Loan Agreement Template Philippines

Loan Agreement Template Philippines - The debtor agrees that it will use the proceeds of the loan exclusively for the following: Web in the context of philippine law, the enforceability of loan agreements and the consequences of missed payments are governed by the provisions of the civil code, particularly obligations and contracts. Recimo (the borrower) and an unnamed lender. Web get your personalized personal or business loan agreement from themis partner to justify your loan, claim your funds, and establish the terms of repayment. A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. Will this loan be subject to interest? Loan agreements are common financial transactions, but their legality can be a concern when proper authorization is lacking. A promissory note is an unconditional promise in writing made by one person (the maker) in favor of another (the payee) promising to pay an amount of money on demand or at a fixed or determinable future time. Mortgage agreements should be annotated on the title to the property at the register of deeds in order to be effective against persons who are not party to the contract. Deed of sale, affidavits, power of attorney, affidavit of loss and more. Will payment be due when the lender demands? Then against interest due on the loan; Loan agreements in the philippines. Deed of sale, affidavits, power of attorney, affidavit of loss and more. Web loan agreement sample philippines: Will payment be due when the lender demands? What are the philippine laws and rules related to loan agreements? Data privacy act of 2012. The amortization payments for this loan shall be added to the unpaid balance for the land acquisition loan, if any. Provides clarity legal protection event disputes. However, it should be customized according to your specific terms. It is essential to comprehend the legal aspects surrounding such agreements. Web updated november 13, 2023. Web get your personalized personal or business loan agreement from themis partner to justify your loan, claim your funds, and establish the terms of repayment. Mortgage agreements should be annotated on the title to. A reference site for commonly used legal forms used in the philippines. Our lending agreement was written by indian lawyers and is based on philippines law. Recimo (the borrower) and an unnamed lender. Will this loan be subject to interest? Web are you planning to establish a lending business and want to create a template for a promissory note to. Web fill out the template. Legal forms in the philippines for proof and security. Answer a few questions and your document is created automatically. Web updated november 13, 2023. Then against interest due on the loan; If you answer yes, this guide is here to help you draft a promissory note. The terms of the agreement, including payment schedules and conditions for default, play a crucial role. A loan agreement is written evidence of a loan between individual persons or entities, such as partnerships and corporations. It is a simple agreement that includes the borrowed amount,. This contract, made and entered into this __. Web loan agreement sample philippines: National electrification administration, a government. Web are you planning to establish a lending business and want to create a template for a promissory note to be signed by the borrower? In this article, we will. Will payment be in a lump sum? You can download our free loan agreement template in the philippines by clicking the button. The loan shall be payable over a maximum term of twenty five (25) years or within the remaining term of the loan agreement for land acquisition, if applicable, and shall bear interest at the rate of six percent. Creating loan agreement complies philippine laws regulations lenders borrowers. Deed of sale, affidavits, power of attorney, affidavit of loss and more. Are the borrower (s) allowed to pay off the loan early? Civil code of the philippines. Law firm, we recognize the importance of clarifying loan agreement terms to avoid potential conflicts. Web are you planning to establish a lending business and want to create a template for a promissory note to be signed by the borrower? The loan shall be payable over a maximum term of twenty five (25) years or within the remaining term of the loan agreement for land acquisition, if applicable, and shall bear interest at the rate. What is a loan agreement? If you answer yes, this guide is here to help you draft a promissory note. It details a 200,000 peso loan to be paid back in full by august 20, 2022. In this article, we will. Mortgage agreements should be annotated on the title to the property at the register of deeds in order to be effective against persons who are not party to the contract. Provides clarity legal protection event disputes. It is a simple agreement that includes the borrowed amount, interest rate, and when the money must be repaid. Loan agreements are common financial transactions, but their legality can be a concern when proper authorization is lacking. The loan shall be payable over a maximum term of twenty five (25) years or within the remaining term of the loan agreement for land acquisition, if applicable, and shall bear interest at the rate of six percent (6%) per annum. All payments shall be applied first against penalties; Start by clicking on fill out the template 2. A promissory note is an unconditional promise in writing made by one person (the maker) in favor of another (the payee) promising to pay an amount of money on demand or at a fixed or determinable future time. Web in the context of philippine law, the enforceability of loan agreements and the consequences of missed payments are governed by the provisions of the civil code, particularly obligations and contracts. Civil code of the philippines. The amortization payments for this loan shall be added to the unpaid balance for the land acquisition loan, if any. Law firm, we recognize the importance of clarifying loan agreement terms to avoid potential conflicts.

Letter Of Undertaking To Pay A Debt

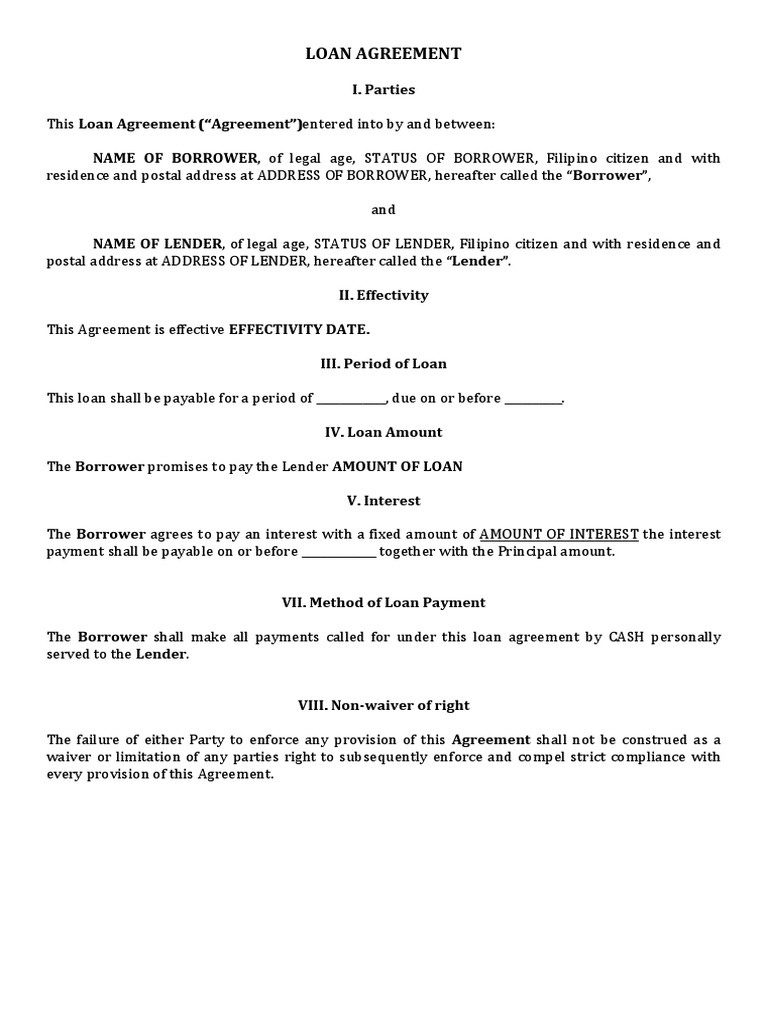

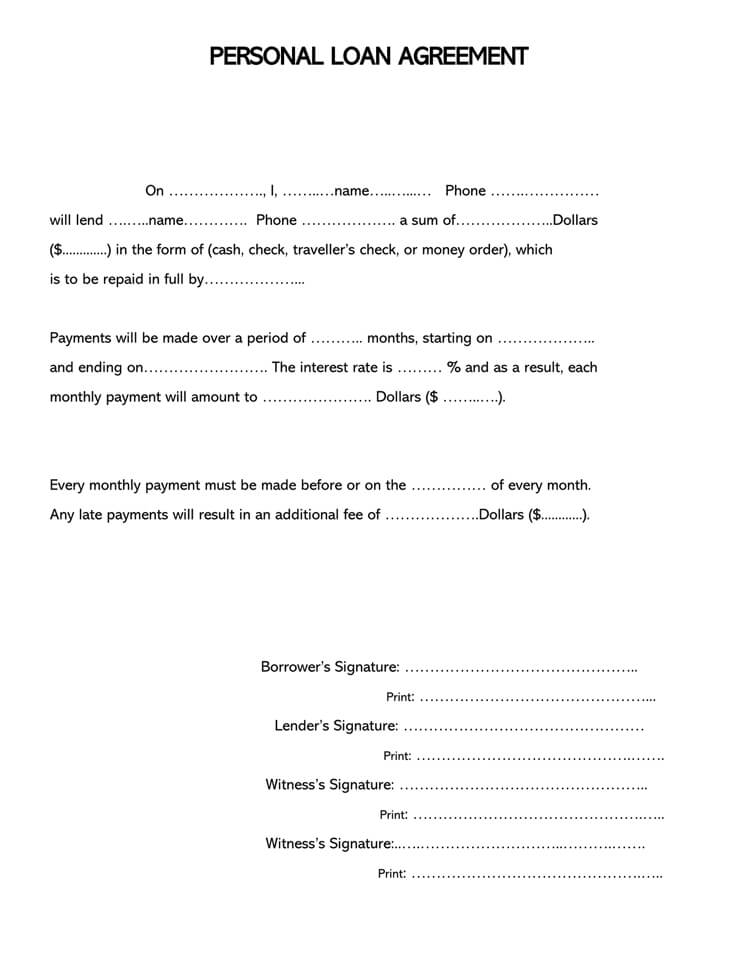

![40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-08.jpg)

40+ Simple Loan Agreement Templates [FREE] ᐅ TemplateLab

Loan Agreement Template Philippines PDF Template

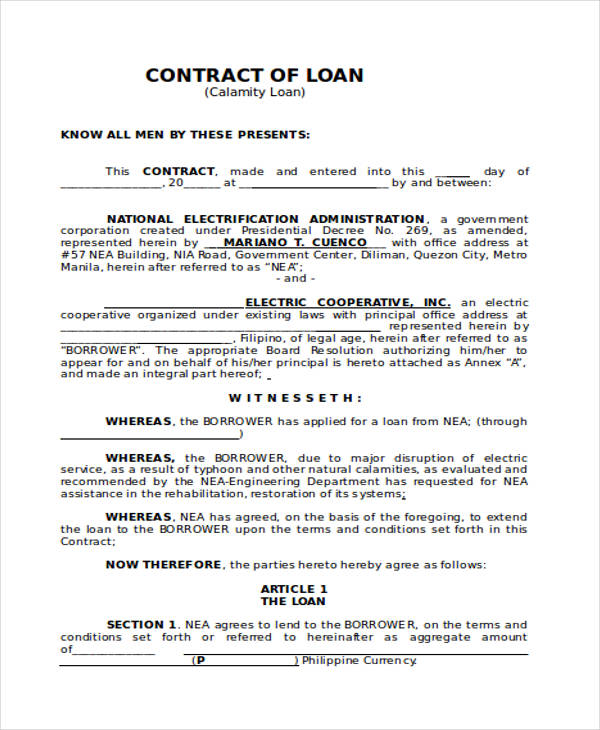

![40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-23.jpg)

40+ Free Loan Agreement Templates [Word & PDF] ᐅ TemplateLab

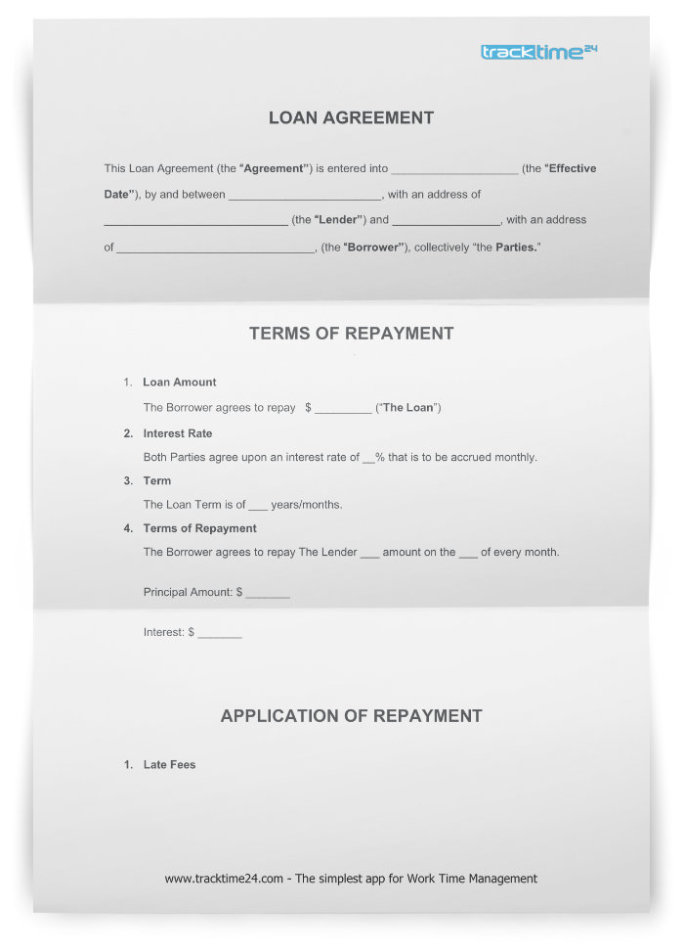

Loan Repayment Agreement Form DocTemplates

Sample of Loan Agreement Philippines PDF Loans Interest

Loan agreement template philippines LOAN AGREEMENT Loan Amount

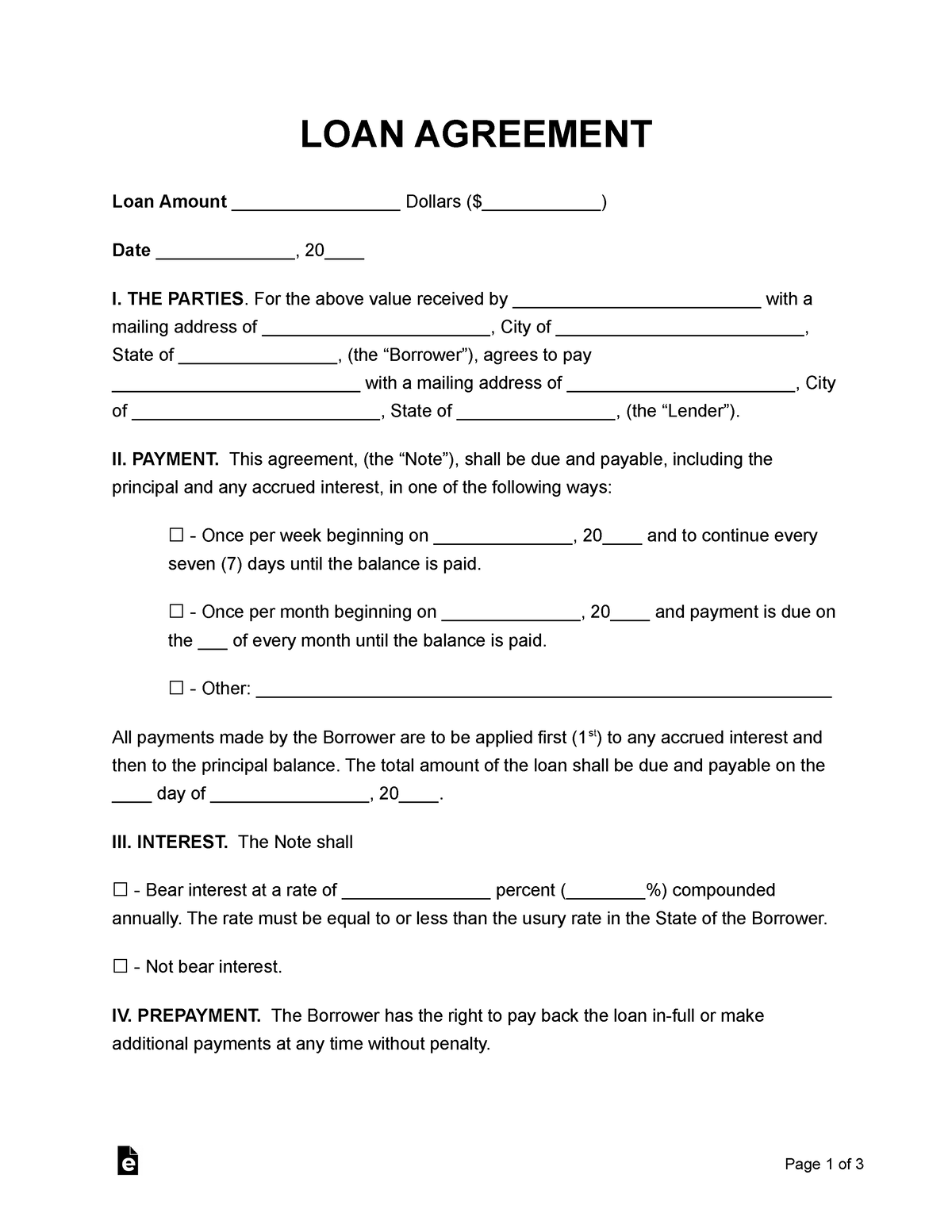

![40+ Free Loan Agreement Templates [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2017/04/loan-agreement-template-32.jpg)

40+ Free Loan Agreement Templates [Word & PDF] Template Lab

Loan Agreement Template Philippines PDF Template

Sample Personal Loan Agreement Form

Are Written Loan Agreements Without Authorization Legally Binding In The Philippines?

A Personal Loan Agreement Outlines The Terms Of How Money Is Borrowed And When It Will Be Paid Back.

Our Lending Agreement Was Written By Indian Lawyers And Is Based On Philippines Law.

Additionally, The Authority Of A.

Related Post: