Free Donation Receipt Template

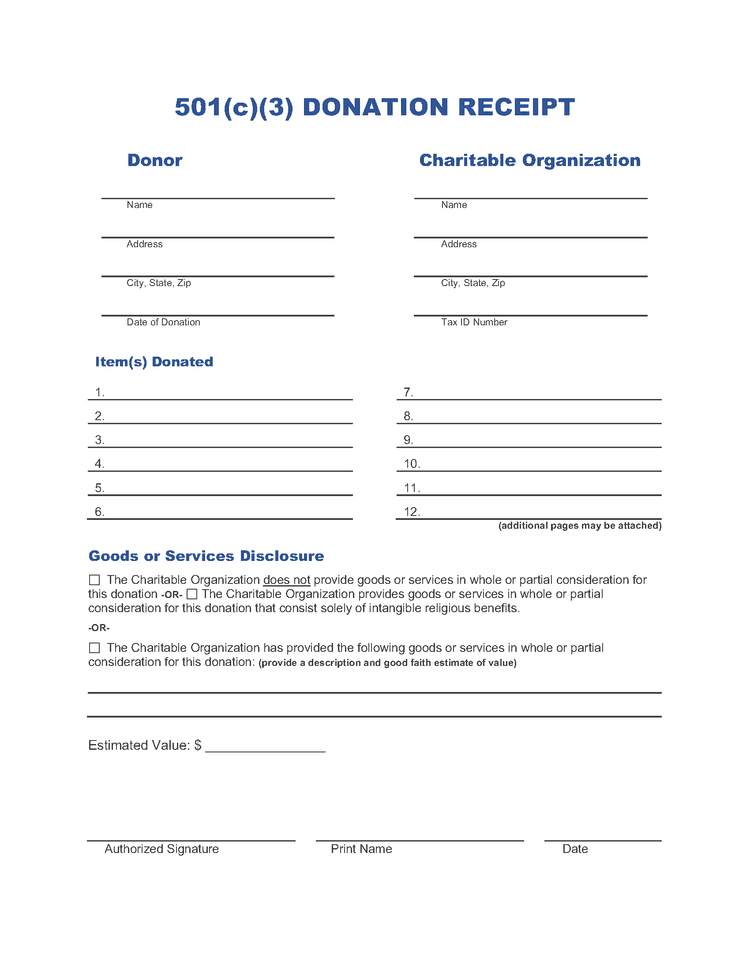

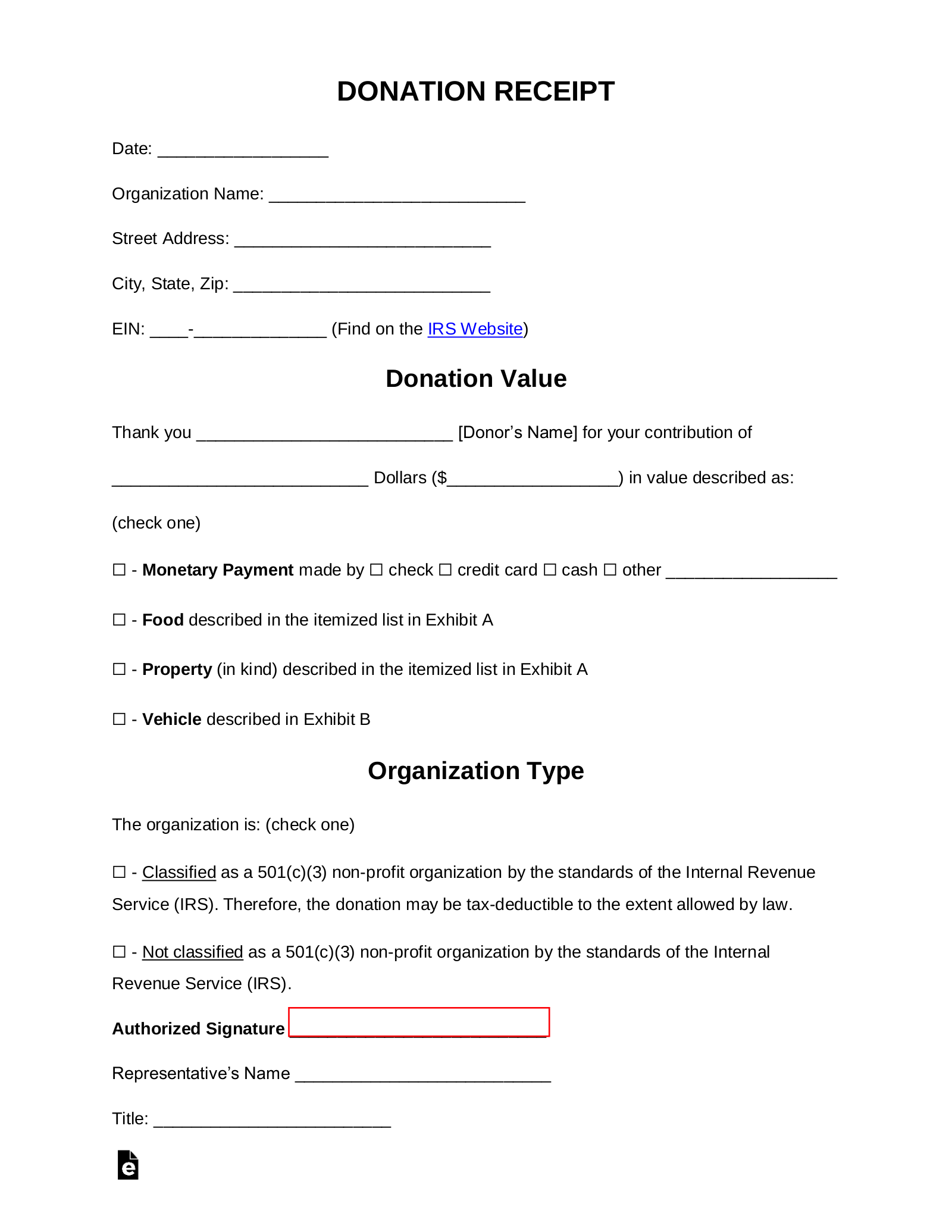

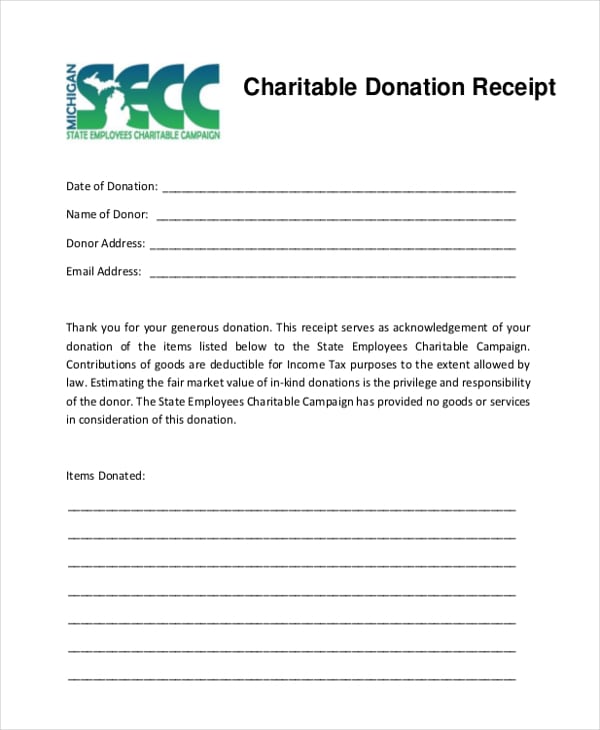

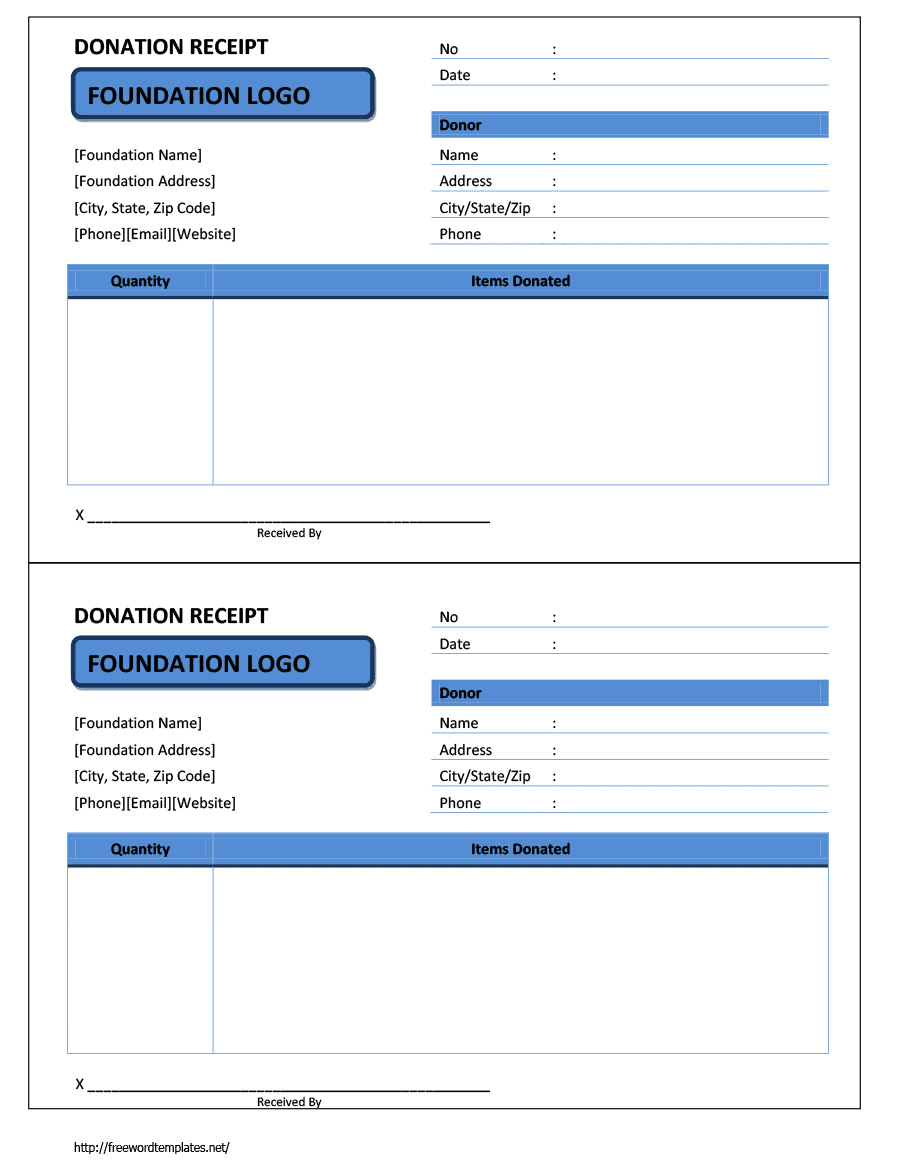

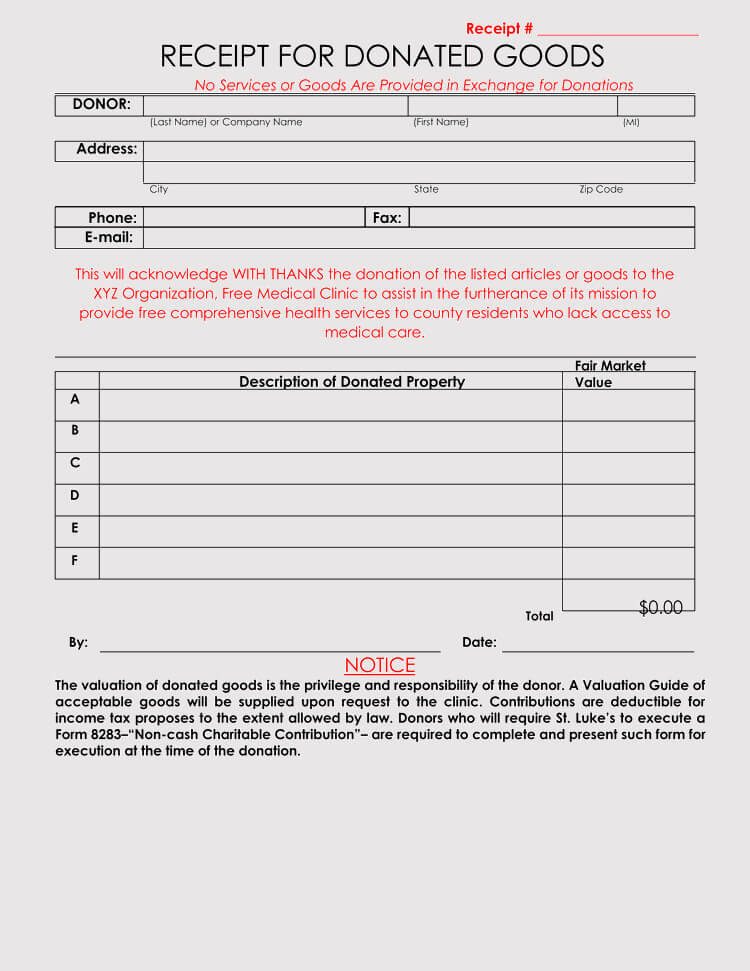

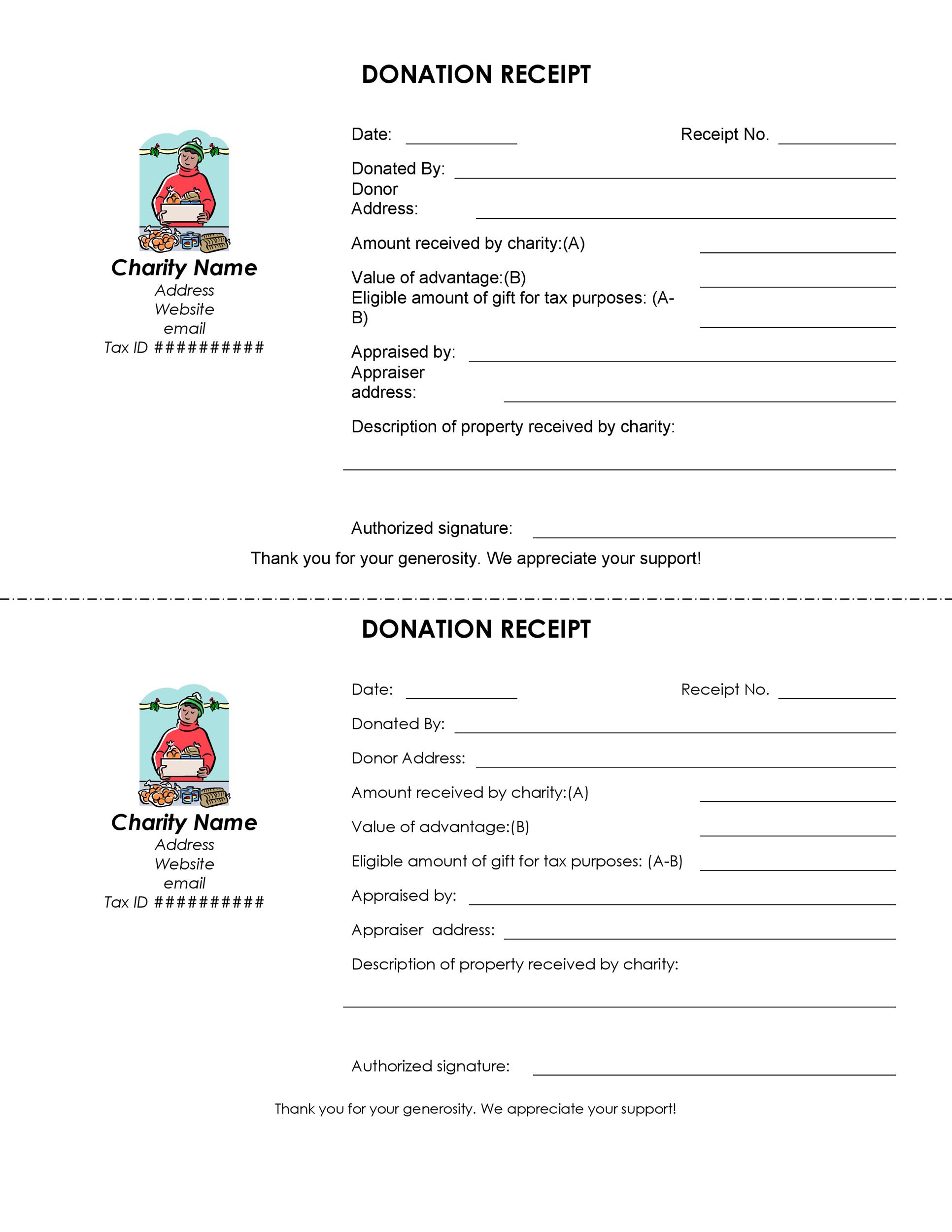

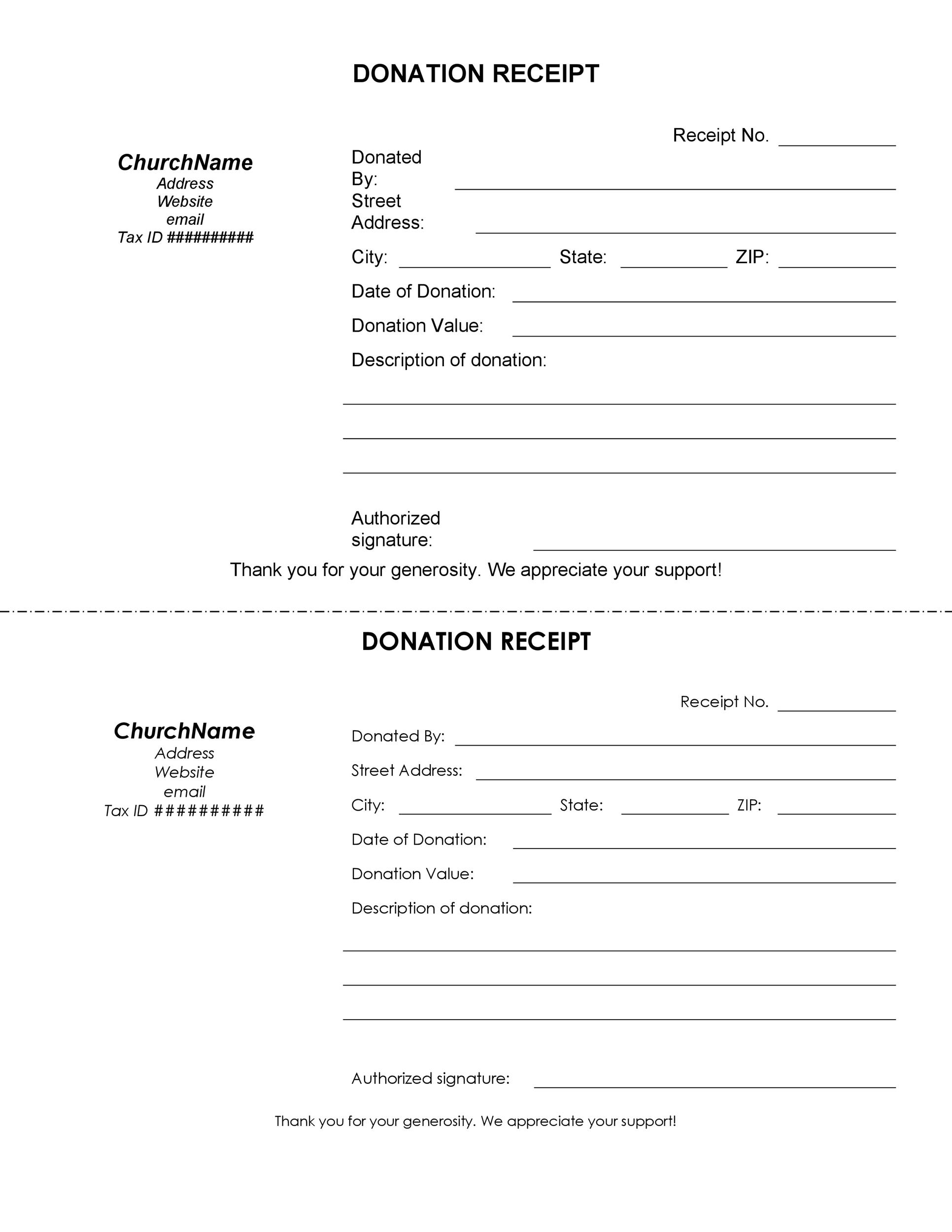

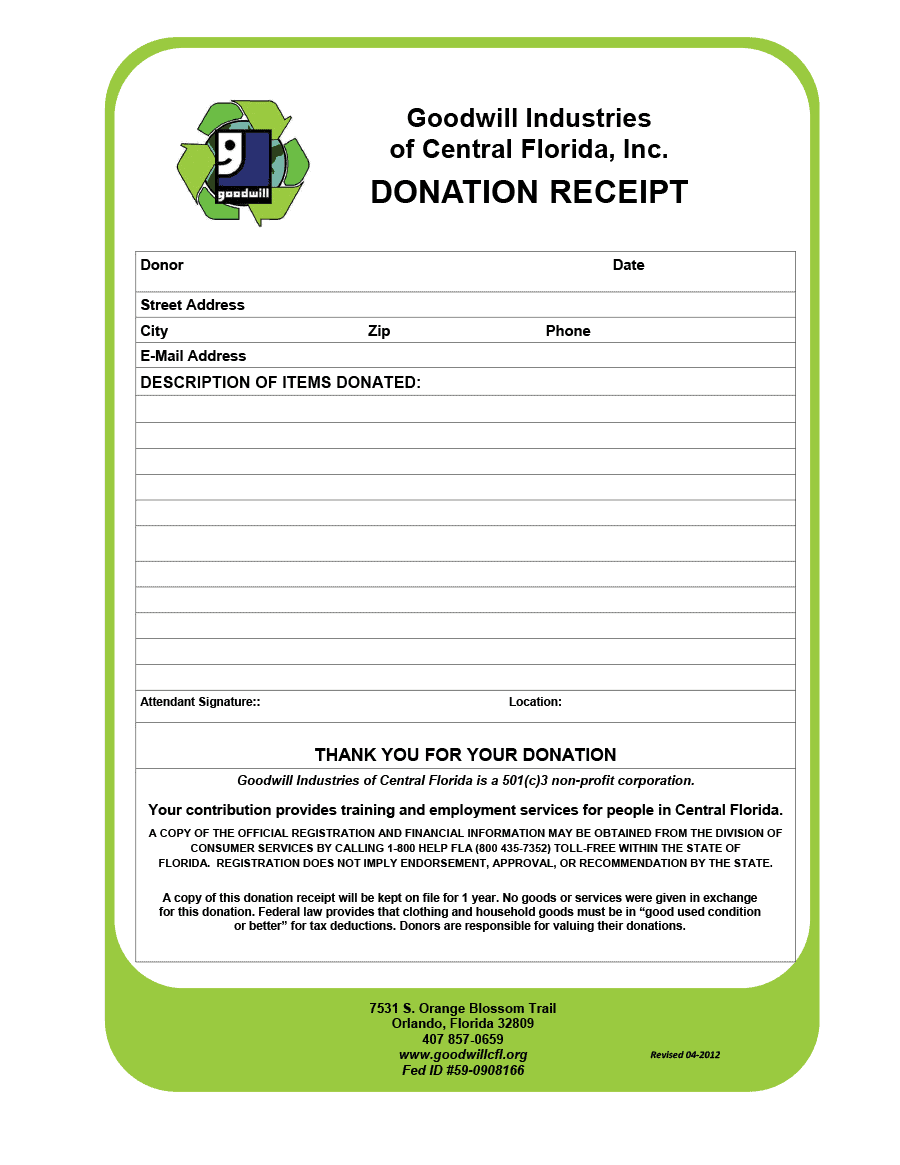

Free Donation Receipt Template - Click the button below to add this template to your account. Feel free to download, modify and use any you like. For example, a business may choose to donate computers to a school and declare that donation as a. An email is a good way to provide documentation about a charitable donation and thank your donors for their help. They promote transparency and give donors a clear record of their contributions, including the date, amount, and purpose of the donation. Microsoft word (.docx) clothing donation receipt template. Information covered by these types of invoices includes: 4 how to print receipt templates. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income tax. Microsoft word (.docx) church donation receipt template. Feel free to download, modify and use any you like. Click the button below to add this template to your account. How to create donation receipts (plus, real examples!) use givebutter’s free donation receipt templates for smooth donor appreciation. 2 what is the difference between the formats? What is a donation receipt? For example, a business may choose to donate computers to a school and declare that donation as a. Web updated april 24, 2024. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. 3 how to create a receipt. The name of the organization. Donation receipts help organizations comply with legal and tax regulations. Information covered by these types of invoices includes: Web an official donation receipt is a document that provides the donor with an itemized list of how their donation was spent. It basically stands as a. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. Web updated december 18, 2023. Web this donation receipt template is entirely customizable for your. These are given when a donor donates to a nonprofit organization. A cash donation receipt provides written documentation of a cash contribution from a donor to a charity or organization. Email template for charitable donation receipt. Primarily, the receipt is used by organizations for filing purposes and individual taxpayers to provide a deduction on their state and federal (irs) income. Web text receipt for donations template. 3 how to create a receipt maker. A charitable donation receipt serves as proof of the contribution made by a donor to a nonprofit organization. When should you send a donation receipt? A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. The date of the contribution. Made to meet canada and the usa requirements. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Web here are some free 501 (c) (3) donation receipt templates for you to download and use; Web free nonprofit donation receipt templates for every giving scenario. It’s utilized by an individual that has donated cash or payment, personal property, or a vehicle and seeking to claim the donation as a tax deduction. Have you ever donated to your favorite charities or for worthy causes to help certain advocacies? Web a donation receipt is a form of receipt that shows concrete evidence that a benefactor had donated. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. These are given when a donor donates to a nonprofit organization. 4 how to print receipt templates. If so, you would have received a donation receipt that details your contributions. It’s utilized by. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. It basically stands as a. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. What is a donation invoice? Web updated august 24, 2023. Web this donation receipt template is entirely customizable for your nonprofit's needs. Email template for charitable donation receipt. An email is a good way to provide documentation about a charitable donation and thank your donors for their help. What is a donation invoice? The name of the organization. Donation invoices (also known as donation receipts) provide proof of a charitable donation. It basically stands as a. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. 3 how to create a receipt maker. Donation receipts help organizations comply with legal and tax regulations. The date of the contribution. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. What to include in a donation receipt. Contact information, such as a phone number. Microsoft word (.docx) church donation receipt template. Web updated december 18, 2023.

501(c)(3) Organization Donation Receipts (6) Invoice Maker

Free Goodwill Donation Receipt Template PDF eForms

Free Donation Receipt Templates Samples PDF Word eForms

5 Charitable Donation Receipt Templates Free Sample Templates

6+ Free Donation Receipt Templates

46 Free Donation Receipt Templates (501c3, NonProfit)

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

50+ Free Receipt Templates (Cash, Sales, Donation, Taxi...)

6+ Free Donation Receipt Templates

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-10.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

This Donation Receipt Will Act As Official Proof Of The Contribution, And Help Donors Claim A Tax Deduction.

Made To Meet Canada And The Usa Requirements.

The Donation Receipt May Be Issued By Your Charity, Organization, Or Group To Document The Receipt Of A Donation.

Have You Ever Donated To Your Favorite Charities Or For Worthy Causes To Help Certain Advocacies?

Related Post: