Printable Irs Form 433 F

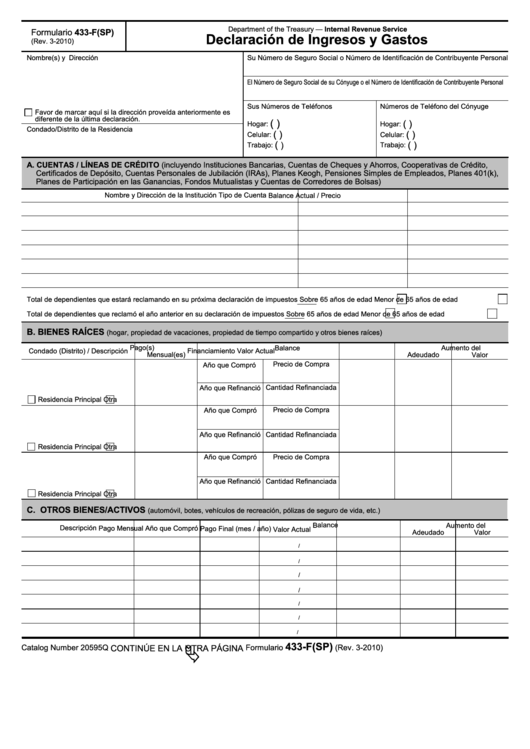

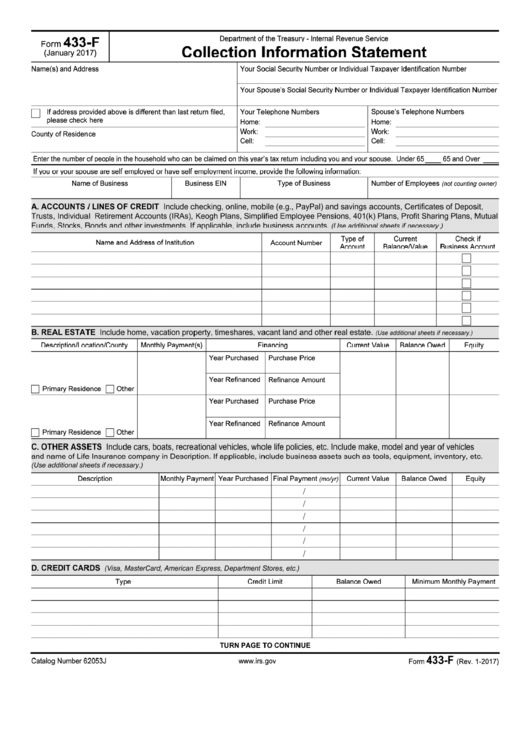

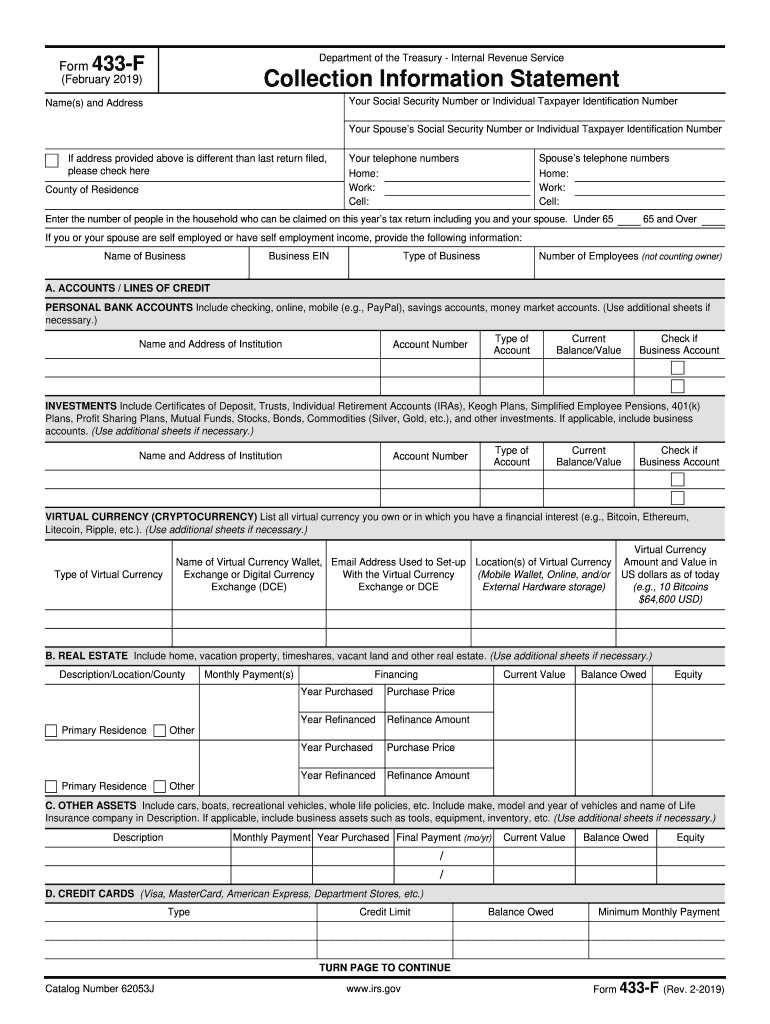

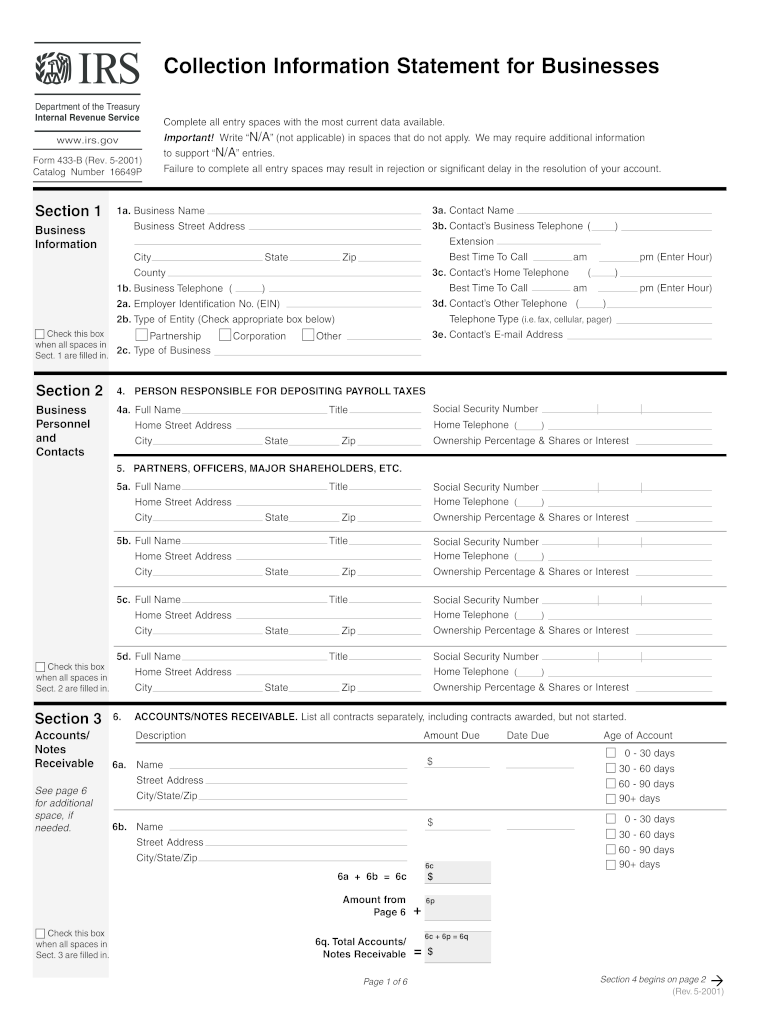

Printable Irs Form 433 F - We’ll show you how to fill out this form and navigate financial statements for individuals. Web if filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. Learn more from the tax experts at h&r block. If address provided above is. Stop irs and state collection actions. At the top of the form,. The irs uses this form to collect information about your financial situation to determine if you can afford to pay. Bbb a+ rated businesscancel anytime3m+ satisfied customers Fast, easy & securepaperless workflow24/7 tech supportfree mobile app It requires personal information, bank account records, real. Learn more from the tax experts at h&r block. At the top of the form,. Stop irs and state collection actions. If address provided above is. Web if filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. Bbb a+ rated businesscancel anytime3m+ satisfied customers At the top of the form,. We’ll show you how to fill out this form and navigate financial statements for individuals. Stop irs and state collection actions. If address provided above is. If address provided above is. Bbb a+ rated businesscancel anytime3m+ satisfied customers At the top of the form,. Learn more from the tax experts at h&r block. We’ll show you how to fill out this form and navigate financial statements for individuals. If your irs case is assigned to a revenue officer, they’ll. Bbb a+ rated businesscancel anytime3m+ satisfied customers It requires personal information, bank account records, real. Learn more from the tax experts at h&r block. If address provided above is. If your irs case is assigned to a revenue officer, they’ll. We’ll show you how to fill out this form and navigate financial statements for individuals. At the top of the form,. Bbb a+ rated businesscancel anytime3m+ satisfied customers Learn more from the tax experts at h&r block. If address provided above is. Learn more from the tax experts at h&r block. Fast, easy & securepaperless workflow24/7 tech supportfree mobile app The irs uses this form to collect information about your financial situation to determine if you can afford to pay. Bbb a+ rated businesscancel anytime3m+ satisfied customers If address provided above is. Fast, easy & securepaperless workflow24/7 tech supportfree mobile app At the top of the form,. Bbb a+ rated businesscancel anytime3m+ satisfied customers Stop irs and state collection actions. Learn more from the tax experts at h&r block. Bbb a+ rated businesscancel anytime3m+ satisfied customers Fast, easy & securepaperless workflow24/7 tech supportfree mobile app If your irs case is assigned to a revenue officer, they’ll. Stop irs and state collection actions. Web if filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. At the top of the form,. We’ll show you how to fill out this form and navigate financial statements for individuals. Stop irs and state collection actions. Learn more from the tax experts at h&r block. Learn more from the tax experts at h&r block. If address provided above is. Fast, easy & securepaperless workflow24/7 tech supportfree mobile app Stop irs and state collection actions. Web if filing this form for a business, you need the business name, employer identification number (ein), type of business, and number of employees. Stop irs and state collection actions. If address provided above is. Bbb a+ rated businesscancel anytime3m+ satisfied customers It requires personal information, bank account records, real. We’ll show you how to fill out this form and navigate financial statements for individuals. If your irs case is assigned to a revenue officer, they’ll. At the top of the form,. Fast, easy & securepaperless workflow24/7 tech supportfree mobile app

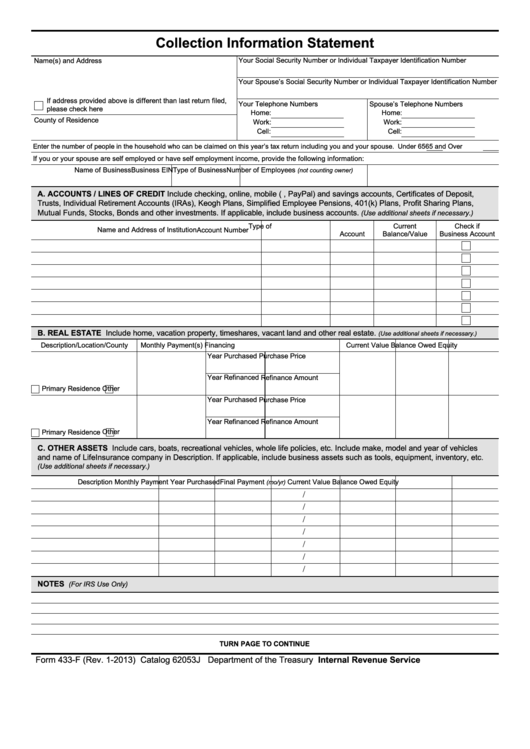

Fillable Form 433F Collection Information Statement printable pdf

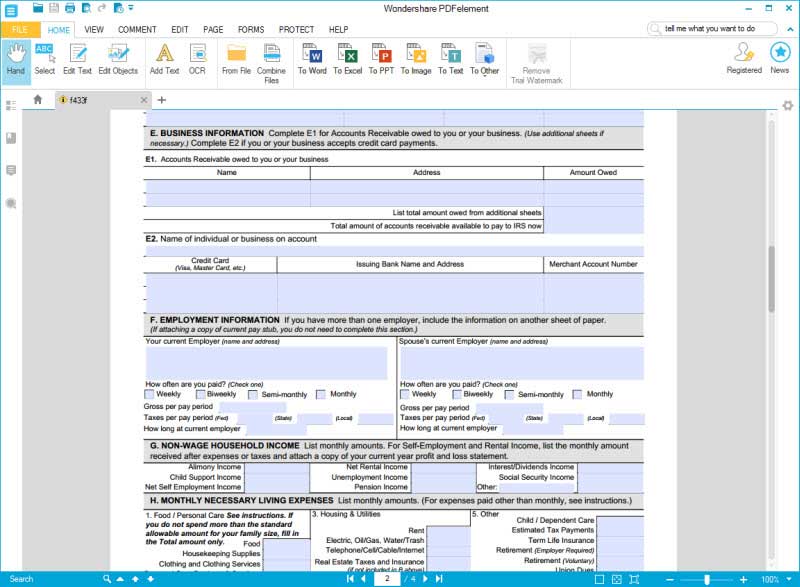

IRS Form 433F Fill it out in Style

IRS Form 433F Fill it out in Style

IRS Form 433F walkthrough (Collection Information Statement) YouTube

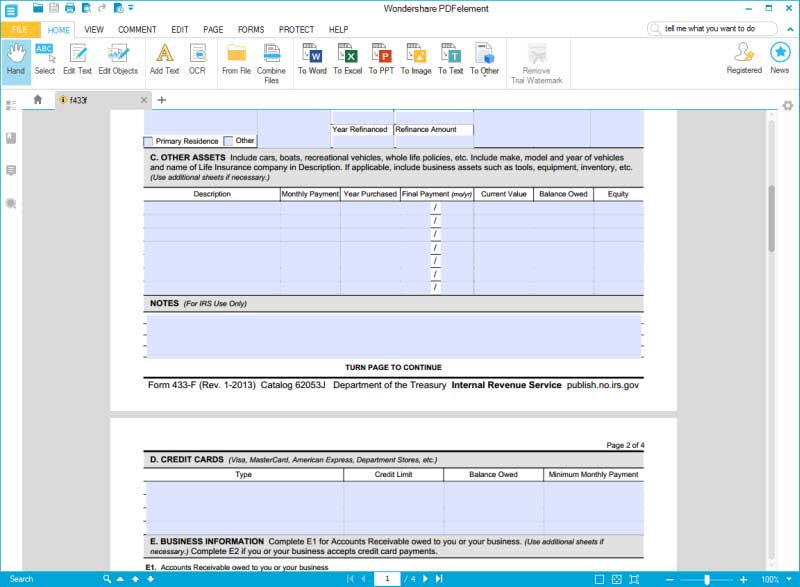

32 433 Forms And Templates free to download in PDF

Form 433 F Printable Printable World Holiday

Fill Free fillable F433f Form 433F (Rev. 22019) PDF form

433 F 20192024 Form Fill Out and Sign Printable PDF Template

Fill Free fillable form 433f collection information statement PDF form

Irs form 433 f Fill out & sign online DocHub

Web If Filing This Form For A Business, You Need The Business Name, Employer Identification Number (Ein), Type Of Business, And Number Of Employees.

Learn More From The Tax Experts At H&R Block.

The Irs Uses This Form To Collect Information About Your Financial Situation To Determine If You Can Afford To Pay.

Related Post: