Not For Profit Donation Receipt Template

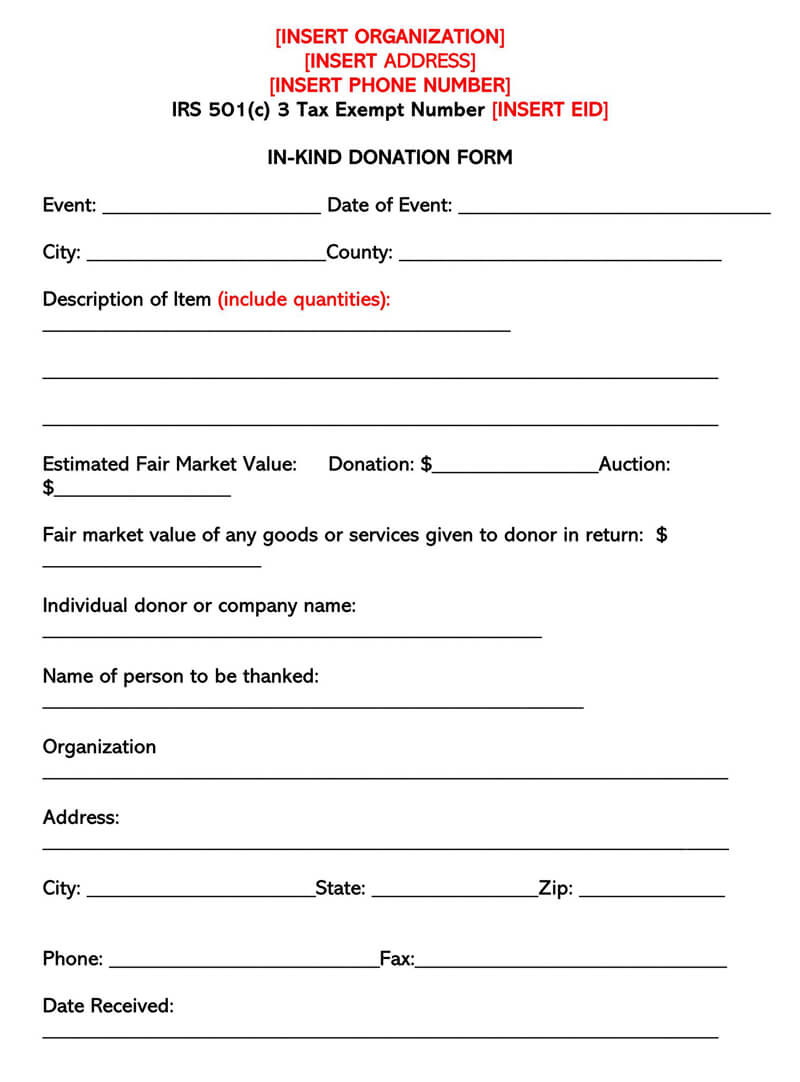

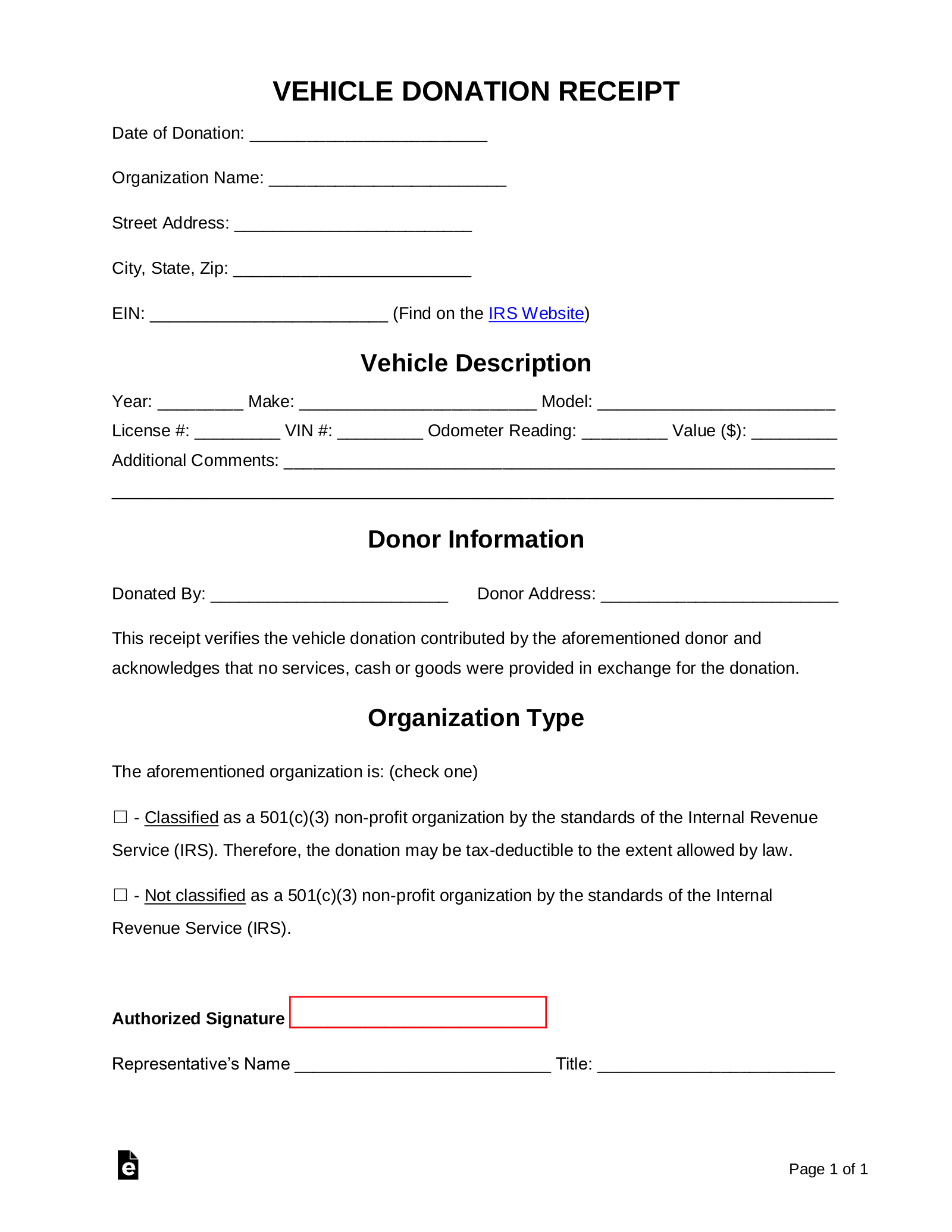

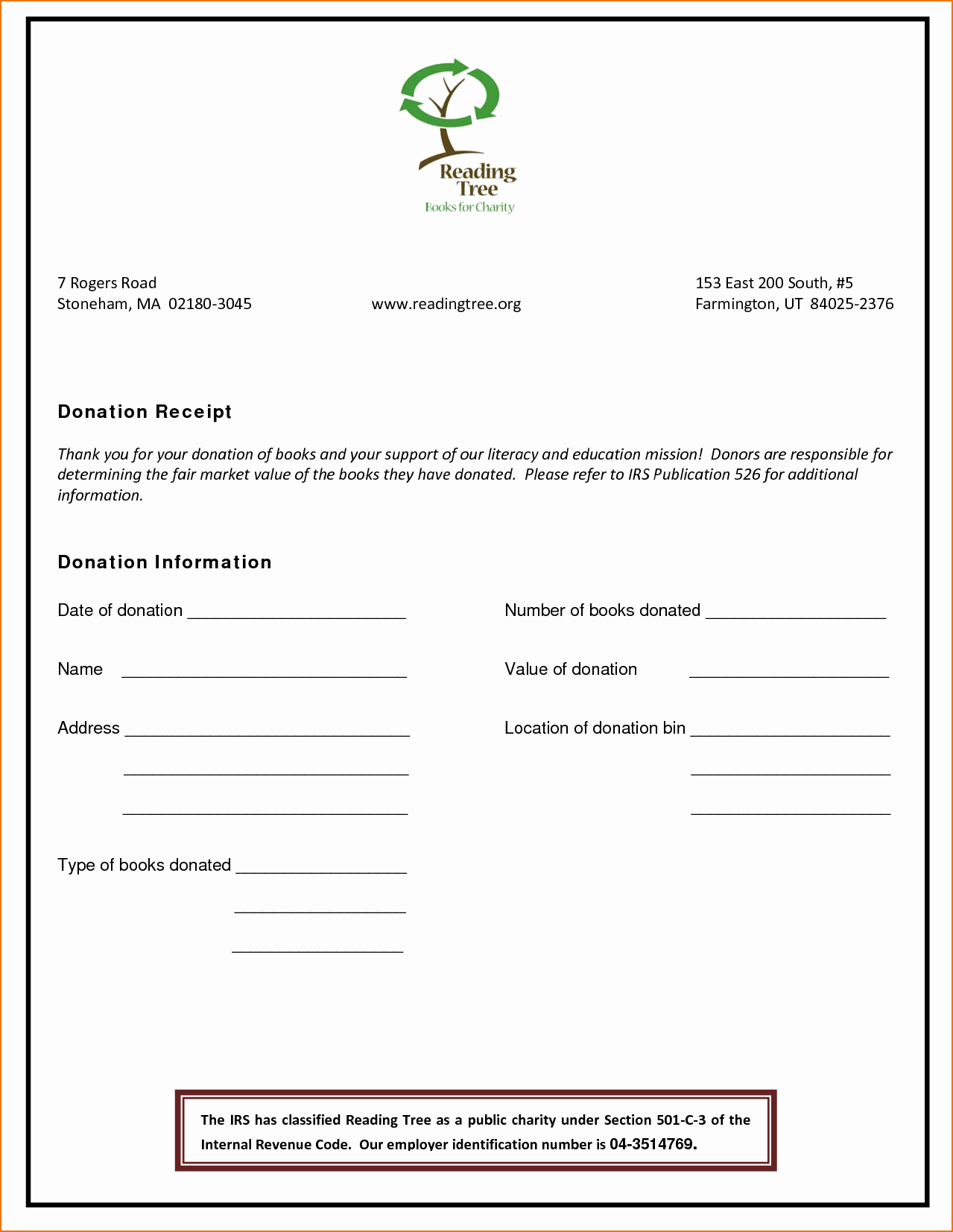

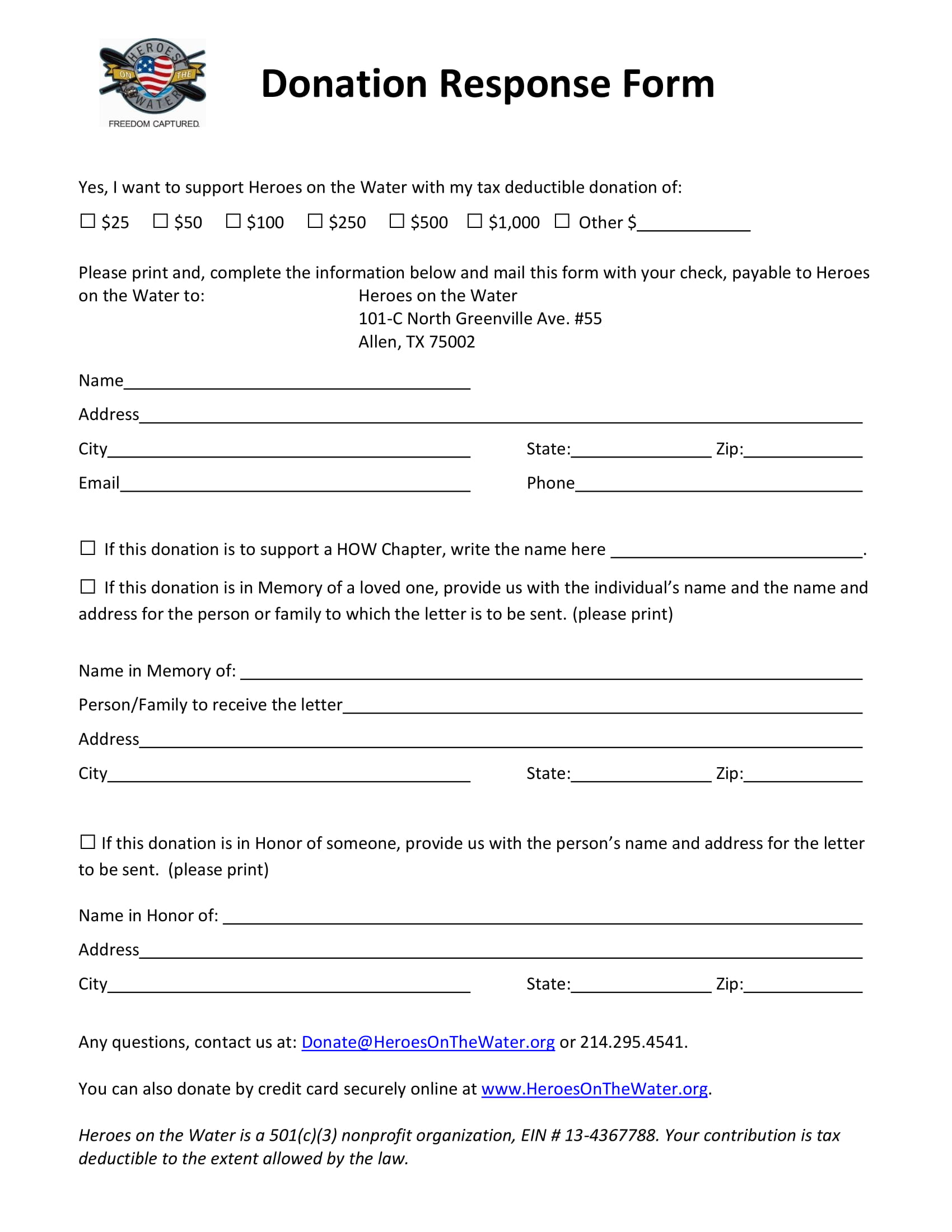

Not For Profit Donation Receipt Template - There are many other reasons to send a receipt after receiving a donation. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Web a donation receipt template should comply with particular requirements when it comes to the information it contains. 5 are all gifts or donations qualified for goodwill donation receipts? It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. You should include this information to make your document useful and official. A donation receipt is used by companies and individuals in order to provide proof that cash or property was gifted to an individual, business, or organization. Web the do’s and don’ts of donation receipts (plus templates!) 13 min read. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Web donation receipt templates | samples. Non profit donation receipt form. Benefits of a 501c3 donation receipt. Donation receipts are important for a few reasons. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. Web what are the best donation receipt templates for nonprofits? This type of receipt should also include information about the value of the good received. It’s important to remember that without a written acknowledgment, the donor cannot claim the tax deduction. What should diy donation receipts include? What is a donation receipt? Content marketing manager, neon one. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Donation receipts are important for a few reasons. Not all donations are monetary, and it's good. Web 501 (c) (3) donation receipt template | sample. Lovetoknow editable donation receipt template. Nonprofit donation receipts are both a legal requirement and an important part of nurturing your supporters. Web 1 donation receipt templates. Benefits of a 501c3 donation receipt. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. This type of receipt should also include information about the value of the good received. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization,. Web read more here. 6 creating your donation receipt template. Web the do’s and don’ts of donation receipts (plus templates!) 13 min read. Web this article covers everything you need to know about creating nonprofit donation receipts from a template. This type of receipt should also include information about the value of the good received. 2 the importance of information receipts for benefactors and beneficiary. Non profit donation receipt form. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Donation receipts are important for a few reasons. Web donation receipt templates | samples. Benefits of an automated donation receipt process. Content marketing manager, neon one. 3 information which should be incorporated in a donation receipt. There are many other reasons to send a receipt after receiving a donation. When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to. This receipt reflects goods or services your nonprofit provides in exchange for a donation. For example, supporters may receive meals and drinks in exchange for nonprofit event registration fees, or an attendee may receive a silent auction item in exchange for donating the highest bid. 3 information which should be incorporated in a donation receipt. Web donation receipt templates |. Web 501 (c) (3) donation receipt template | sample. Web delight donors with this free donation receipt template. What is a donation receipt? Benefits of a 501c3 donation receipt. Web quid pro quo donation receipts: Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. 5 are all gifts or donations qualified for goodwill donation receipts? For example, supporters may receive meals and drinks in exchange for nonprofit event registration fees, or an attendee may receive a silent auction item in exchange for donating the highest bid. The irs requires nonprofits to send receipts for any charitable gift over $250, and we all know how critical it is to keep the irs happy. When an organization, business, trust, or other entity is operated exclusively to provide some sort of public benefit, it can file irs form 1023 to become a 501 (c) (3) nonprofit. Web what are the best donation receipt templates for nonprofits? Web this article covers everything you need to know about creating nonprofit donation receipts from a template. Web use these nonprofit donation receipt letter templates for the different types of donations your nonprofit receives: Web nonprofits must send a receipt for any single donation of $250 or more. Web nonprofit donation receipt template: Not all donations are monetary, and it's good to have a special receipt template to acknowledge and document donations of goods. Take the stress out of acknowledgment with this guide to writing and sending the perfect donation receipt. 6 creating your donation receipt template. What does 501 (c) (3) mean? 6 free templates | instrumentl. When should you send a donation receipt?

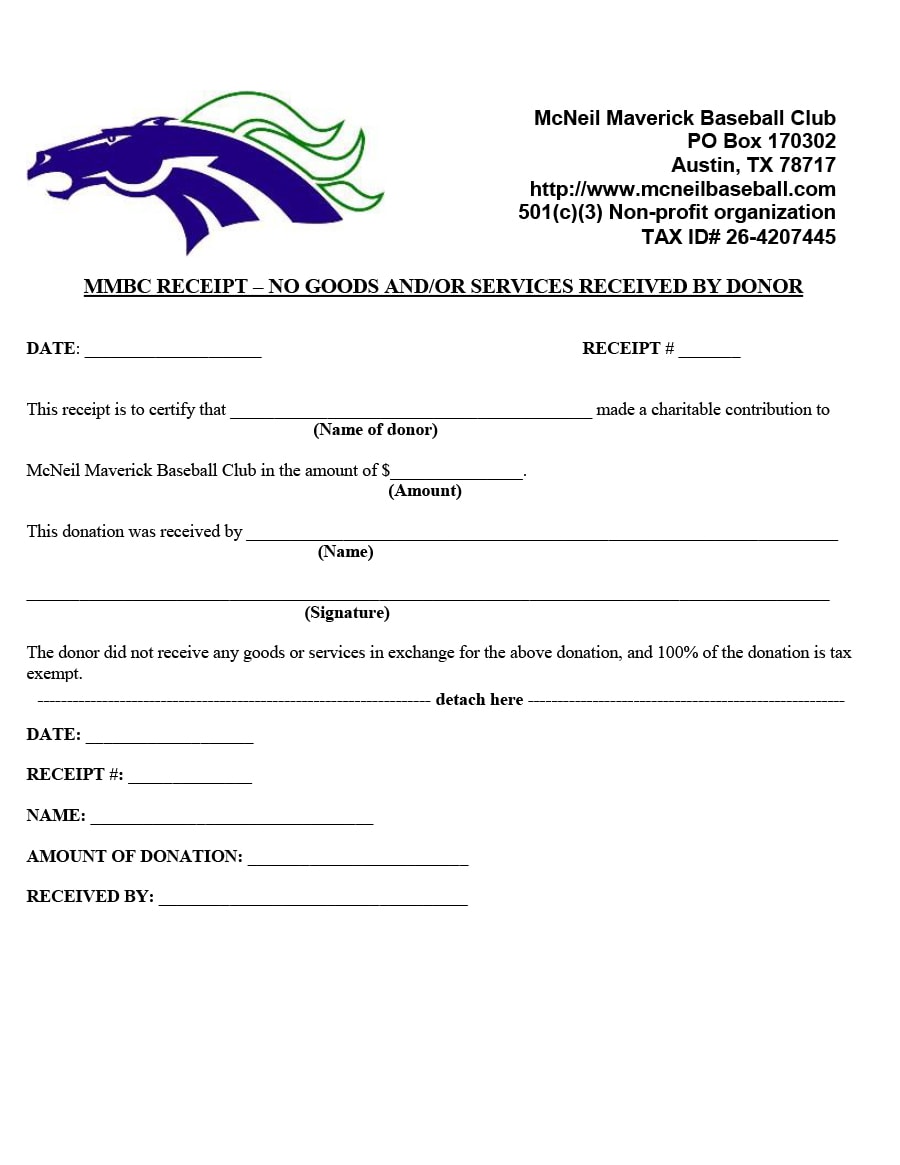

Free Nonprofit (Donation) Receipt Templates (Forms)

Non Profit Donation Receipt Template Business

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-24.jpg)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Get Our Free Charitable Donation Receipt Template Receipt template

Free Vehicle Donation Receipt Template Sample Pdf Word Eforms My XXX

Nonprofit Donation Receipt Template

Printable Church Donation Receipt Template Printable World Holiday

Non Profit Donation form Template Lovely Non Profit Donation Receipt

Printable Donation Form Template

Planning Center Donation Receipt Template Cheap Receipt Forms

A Donation Receipt Is Used By Companies And Individuals In Order To Provide Proof That Cash Or Property Was Gifted To An Individual, Business, Or Organization.

Your Donation Of $250 On July 4, 2019, To Our Save The Turtles!

Benefits Of A 501C3 Donation Receipt.

So, Let Us Be The First To Say Thank You For Being A Part Of Our Mission In Saving The Sea Turtles!

Related Post: