Lbo Template

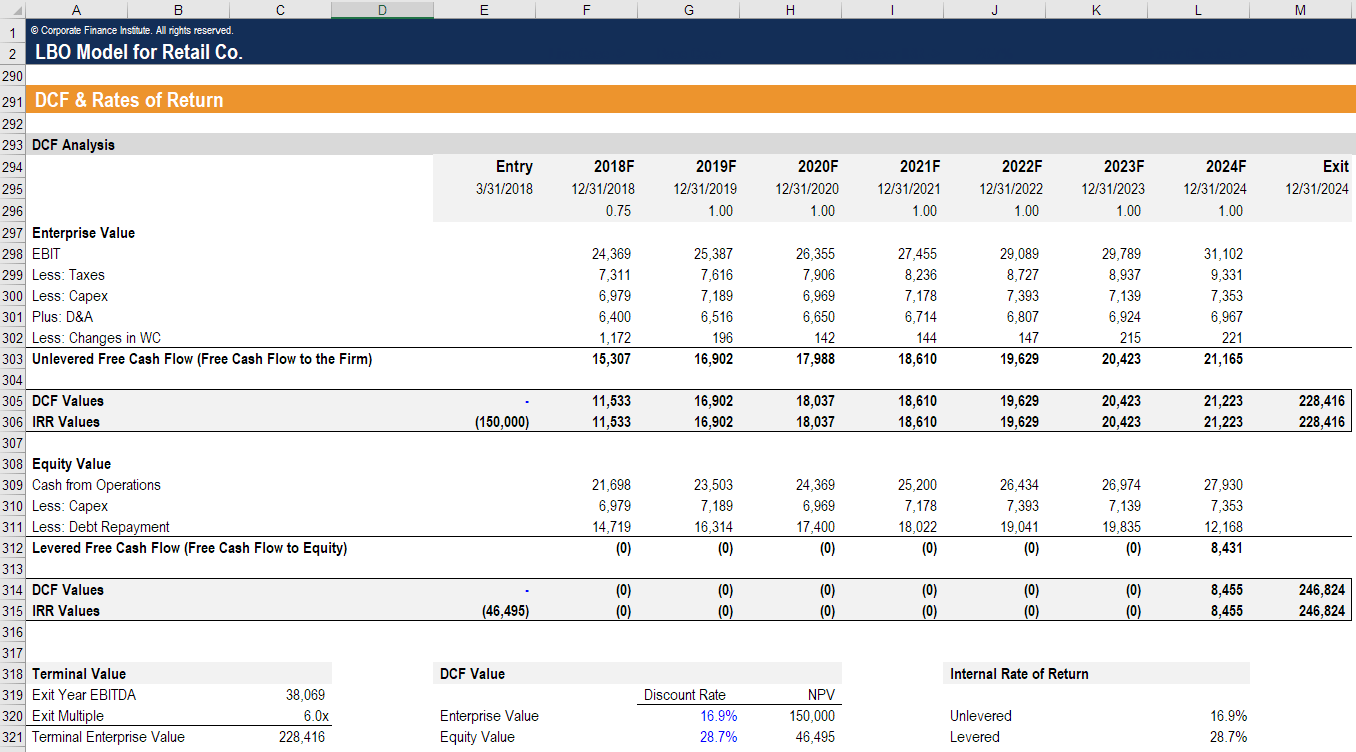

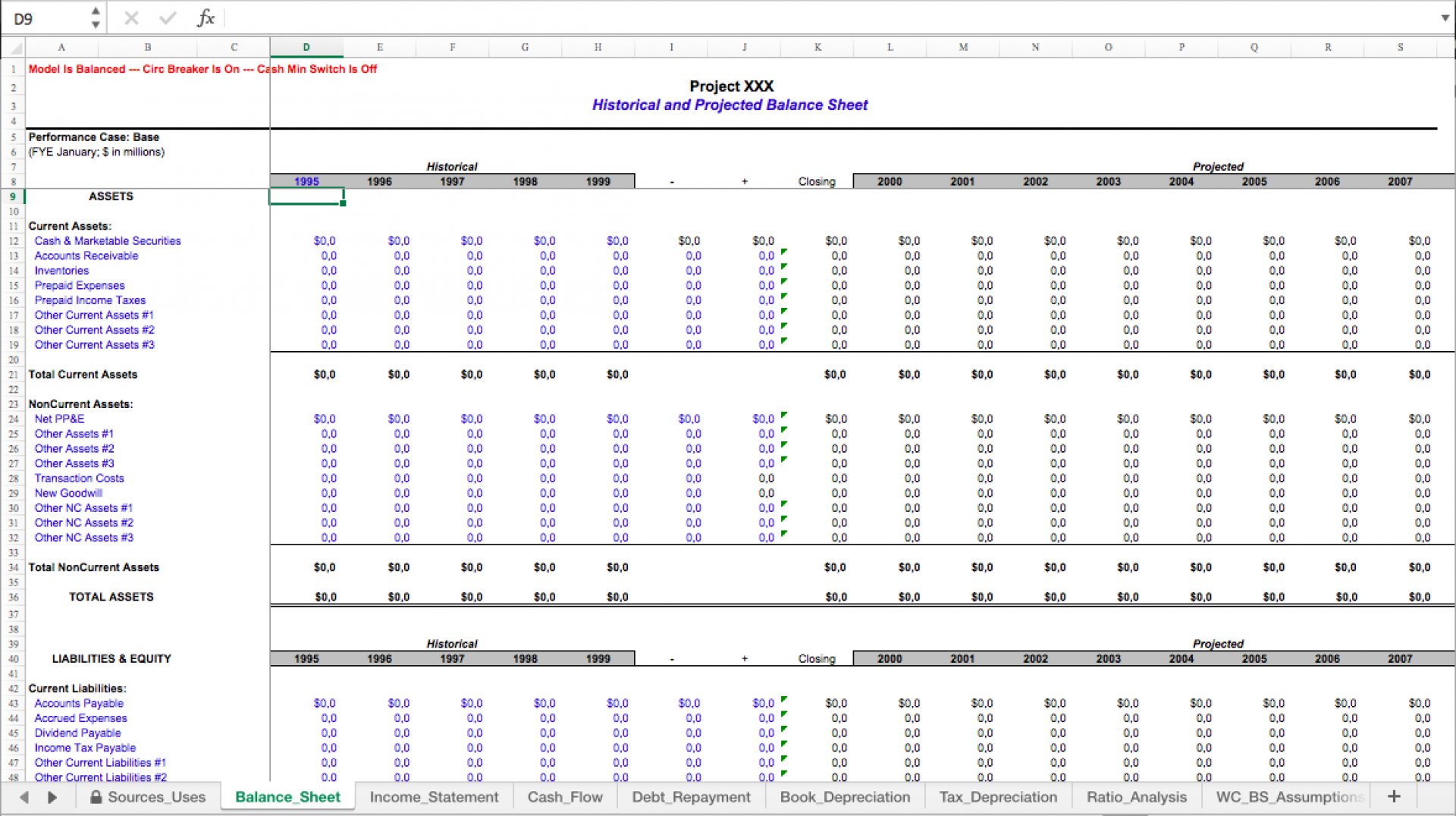

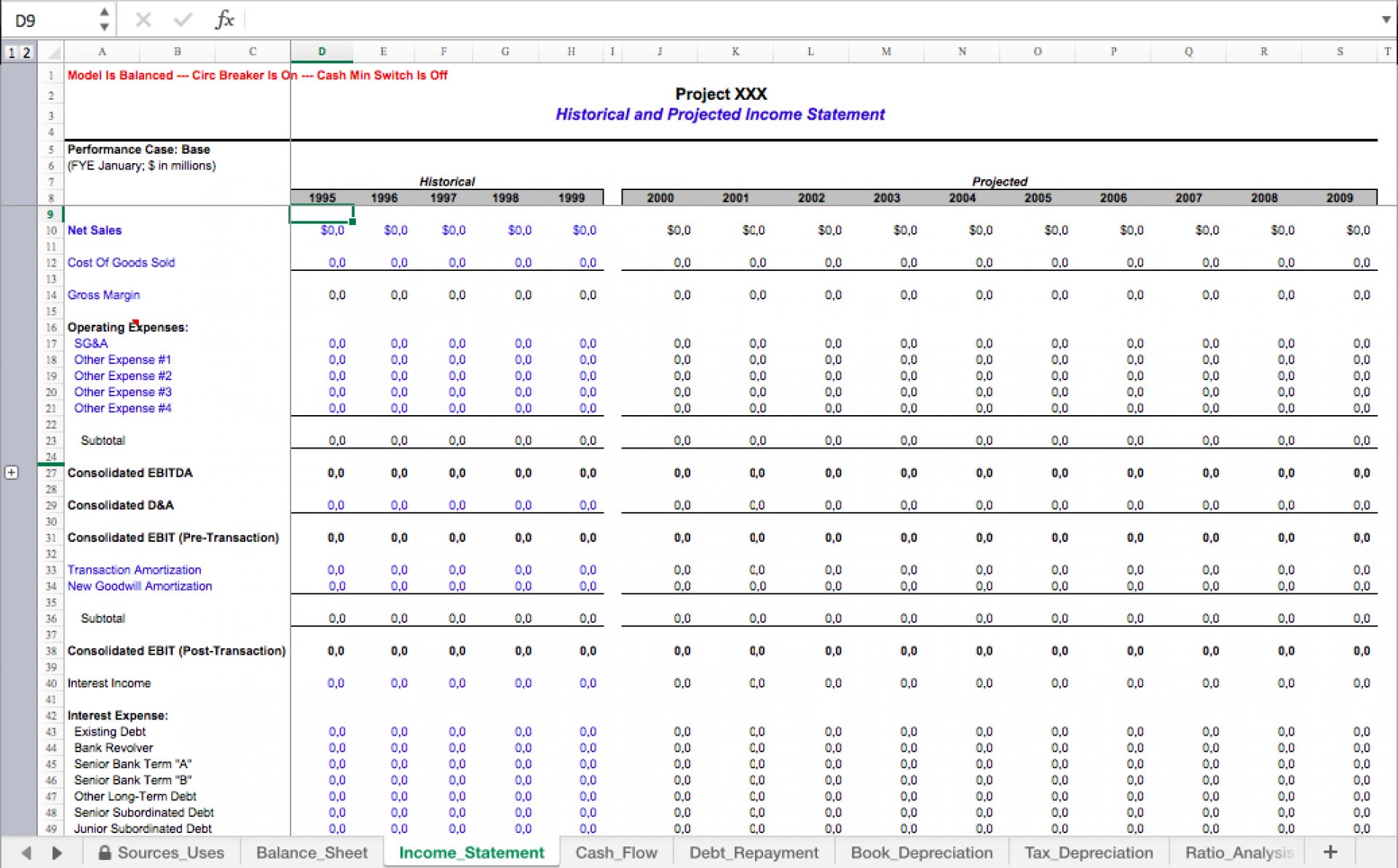

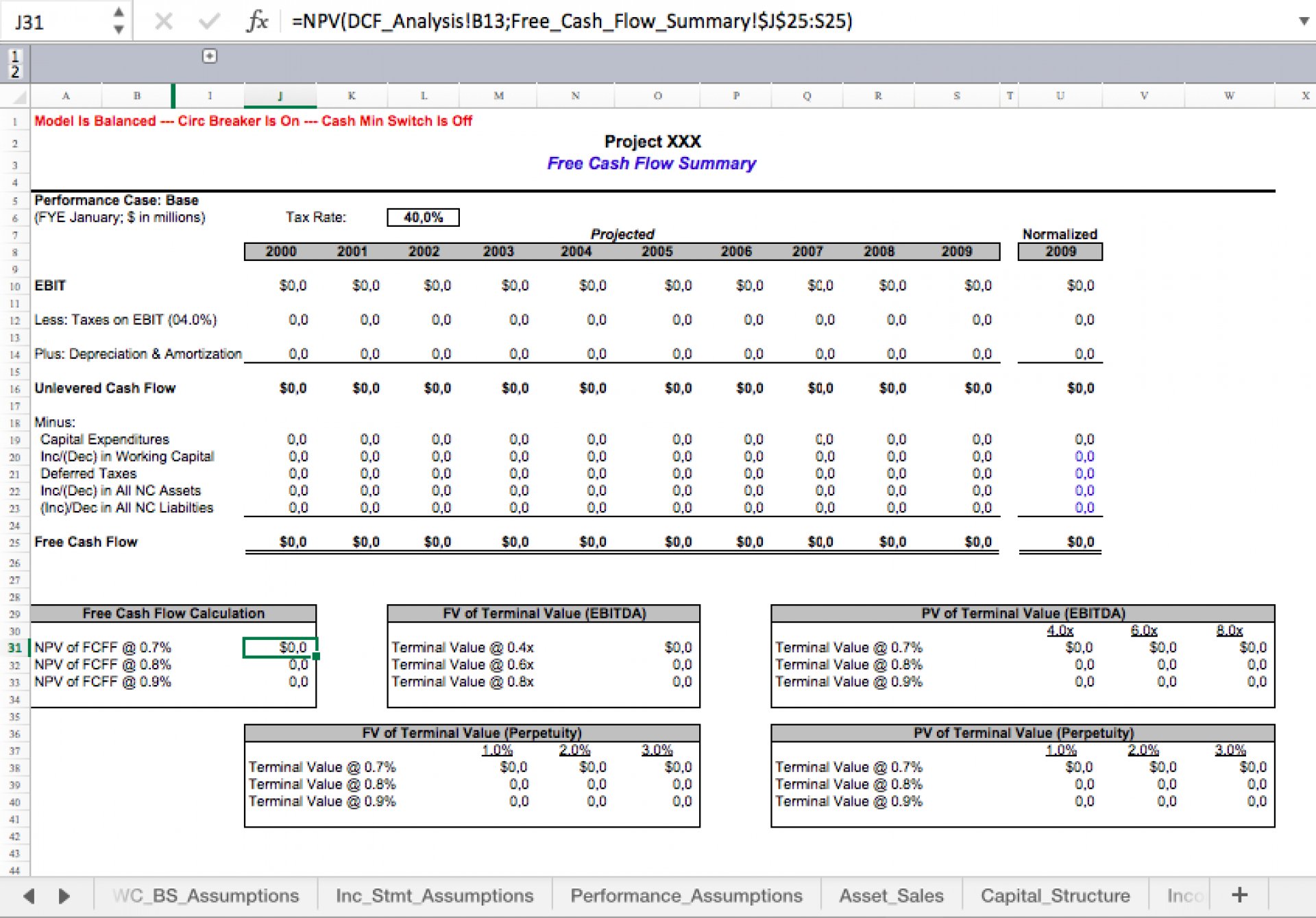

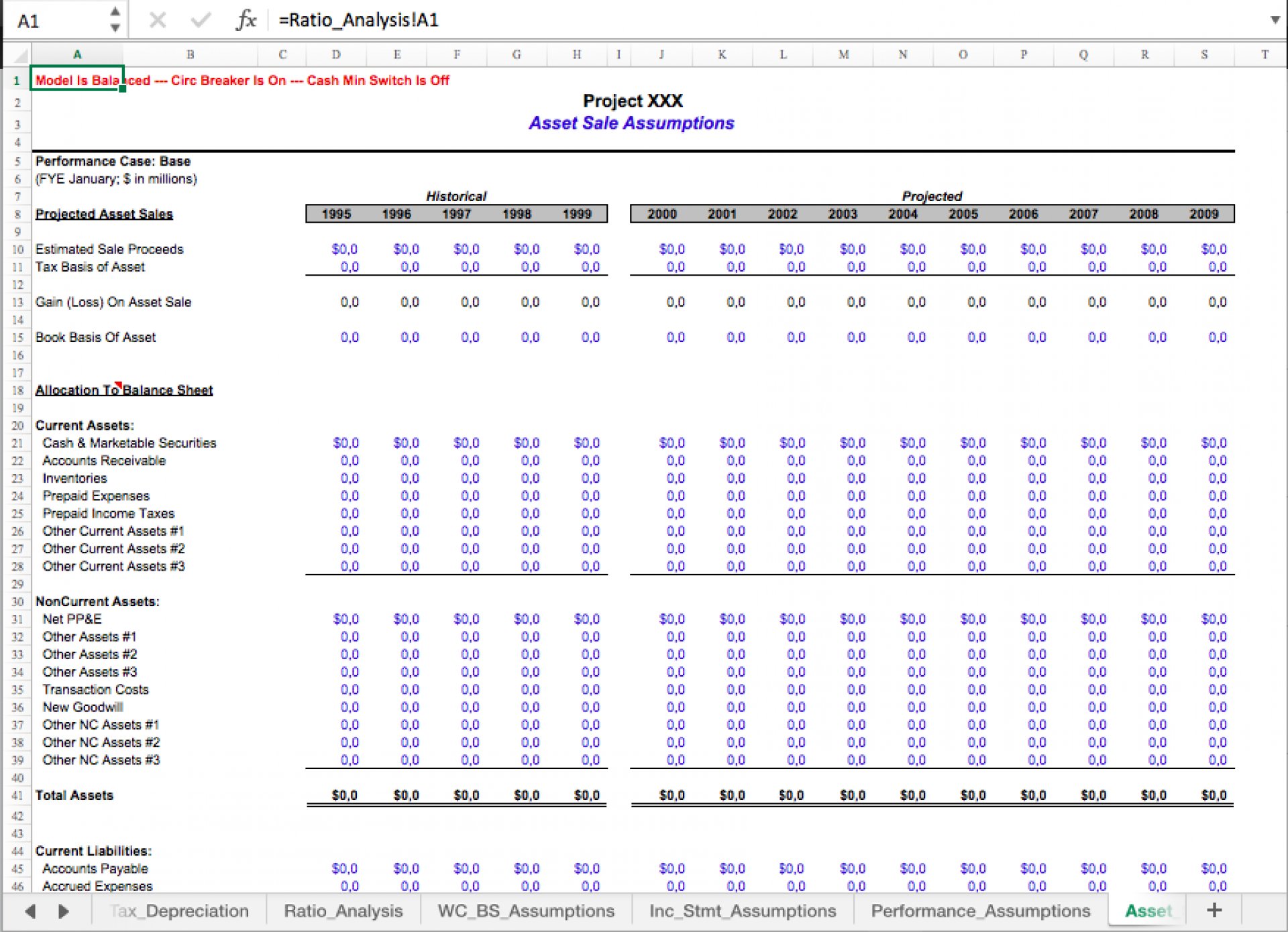

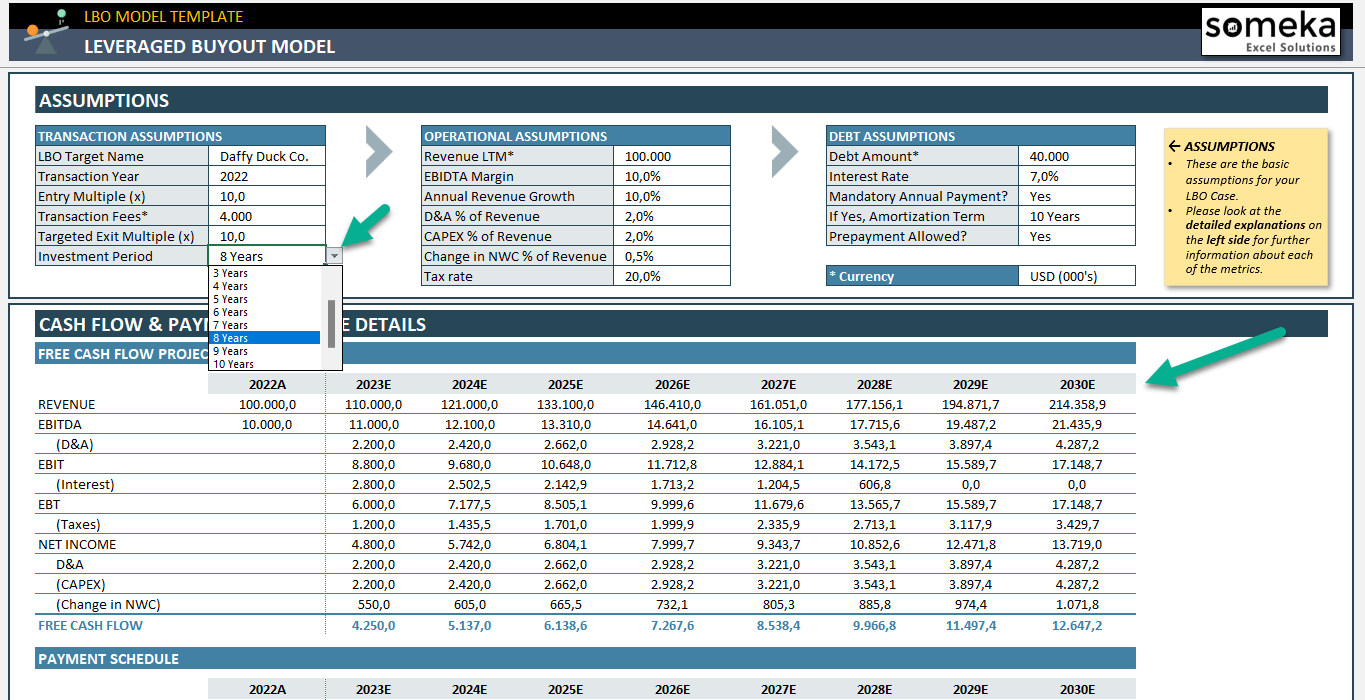

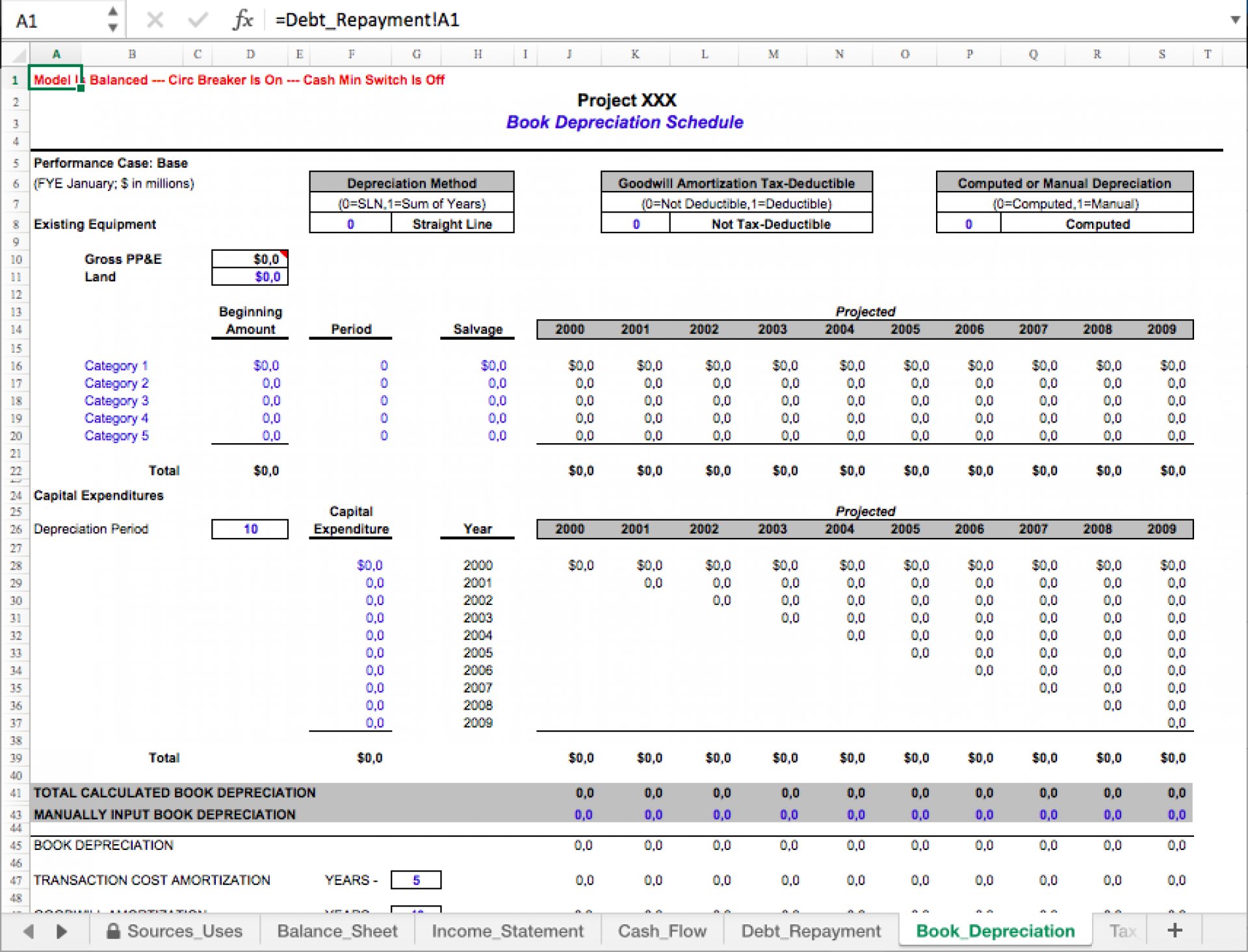

Lbo Template - Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Web in a lbo tutorial that introduces a complex model for a publicly traded company. Web lbo model template (short form): The first approach introduces too many concepts simultaneously, and the second approach reduces financial modeling to data entry. In this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. Web a leveraged buyout (lbo) is the acquisition of a company or business unit, where the buyer finances the purchase price through substantial debt financing. The ones with templates tend to have more complex formulas, and the ones where you start from scratch have simpler formulas but are more challenging to finish under time pressure. With the help of this model, you will be able to analyse: The use of high leverage increases the potential returns. Download wso's free public to private lbo pitch model template below! Sources and uses of funds table. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web lbo modeling involves complex calculations, including estimating purchase price using multiples, determining financing sources, creating pro forma financial statements, calculating exit values, and conducting sensitivity analyses to assess investment risks. An lbo transaction typically involves. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Download wso's free leveraged buyout (lbo) model template below! Web in. Web advanced lbo model template for excel (long form) 1 minutes read. In this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. Web in this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation. Sources and uses of funds table. • the income statement, balance sheet, and cash flow statement The use of high leverage increases the potential returns. Or worse, presenting someone new to lbo models with a thorough lbo template that needs to be populated. Whether you are entering the financial world in an advisory role in investment banking, or as an. Download wso's free leveraged buyout (lbo) model template below! With the help of this model, you will be able to analyse: As a starting point, we’ll use the completed lbo model from our lbo equity waterfall tutorial. Web leveraged buyouts (lbo) models are one of the most important analytical tools for investors and bankers to understand. Purchase price allocation (ppa). You’ll notice the model includes the following four tabs: Web last updated february 20, 2024. Web lbo model template (short form): In this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick questions in private equity (and other) interviews. Web advanced lbo model template for excel (long. Web last updated february 20, 2024. With the help of this model, you will be able to analyse: Purchase price allocation (ppa) step 4. Sources and uses of funds table. This template allows you to build your own private equity lbo model using various financing/debt inputs and schedules. The leveraged buyout model (lbo) is often viewed as extraordinarily complex, but it shouldn’t be. This template allows you to create your own public to private company lbo transaction model. Closing balance sheet (b/s) step 5. Download the template, and let’s take a look. Web in this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and. You’ll notice the model includes the following four tabs: • the income statement, balance sheet, and cash flow statement The use of high leverage increases the potential returns. Download the template, and let’s take a look. In this lbo model tutorial, you’ll learn how to build a very simple lbo model “on paper” that you can use to answer quick. Purchase price allocation (ppa) step 4. Web a leveraged buyout (lbo) is the acquisition of a company or business unit, where the buyer finances the purchase price through substantial debt financing. Purchase price assumptions [part 1] sources and uses table and financial forecast [part 2] cash flow statement (cfs) and debt schedule [part 3] exit assumptions and returns schedule [part. What is an lbo model? This video series will teach you how to build an lbo model, and introduce you to purchase accounting, making balance sheet adjustments and detailed debt schedules. Web in this video tutorial, we’ll build a leveraged buyout (lbo) model, given some operating and valuation assumptions, in excel. Web this excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis models. Notably, the assets of the company being acquired typically serve as collateral for the debt. Web the leveraged buyout (lbo) model forecasts future equity value and irr while analyzing a target business for acquisition using an lbo structure. • the income statement, balance sheet, and cash flow statement An lbo model is a financial tool typically built in excel to evaluate a leveraged buyout (lbo) transaction, which is the acquisition of a company that is funded using a significant amount of debt. Web detailed leveraged buyout (lbo) financial model template and presentation. The use of high leverage increases the potential returns. The first approach introduces too many concepts simultaneously, and the second approach reduces financial modeling to data entry. Download the template, and let’s take a look. This template allows you to create your own public to private company lbo transaction model. Web last updated february 20, 2024. Web a leveraged buyout (lbo) is the acquisition of a company or business unit, where the buyer finances the purchase price through substantial debt financing. Web the two main categories are tests that give you an excel template and tests in which you start from a blank sheet.

Leveraged Buyout Model Template (LBO) Long Form Macabacus

LBO Model Overview, Example, and Screenshots of an LBO Model

ShortForm LBO Model Free Course + Excel Template

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Templates Macabacus

LBO Model Excel Template Leveraged Buyout Model Valuation

Leveraged Buyout (LBO) Model Template Excel Eloquens

Web Lbo Model Template (Short Form):

Lbo Modeling Is Used To Value A Leveraged Buyout (Lbo) Transaction Where A Target Company Is Acquired Using A Significant Amount Of Debt.

Download Wso's Free Leveraged Buyout (Lbo) Model Template Below!

In This Lbo Model Tutorial, You’ll Learn How To Build A Very Simple Lbo Model “On Paper” That You Can Use To Answer Quick Questions In Private Equity (And Other) Interviews.

Related Post: