How To Do An Owners Draw

How To Do An Owners Draw - Web however, besides that exception, small business owners are paid via an owner’s draw. What is an owner’s draw? The gate in which each horse starts. The owner's equity is made up of different funds, including money you've invested in your. The pros and cons of taking an owner’s draw. Web before deciding which method is best for you, you must first understand the basics. How to pay yourself as a business owner by business type. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. Business owners might use a draw for. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web owner’s drawing is a temporary contra equity account with a debit balance that reduces the normal credit balance of an owner's equity capital account in a business organized. Learn how to pay an owner of a sole proprietor business in quickbooks. If you're an accountant for a small business, you may be responsible for allocating funds for the owner's. Web the two main ways to pay yourself as a business owner are owner’s draw and salary. How to pay yourself as a business owner by business type. The pros and cons of taking an owner’s draw. How an owner's draw affects taxes. You can enter an opening balance for your owner's draw. “we don’t have to stand in. Web how to pay yourself with the draw method: Next, durland talks about how golfers slice the ball, how they hook the ball, and what we can learn from the latter to make two. Web set up and pay an owner's draw. With the draw method, you can draw money from your business earning. Using this method, the owner. Is there a certain amount that i must take? Web there are two main ways to pay yourself: Next, durland talks about how golfers slice the ball, how they hook the ball, and what we can learn from the latter to make two. Web there are two primary ways a business owner can compensate themselves. “we don’t have to stand in. Small business owners often use their personal. Next, durland talks about how golfers slice the ball, how they hook the ball, and what we can learn from the latter to make two. How to pay yourself as a business owner by business type. Web while the post position draw is usually held on monday. You can enter an opening balance for your owner's draw. Web an owner’s draw, also called a draw, is when a business owner takes funds out of their business for personal use. If you're an accountant for a small business, you may be responsible for allocating funds for the owner's personal income. Small business owners often use their personal. “we. The pros and cons of taking an owner’s draw. Web starting a business. How do business owners get paid? “we don’t have to stand in. Using this method, the owner. An owners draw is a money draw. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. Web the owner's draws are usually taken from your owner's equity account. The pros and cons of taking an owner’s draw. How do business owners get paid? Web the two main ways to pay yourself as a business owner are owner’s draw and salary. Web while the post position draw is usually held on monday ahead of the event, the 2024 draw was held a full week ahead on saturday. As for which one to use, the irs. Web owner’s drawing is a temporary contra equity account. If you're an accountant for a small business, you may be responsible for allocating funds for the owner's personal income. Learn how to pay an owner of a sole proprietor business in quickbooks. Web “we we’re kind of hoping for an outside draw,” pletcher said after the draw in the new $200 million paddock coliseum at churchill downs. The owner's. With the draw method, you can draw money from your business earning. Web an owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web before deciding which method is best for you, you must first understand the basics. Web the owner's draws are usually taken from your owner's equity account. Web the two main ways to pay yourself as a business owner are owner’s draw and salary. Web how to pay yourself with the draw method: Web while the post position draw is usually held on monday ahead of the event, the 2024 draw was held a full week ahead on saturday. An owners draw is a money draw. How an owner's draw affects taxes. December 18, 2017 1 min read. Using this method, the owner. Web “we we’re kind of hoping for an outside draw,” pletcher said after the draw in the new $200 million paddock coliseum at churchill downs. The draw method and the salary method. How do business owners get paid? If you're an accountant for a small business, you may be responsible for allocating funds for the owner's personal income. How to pay yourself as a business owner by business type.

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

How to pay invoices using owner's draw? QuickBooks Community

owner's drawing account definition and Business Accounting

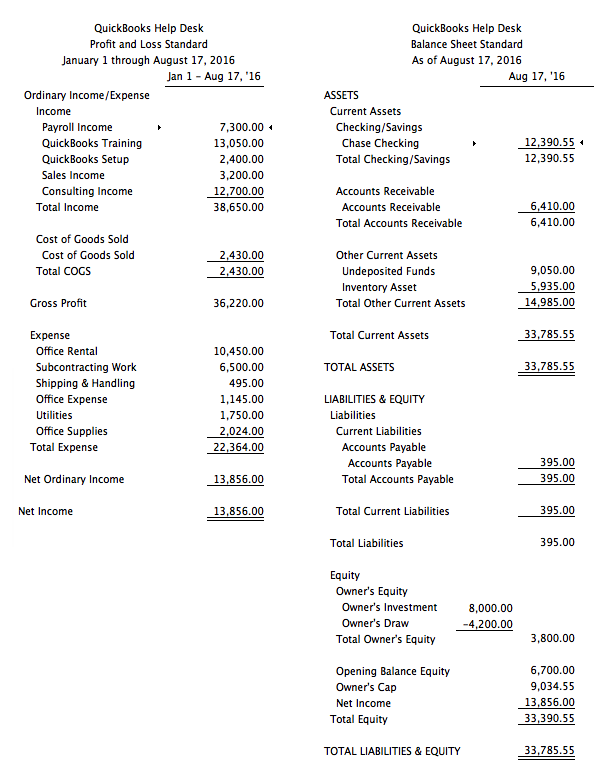

Owners draw balances

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

Owner Draw 101 for Photographers YouTube

All About The Owners Draw And Distributions Let's Ledger

What Is an Owner's Draw? Definition, How to Record, & More

How to record an Owner's Draw Bookkeeping software, Business expense

What is Owner’s Draw (Owner’s Withdrawal) in Accounting? Accounting

September 30, 2021 09:54 Am.

Web The First Thing You Need To Know Is That There Are Two Main Ways You Can Pay Yourself:

Web Updated January 26, 2023.

Faqs About Paying Yourself As A Business Owner.

Related Post: