Drawee Payee Maker Bruin Blog

The Parts of a Check

How to Write a Check 5 Step Video with Pictures! Home

Cash Drawer APG Check Cashing Software QuickCheck

Understanding Check Basics Central Bank

How to Write a Check Cheque Writing 101 HubPages

"The Role of Technology in Enhancing Check Layout Design and

Web The Person Or Entity Writing The Check Is Known As The Payor Or Drawer, While The Person To Whom The Check Is Written Is The Payee.

In A Financial Transaction, A Drawee Typically Serves As An Intermediary.

Web Understanding Check Format Helps You Set Up Direct Deposit Instructions, Make Sure Checks You Receive Are Filled In Properly, And Order New Checks.

Writing A Check Is A Way To Tell A Bank To Transfer Funds From One Account To Another.

Related Post: