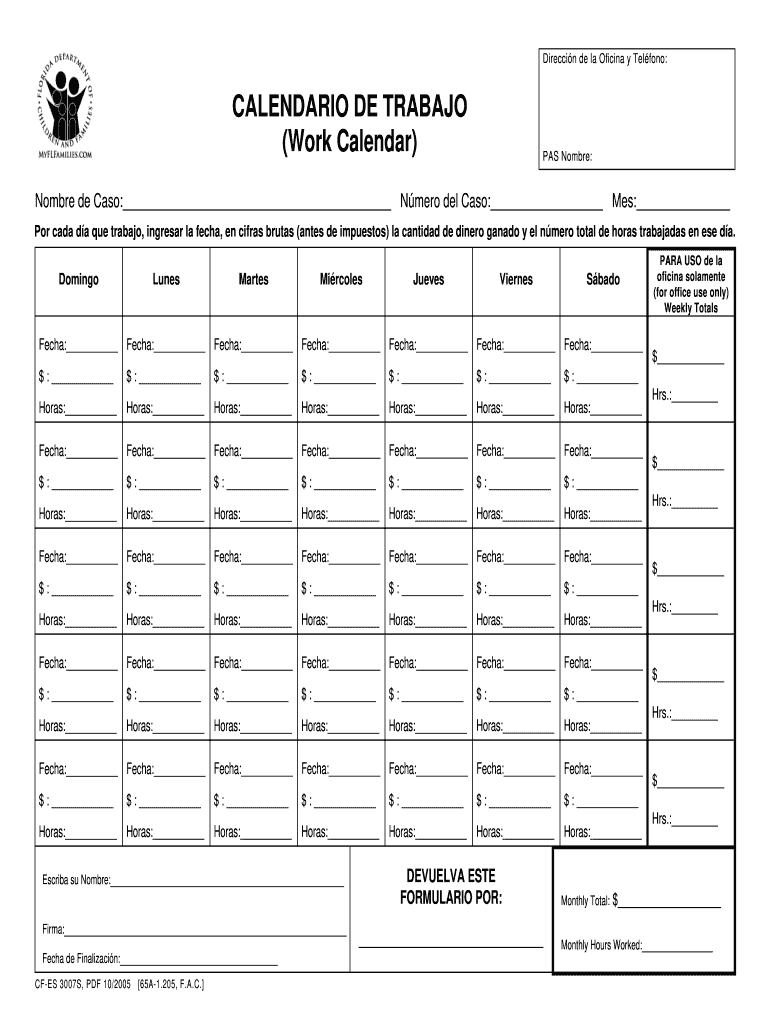

Self Employment Calendar

Self Employment Calendar - Access the calendar online from your mobile device or desktop. In the last column, please. 24/7 tech supportpaperless solutionspaperless workflowmoney back guarantee When that happens, the deadline is extended to the next business day. Make sure to include your name, type of business, and social security. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Name of person or job done. Web if you deposited all withheld income taxes when due, then you have 10 additional calendar days to file. Web typically, tax day is april 15, unless that date falls on a weekend or holiday. Work calendar for (month) date. Web find forms for various public assistance programs,. Web if you deposited all withheld income taxes when due, then you have 10 additional calendar days to file. Easily fill out pdf blank, edit, and sign them. Make sure to include your name, type of business, and social security. Web web self employment guide. Web if you deposited all withheld income taxes when due, then you have 10 additional calendar days to file. Web find forms for various public assistance programs,. Easily fill out pdf blank, edit, and sign them. Web for every day you work, enter the date, gross (before taxes) amount of money earned and the total number of hours worked for. Easily fill out pdf blank, edit, and sign them. Name of person or job done. Web use the irs tax calendar to view filing deadlines and actions each month. Web if you deposited all withheld income taxes when due, then you have 10 additional calendar days to file. Web typically, tax day is april 15, unless that date falls on. Work calendar for (month) date. See nonpayroll income tax withholding in publication 15 for more. Web if you deposited all withheld income taxes when due, then you have 10 additional calendar days to file. Make sure to include your name, type of business, and social security. _____ fs #_____ work calendar log for _____ (month) monday tuesday wednesday thursday friday. Web typically, tax day is april 15, unless that date falls on a weekend or holiday. Save or instantly send your ready documents. In the last column, please. When that happens, the deadline is extended to the next business day. Web the following tips will allow you to complete work calendar for self employment. (month) name of person or job hours money earned done. Web typically, tax day is april 15, unless that date falls on a weekend or holiday. Web for every day you work, enter the date, gross (before taxes) amount of money earned and the total number of hours worked for that day. Web use the irs tax calendar to view. Web typically, tax day is april 15, unless that date falls on a weekend or holiday. Name of person or job done. Home & familybudget guides & adviceveterans resourcespersonal finance & taxes Save or instantly send your ready documents. Web web self employment guide. (month) name of person or job hours money earned done. Web typically, tax day is april 15, unless that date falls on a weekend or holiday. Web use the irs tax calendar to view filing deadlines and actions each month. Web complete work calendar for self employment online with us legal forms. Save or instantly send your ready documents. See nonpayroll income tax withholding in publication 15 for more. Web web self employment guide. Easily fill out pdf blank, edit, and sign them. How to rise with momentum. Web for every day you work, enter the date, gross (before taxes) amount of money earned and the total number of hours worked for that day. See nonpayroll income tax withholding in publication 15 for more. Access the calendar online from your mobile device or desktop. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Web complete work calendar for self employment online with us legal forms. This calendar is also available in spanish. Name of person or job done. How to rise with momentum. See nonpayroll income tax withholding in publication 15 for more. Web for every day you work, enter the date, gross (before taxes) amount of money earned and the total number of hours worked for that day. _____ fs #_____ work calendar log for _____ (month) monday tuesday wednesday thursday friday. Please enter the date, the gross amount (before taxes or deduc ons) and total hours worked for each day. Web web self employment guide. Make sure to include your name, type of business, and social security. Web use the irs tax calendar to view filing deadlines and actions each month. Web a collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Web complete work calendar for self employment online with us legal forms. Work calendar for (month) date. Access the calendar online from your mobile device or desktop. Web the following tips will allow you to complete work calendar for self employment. If you file using a. Easily fill out pdf blank, edit, and sign them.

Self Employment Work Calendar

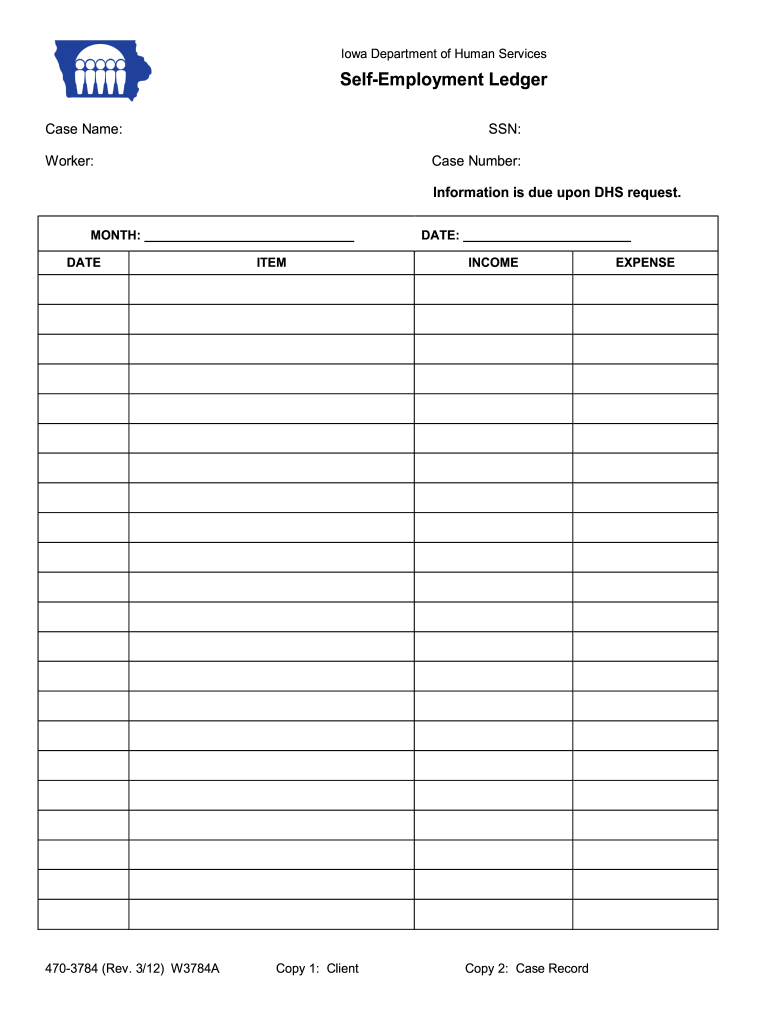

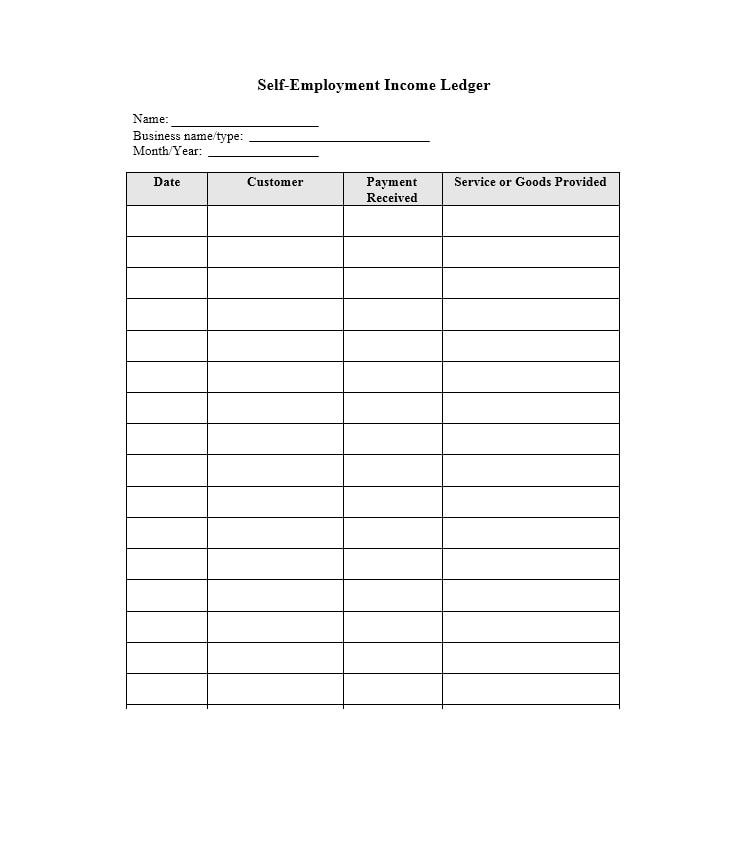

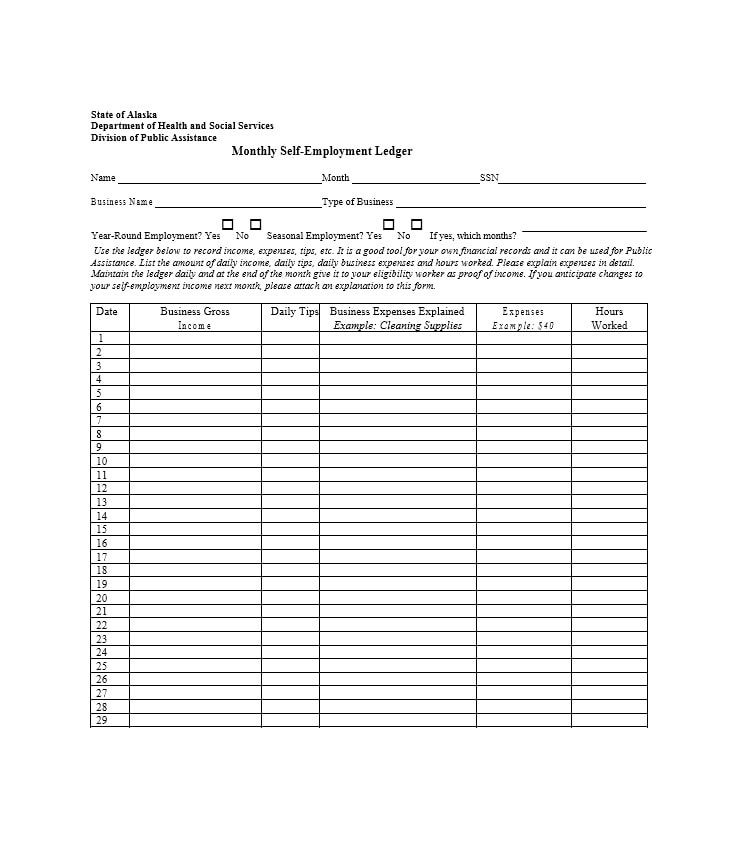

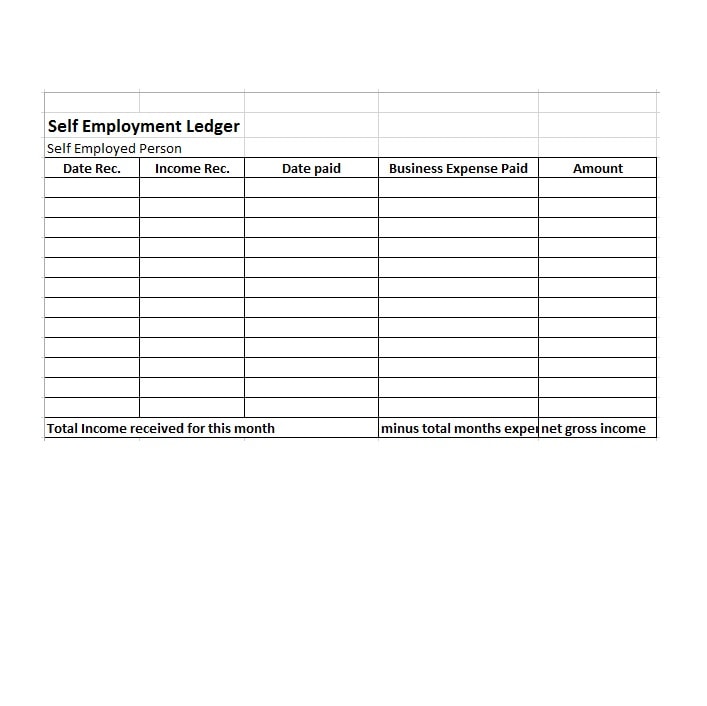

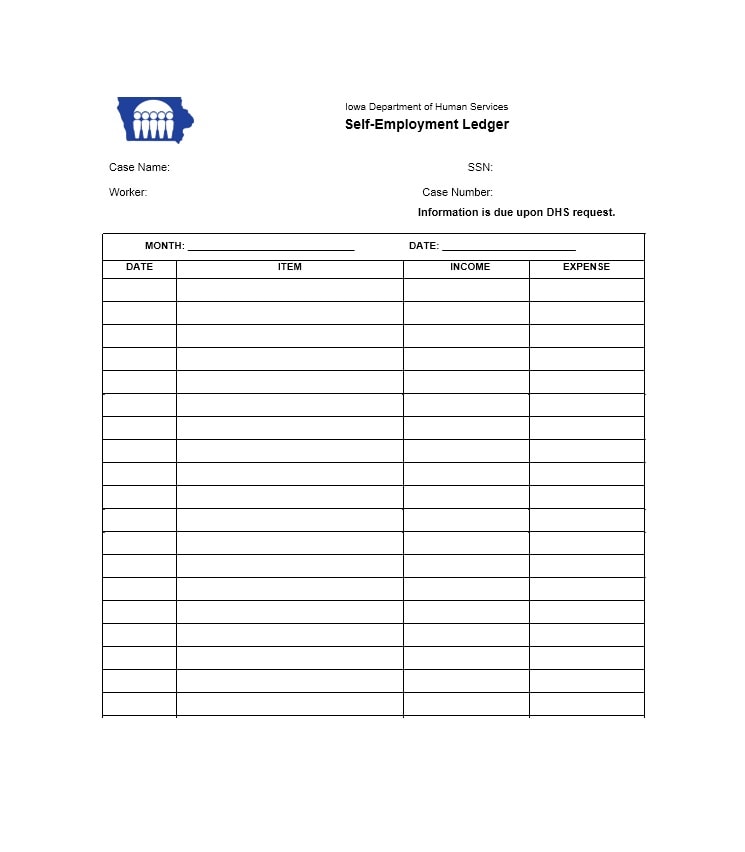

Monthly SelfEmployment Ledger Template

Work Calendar For Self Employment Fill and Sign Printable Template

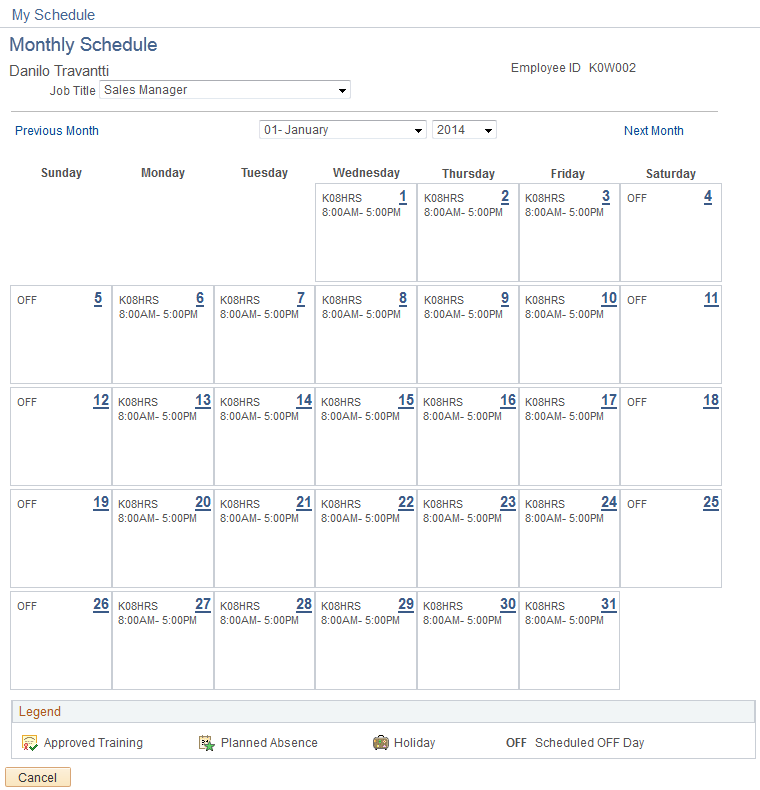

Managing Employee Self Service Pages

Free Self Employment Ledger Template Printable Templates

Free Printable Self Employment Ledger Printable World Holiday

Self Employment Calendar Printable Word Searches

Dcf Work Calendar Fill Online, Printable, Fillable, Blank pdfFiller

Printable Self Employment Ledger Template Printable Templates

Printable Self Employment Ledger Template Printable Templates

Home & Familybudget Guides & Adviceveterans Resourcespersonal Finance & Taxes

How To Find And Keep Your Customers.

(Month) Name Of Person Or Job Hours Money Earned Done.

Web Find Forms For Various Public Assistance Programs,.

Related Post: