Free 1099 Template

Free 1099 Template - Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types”. Persons with a hearing or speech disability with access to tty/tdd equipment can. Enter information into the portal or upload a file with a downloadable template in iris. How to use this 1099 spreadsheet. Web updated november 06, 2023. File your 1099 with the irs for free. A 1099 is a type of form that shows income you received that wasn't from your employer. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)). Quick & secure online filing. Simply hit download, fill in your details, and send it in to the irs. If you paid an independent contractor more than $600 in. From there, you can also download it to use as a 1099 excel template. Try our 1099 expense tracker for free. Persons with a hearing or speech disability with access to tty/tdd equipment can. Persons with a hearing or speech disability with access to tty/tdd equipment can. Persons with a hearing or speech disability with access to tty/tdd equipment can. A 1099 is a type of form that shows income you received that wasn't from your employer. If you want to report nonemployee compensation, you will have to file form 1099. Pricing starts as low as $2.75/form. If you paid an independent contractor more than $600 in. Simply hit download, fill in your details, and send it in to the irs. The 1099 form is a common irs form covering several potentially taxable income situations. Web with iris, business taxpayers can: For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer. Make corrections to information returns filed with iris. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web just click on the link. Web just click on the link above and make a copy in google sheets. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web with iris, business taxpayers can: Currently, iris accepts forms 1099 only for tax year 2022 and later. Depending on what’s happened in your financial life during the year, you could get one. Tips and instructions for use. Pricing starts as low as $2.75/form. Web updated november 06, 2023. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. Web recipient’s taxpayer identification number (tin). From there, you can also download it to use as a 1099 excel template. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. Persons with a hearing or speech disability with access to tty/tdd equipment can. Enter information into the portal or upload a file with a downloadable template in iris. File. Pricing starts as low as $2.75/form. Currently, iris accepts forms 1099 only for tax year 2022 and later. File to download or integrate. Web updated november 06, 2023. Web with iris, business taxpayers can: Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. A 1099 is a type of form that shows income you received that wasn't from your employer. Web recipient’s taxpayer identification number (tin). Web just click on the link above and. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types”. File your 1099 with the irs for free. Getting a 1099 form doesn't mean you necessarily owe taxes on that income, but you will. Web just click on the link above and make a copy in google sheets. Web. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. Quick & secure online filing. Enter information into the portal or upload a file with a downloadable template in iris. What to do after filling out your 1099 template. File your 1099 with the irs for free. Depending on what’s happened in your financial life during the year, you could get one or more 1099 tax form “types”. Pricing starts as low as $2.75/form. Make corrections to information returns filed with iris. Tips and instructions for use. File to download or integrate. From there, you can also download it to use as a 1099 excel template. Persons with a hearing or speech disability with access to tty/tdd equipment can. The 1099 form is a common irs form covering several potentially taxable income situations. This form is used by businesses to report payments made to nonemployees, like independent contractors or freelancers. How to use this 1099 spreadsheet. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein)).

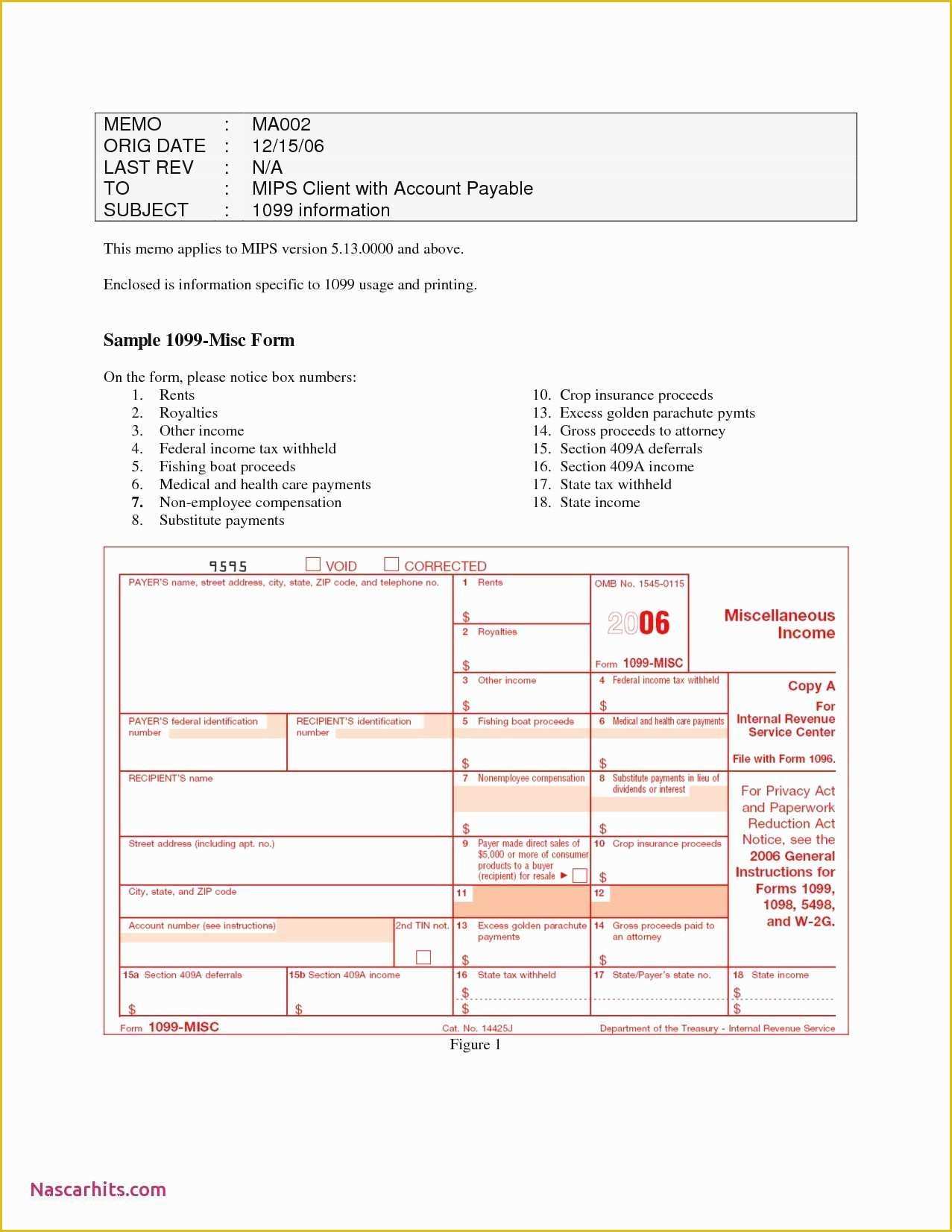

1099 Misc Excel Template Free Printable Word Searches

Free 1099 Template Excel (With StepByStep Instructions!)

62 Free 1099 Misc Template Word Heritagechristiancollege

Free 1099 Misc Template Word Of 1099 Invoice Template

1099 Misc Excel Template Free Printable Word Searches

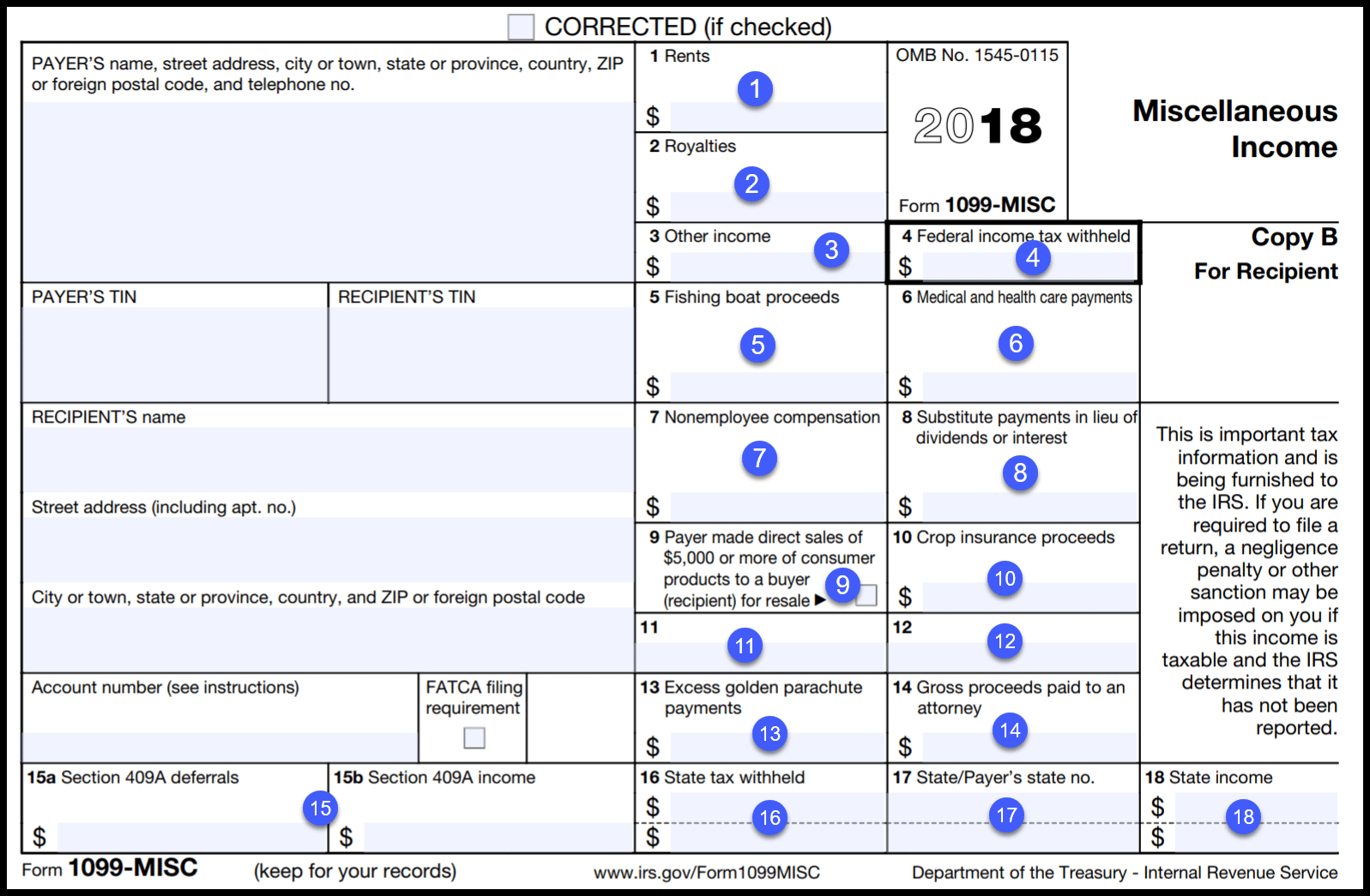

Printable 1099 Misc Form 2018 Printable Word Searches

1099 Template Excel

1099 Form Template. Create A Free 1099 Form Form.

Free Printable 1099 Form 2018 Free Printable

1099 Nec Template Excel Free The Templates Art

Currently, Iris Accepts Forms 1099 Only For Tax Year 2022 And Later.

Web Updated November 06, 2023.

Web Recipient’s Taxpayer Identification Number (Tin).

A 1099 Is A Type Of Form That Shows Income You Received That Wasn't From Your Employer.

Related Post: