Llc Owners Draw

Llc Owners Draw - Here’s the overview you need. Check what requirements your state has. Web draws are permitted for companies structured as sole proprietorships, partnerships, or limited liability companies (llcs). Web owners of sole proprietorships, partnerships, and some limited liability companies (llcs) take draws. Unlike a sole proprietorship, which can simply do business under its owner's name, llcs must register a formal name with their. Web instead, you are paid directly through what is known as an “owner’s draw” from the profits that your company earns. When we talk about the classification of llc. Web in most cases, you must be a sole proprietor, member of an llc, or a partner in a partnership to take owner’s draws. Choose a name for your illinois llc. Under illinois law, the name of a new llc. Appoint a registered agent in illinois. Web instead, you are paid directly through what is known as an “owner’s draw” from the profits that your company earns. Web file your articles of organization. Here’s the overview you need. There is no fixed amount and no fixed interval for these. A limited liability company in general does not have to pay any business taxes. Web the owner's draw: Web file your articles of organization. Want to do an owner’s draw? Web how to start an illinois limited liability company. An owner’s draw is when an owner of a sole proprietorship, partnership or limited liability company (llc) takes money from their business for personal use. Web owner’s draw involves drawing discretionary amounts of money from your business to pay yourself. There is no fixed amount and no fixed interval for these. Web that’s called an owner’s draw. Web file your. However, the amount withdrawn must be reasonable and. To form an llc, you need to: Web taxes on owner’s draw in an llc. Here’s the overview you need. Want to do an owner’s draw? Web a limited liability company (llc) offers flexible tax classifications that can significantly impact the way the business is taxed. Web any llc member (a.k.a. An aurora apartment complex owner is suing the city of aurora, claiming its process of inspecting apartments is unconstitutional. You can simply write yourself a check or transfer the money for your business profits from. You can simply write yourself a check or transfer the money for your business profits from your llc’s business bank account to. Web instead, you are paid directly through what is known as an “owner’s draw” from the profits that your company earns. By contrast, corporations don’t take draws. Web may 3, 2024 at 4:42 p.m. When forming an llc. By contrast, corporations don’t take draws. When we talk about the classification of llc. There is no fixed amount and no fixed interval for these. However, the amount withdrawn must be reasonable and. You can simply write yourself a check or transfer the money for your business profits from your llc’s business bank account to. Check what requirements your state has. Web that’s called an owner’s draw. Web any llc member (a.k.a. How much should you take out with an owner's. Shareholder) can be paid through profit distributions or owner’s draws. By contrast, corporations don’t take draws. Choose a name for your illinois llc. However, the amount withdrawn must be reasonable and. Web an owner’s draw is a financial mechanism through which business owners can withdraw funds from their company for personal use. Strategy · customer service · management · compliance When forming an llc in illinois, the first step is to choose a business name. Web how to start an illinois limited liability company. There is no fixed amount and no fixed interval for these. This means you withdraw funds from your. A limited liability company in general does not have to pay any business taxes. Web any llc member (a.k.a. Web owners of sole proprietorships, partnerships, and some limited liability companies (llcs) take draws. When we talk about the classification of llc. Web may 3, 2024 at 4:42 p.m. Unlike a sole proprietorship, which can simply do business under its owner's name, llcs must register a formal name with their. Want to do an owner’s draw? Web the owner's draw: Web that’s called an owner’s draw. This means passing business profits on to owners. The money is used for personal. When forming an llc in illinois, the first step is to choose a business name. This means you withdraw funds from your. What it is and how it works. Appoint a registered agent in illinois. There is no fixed amount and no fixed interval for these. Typically, corporations, like an s corp,.

owner's drawing account definition and Business Accounting

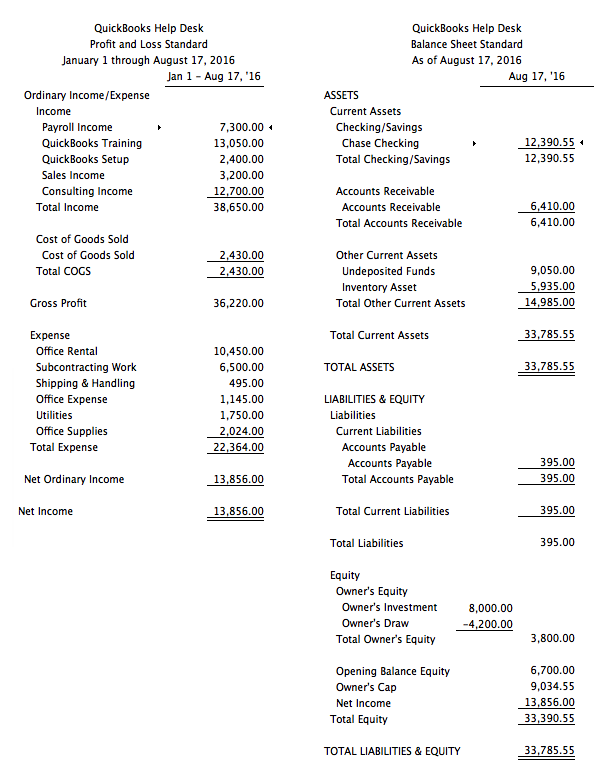

How do I Enter the Owner's Draw in QuickBooks Online? My Cloud

how to take an owner's draw in quickbooks Masako Arndt

Answer You can record this an an owners’ draw from your business. This

owner's drawing account definition and Business Accounting

how to take an owner's draw in quickbooks Masako Arndt

Owner's Draws What they are and how they impact the value of a business

how to take an owner's draw in quickbooks Masterfully Diary Picture Show

how to take an owner's draw in quickbooks Masako Arndt

ACCOUNTING WAY (EDUCATIONAL) Accounting Equation for a Sole

Shareholder) Can Be Paid Through Profit Distributions Or Owner’s Draws.

Web Draws Are Permitted For Companies Structured As Sole Proprietorships, Partnerships, Or Limited Liability Companies (Llcs).

Web A Limited Liability Company (Llc) Offers Flexible Tax Classifications That Can Significantly Impact The Way The Business Is Taxed.

A Limited Liability Company In General Does Not Have To Pay Any Business Taxes.

Related Post: