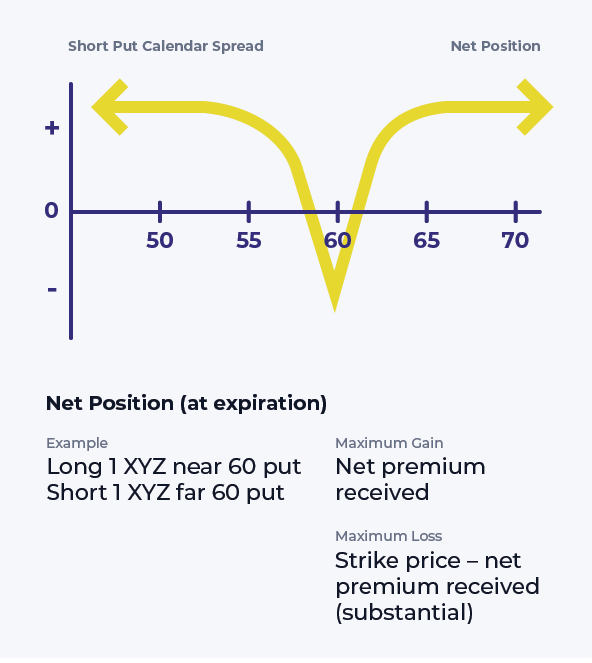

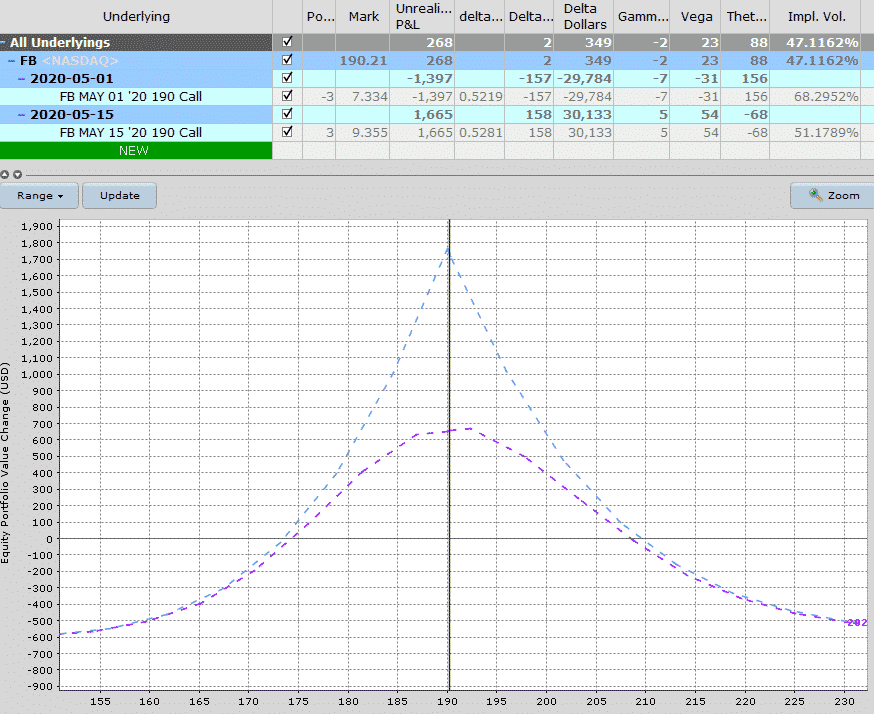

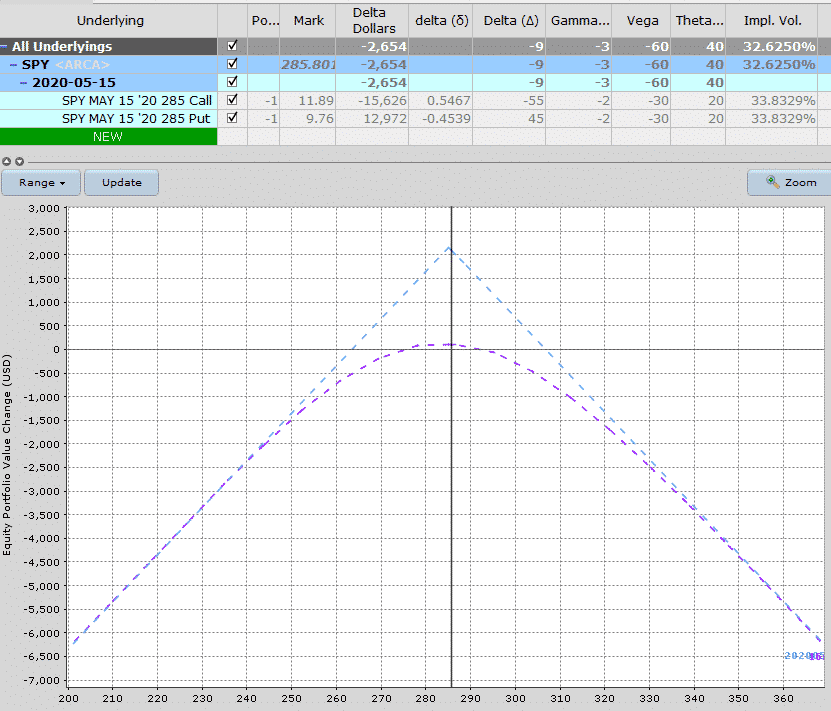

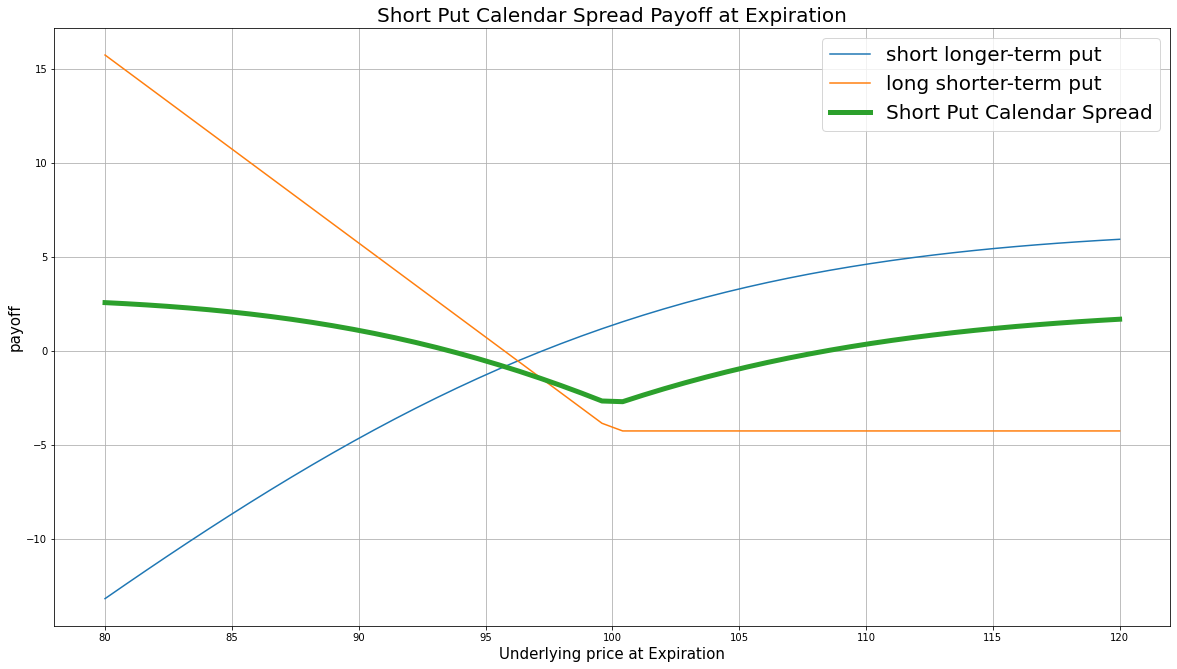

Short Put Calendar Spread

Short Put Calendar Spread - If the spread has increased beyond the upper range of 1.7205, it means either. Web a short put spread is an options trading strategy that involves buying one put option contract and selling another put option on the same underlying asset with the same. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. The strategy most commonly involves puts. Web buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar spread. Two transactions (buy calls and write calls) credit spread (upfront credit received) medium trading level required. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. Profits come from stable or an increase in the underlying. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain. A short put option is sold, and a long put option is purchased at the same strike price but with a later expiration date than the short. A calendar spread is an option trade that involves buying and. Web put calendar spreads consist of two put options. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. Web buying one put option and selling a second put option with a more distant expiration is an example of a. It involves buying and selling contracts at the. Two transactions (buy calls and write calls) credit spread (upfront credit received) medium trading level required. Web put calendar spreads consist of two put options. If the spread has increased beyond the upper range of 1.7205, it means either. Web a short put spread is an options trading strategy that involves buying. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. 3.4k views 2 years ago. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. A. Web a short put spread obligates you to buy the stock at strike price b if the option is assigned but gives you the right to sell stock at strike price a. Profits come from stable or an increase in the underlying. What is a calendar spread? Web put calendar spreads consist of two put options. Short calendar spreads with. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. What is a calendar spread? Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but. Web a short put spread is an options trading strategy that involves buying one put option contract and selling another put option on the same underlying asset with the same. Two transactions (buy calls and write calls) credit spread (upfront credit received) medium trading level required. Short calendar spreads with puts are often established before earnings reports, before new product. 3.4k views 2 years ago. Short calendar spreads with puts are often established before earnings reports, before new product introductions. What is a calendar spread? Web put calendar spreads consist of two put options. It involves buying and selling contracts at the. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. 3.4k views 2 years ago. A calendar spread is an options strategy that involves multiple legs. A short put option is sold, and a long put option is purchased. Web a calendar spread is a strategy involving buying longer term options and selling equal number of shorter term options of the same underlying stock or index with the same. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain.. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. Web short put calendar spread: Short. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Short calendar spreads with puts are often established before earnings reports, before new product introductions. Two transactions (buy calls and write calls) credit spread (upfront credit received) medium trading level required. A calendar spread is an option trade that involves buying and. Web the short calendar put spread is used to try and profit when you are expecting a security to move significantly in price, but it isn't clear on which direction it will move in. The strategy most commonly involves puts. It involves buying and selling contracts at the. If the spread has increased beyond the upper range of 1.7205, it means either. Web any value of the spread outside this range gives us an opportunity to set up a calendar spread. When running a calendar spread with puts, you’re selling and buying a put with the same strike price, but the put you buy will have a later expiration date than the. A calendar spread is an options strategy that involves multiple legs. Buying one put option and selling a second put option with a more distant expiration is an example of a short put calendar. Web put calendar spreads consist of two put options. What is a calendar spread? A short put option is sold, and a long put option is purchased at the same strike price but with a later expiration date than the short. Web a short calendar spread with puts is a possible strategy choice when the forecast is for a big stock price change but the direction of the change is uncertain.

Calendar Spreads 101 Everything You Need To Know

Calendar Spreads 101 Everything You Need To Know

Short Put Calendar Short put calendar Spread Reverse Calendar

Put Calendar Spread

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/607da29411b814023198cd31_Put-Calendar-Spread-Options-Strategies-Option-Alpha-Handbook.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Calendar Spread Explained InvestingFuse

Bearish Put Calendar Spread Option Strategy Guide

Calendar Put Spread Options Edge

Short Put Calendar Spread Options Strategy

3.4K Views 2 Years Ago.

Web A Calendar Spread Is A Strategy Involving Buying Longer Term Options And Selling Equal Number Of Shorter Term Options Of The Same Underlying Stock Or Index With The Same.

Web Buying One Put Option And Selling A Second Put Option With A More Distant Expiration Is An Example Of A Short Put Calendar Spread.

Web Short Put Calendar Spread:

Related Post: