Pay Stub Template For 1099 Employee

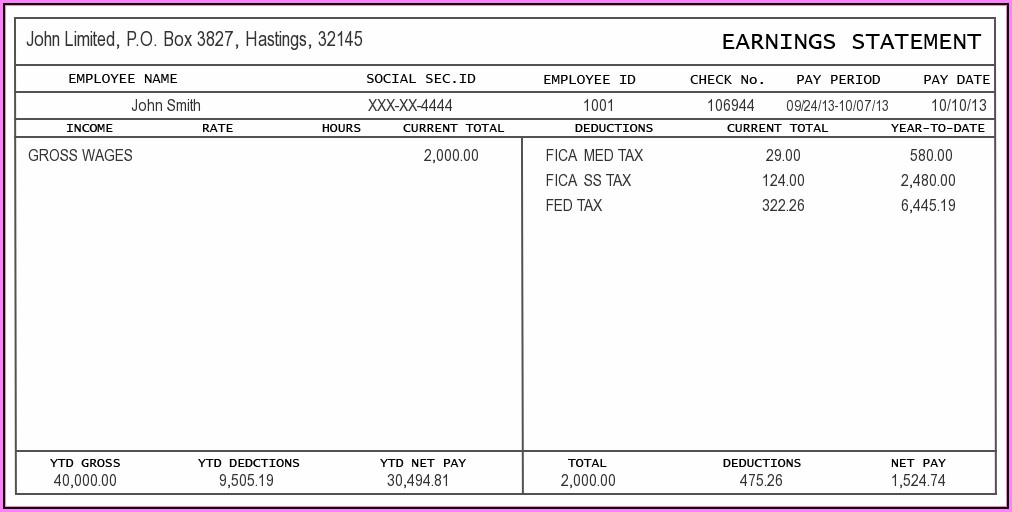

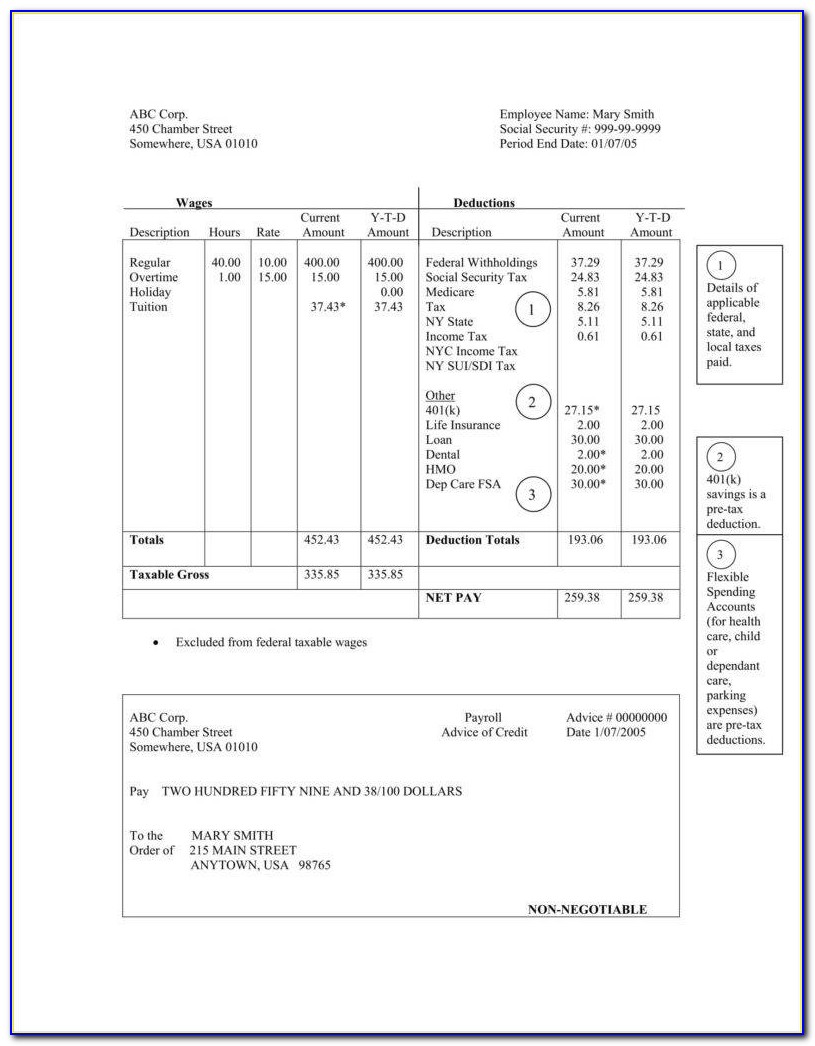

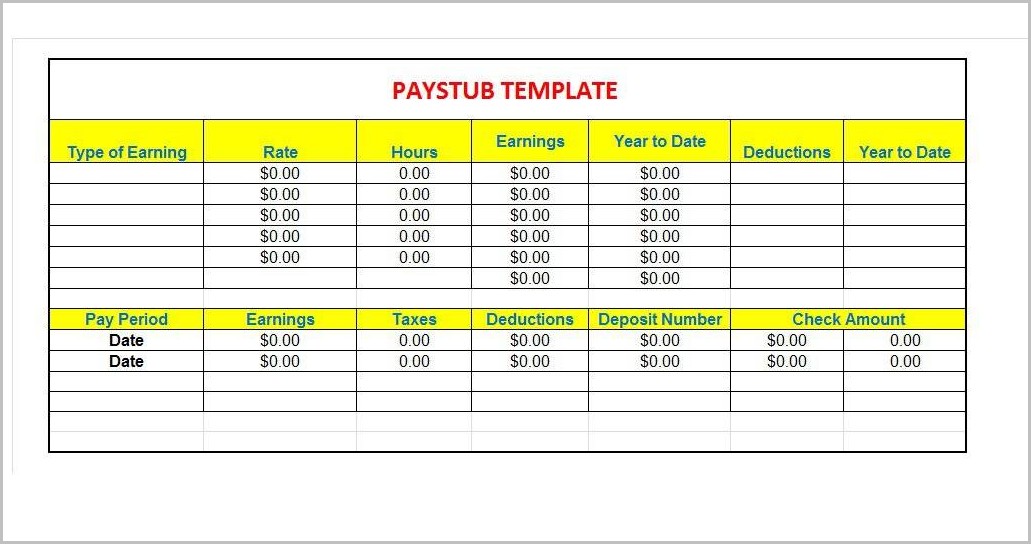

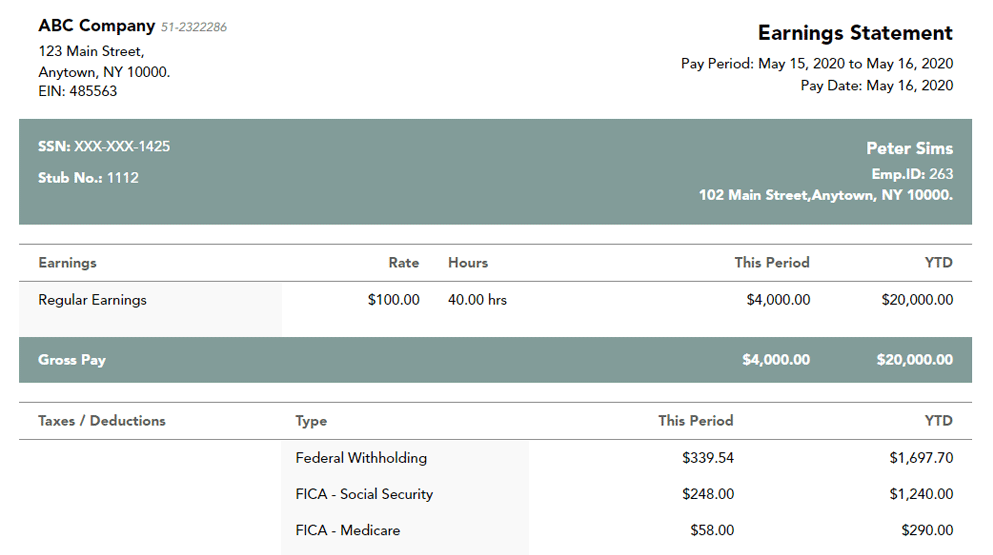

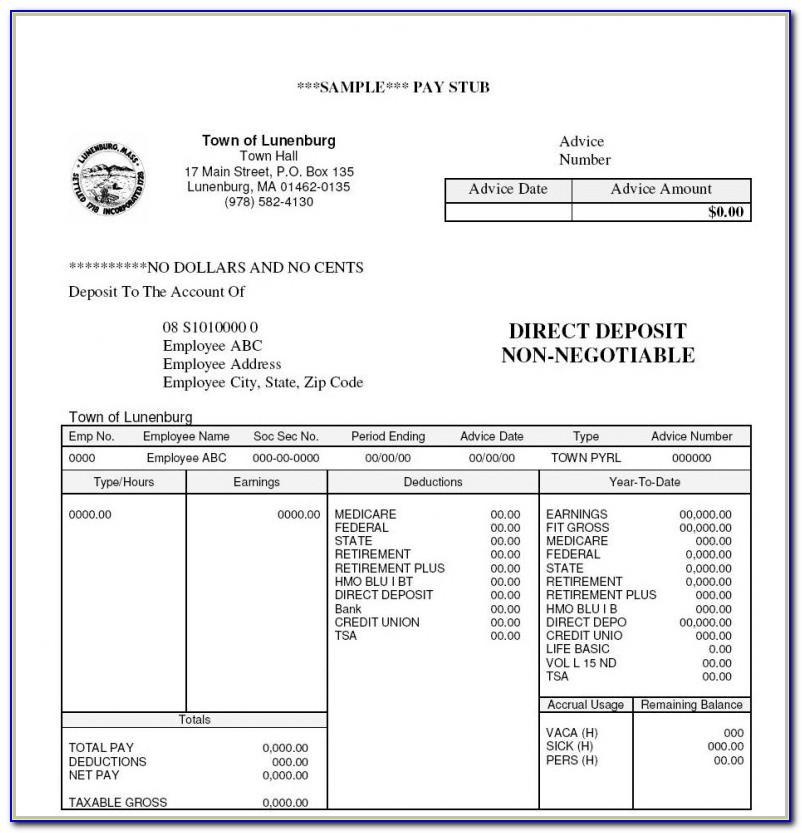

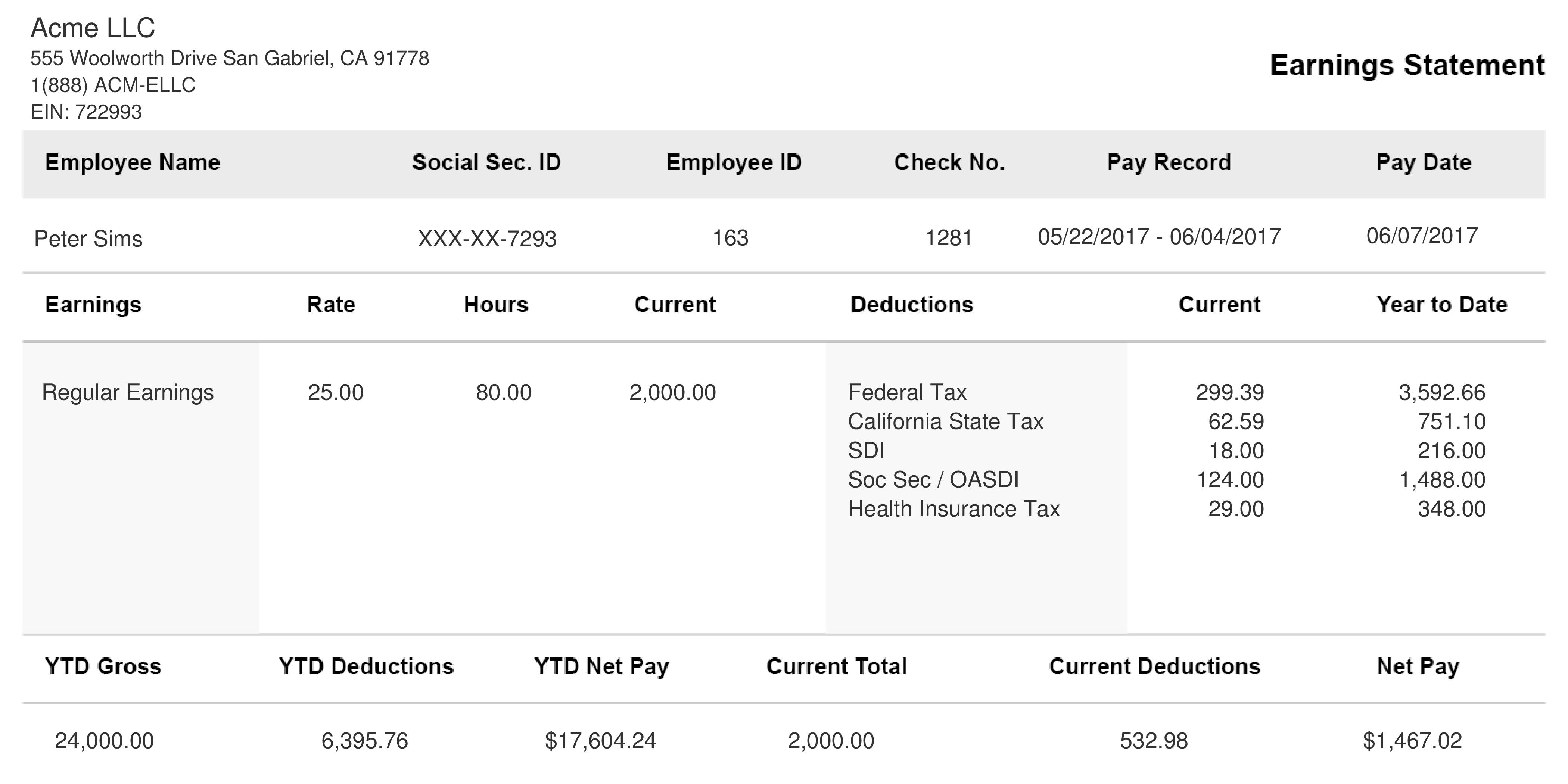

Pay Stub Template For 1099 Employee - Company address with zip code. A pay stub form is a template used by an employer to provide detailed information about an employee's paycheck. Word • excel • pdf. Join thousands of satisfied independent contractors and small business owners and get the highest quality pay stubs, w2s and 1099s — right to your inbox! Web integrating employee payments with independent contractor transactions allows all payroll data to be saved in one place. Web how to pay 1099 employees: Shared by edwardwrighton in employee records. Year to date pay stub template. Back to all user logins. Pay stubs are records of employee compensation that outline earnings and deductions. Understanding the 1099 employee form in detail. Web 8 free pay stub templates that you can download, customize, and send out to your employees right away. We’re the best pay stub generator for a reason. Choose any independent contractor pay stub template from the list of free templates available. Web download your fillable independent contractor pay stub template in pdf. You can fill out the 1099 form online easily through certain generators. Web enter the type of hours worked, number of hours, and pay rates, and the template will calculate the totals. Download for excel download for word download in pdf. Web a 1099 employee pay stub is a document that details the income earned by an independent contractor or. You can also itemize deductions, while net pay is displayed at the bottom of the template. Web paystubs for independent contractors should contain in their forms, the following fields: Your yearly get paid income. Download (14.68 kb) table of contents. Web these pay stubs are essential for 1099 employees as they serve as proof of income for various financial transactions. Your yearly get paid income. Take the stress out of tax season with paystub hero’s 1099 nec. Shared by edwardwrighton in employee records. Pay stubs are records of employee compensation that outline earnings and deductions. A paycheck typically comes with a pay stub template. Web generate pay stubs for 1099 contractors in 3 simple steps—that's all it takes. They include information on gross earnings, tax deductions, and net pay. Before you decide how to pay 1099 employees, you need to ensure that the worker can be correctly classified as an independent contractor. Web integrating employee payments with independent contractor transactions allows all payroll data. A paycheck typically comes with a pay stub template. Detail the pay period, payment date, and the total amount paid. Take the stress out of tax season with paystub hero’s 1099 nec. Pay stubs are records of employee compensation that outline earnings and deductions. Web paystubs for independent contractors should contain in their forms, the following fields: Word • excel • pdf. Choose any independent contractor pay stub template from the list of free templates available. We’re the best pay stub generator for a reason. Web enter the type of hours worked, number of hours, and pay rates, and the template will calculate the totals. Shared by edwardwrighton in employee records. Download for excel download for word download in pdf. Download (14.68 kb) table of contents. Take the stress out of tax season with paystub hero’s 1099 nec. Create a pay stub for yourself. Choose any independent contractor pay stub template from the list of free templates available. Create a pay stub for yourself. Gross pay, net pay, state taxes, federal taxes. Incorrectly filing forms for workers who are actually employees makes businesses liable to penalties. Back to all user logins. This paystub is crucial for freelancers and contractors as it serves as proof of income for tax purposes, loan applications, and personal financial management. If applicable, include the rate (such as hourly, weekly, or per project) and the number of hours worked. Word • excel • pdf. Web login & support | adp ipay | view & print pay stubs, w2, & 1099 tax statements | adp. Before you decide how to pay 1099 employees, you need to ensure that the worker can be. A pay stub is used by employers to notify an employee of their pay amount and provide documentation for it. Your yearly get paid income. Generating a pay stub using a generator will take less than five minutes, and that’s stretching it. We’re the best pay stub generator for a reason. Web integrating employee payments with independent contractor transactions allows all payroll data to be saved in one place. If you have not previously logged in to the portal, you will need a registration code from your employer. Web the form usually includes all of the extra earnings of an individual, aside from salary and wages, including prizes, royalties, awards, and a variety of payments. Web login & support | adp ipay | view & print pay stubs, w2, & 1099 tax statements | adp. Discover the ease of creating pay stubs for 1099 employees with paystubhero. This paystub is crucial for freelancers and contractors as it serves as proof of income for tax purposes, loan applications, and personal financial management. Company address with zip code. Create a pay stub for yourself. Web what is a 1099 pay stub? Year to date pay stub template. A pay stub form is a template used by an employer to provide detailed information about an employee's paycheck. If applicable, include the rate (such as hourly, weekly, or per project) and the number of hours worked.

Free Pay Stub Template For 1099 Employee Templates1 Resume Examples

Pay Stub Template For 1099 Employee

Free Pay Stub Template For 1099 Employee Template 1 Resume Examples

6+ pay stub template for 1099 employee Secure Paystub

1099 Employee Pay Stub Template

Free Pay Stub Template For 1099 Employee Templates1 Resume Examples

Pay Stub Template For 1099 Employee

1099 Paycheck Stub

Free Pay Stub Template For 1099 Employee Tutore Org Master Of Documents

1099 Employee Pay Stub Template

Web Enter The Type Of Hours Worked, Number Of Hours, And Pay Rates, And The Template Will Calculate The Totals.

Before You Decide How To Pay 1099 Employees, You Need To Ensure That The Worker Can Be Correctly Classified As An Independent Contractor.

Web These Pay Stubs Are Essential For 1099 Employees As They Serve As Proof Of Income For Various Financial Transactions And Are Crucial For Accurate Tax Reporting.

Accurate Earnings & Deductions Calculation.

Related Post: