Tax Receipt For Donation Template

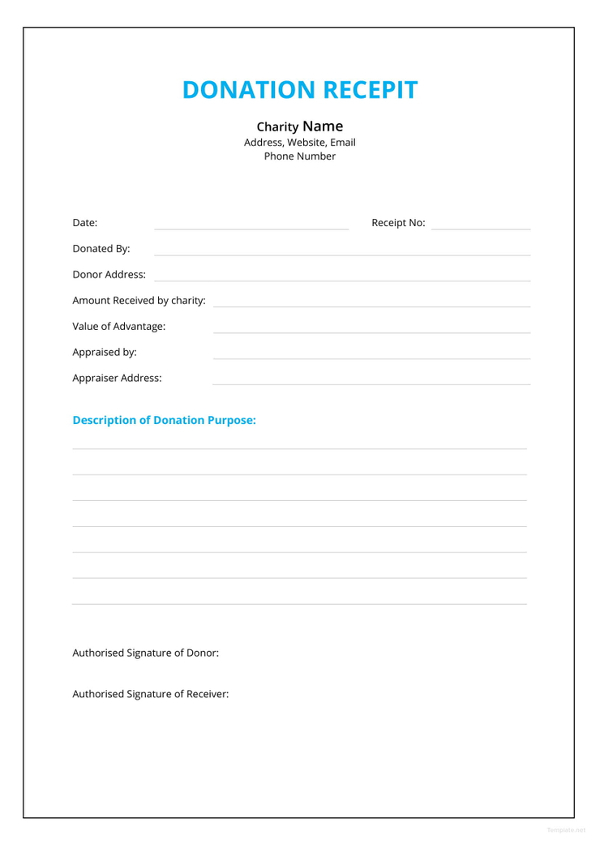

Tax Receipt For Donation Template - It is typically provided by the organization that received the donation and serves as. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. Our receipt template can be used for donations and contains fields you can customize. Web email template for charitable donation receipt. This can include cash donations, personal property, or a vehicle. Web sample 501(c)(3) donation receipt (free template) all of these rules and regulations can be confusing. Web updated april 24, 2024. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. Keep accurate records and tax purposes. Web updated april 24, 2024. Web what irs considers as charity. Authorized signature _____ representative’s name _____. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. A donation tax receipt is essential for your organization and donors, and they ensure you’re maintaining good relationships with your donors. Our receipt template can be used for donations and contains fields you can customize. Registered charities and other qualified donees can. Web donation receipts, also called donation tax receipts, are a form of written proof that provide official documentation of a contribution made by a donor. If a donor receives goods or services in exchange for a donation over $75 ( calculate your donation receipt value for such transactions here) These donation receipts are written records that acknowledge a gift to. A 501 (c) (3) donation receipt is required to be completed by charitable organizations when receiving gifts in a value of $250 or more. If a donor specifically requests for a donation receipt. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Web in the us, it is required that an organization. A receipt is required for all donation types in excess of $250. Not all donations are monetary, and it's good to have a special receipt template to acknowledge and document donations of goods. Web skynova has multiple templates and software to help small businesses, including nonprofit 501(c)(3) organizations. In addition to showing donor appreciation, these messages help your supporters file. Our receipt template can be used for donations and contains fields you can customize. If a donor specifically requests for a donation receipt. It’s especially important to make sure this is recorded to have proof of donation and prevent misuse. This type of receipt should also include information about the value of the good received. In this article, you’ll discover. Donorbox tax receipts are highly editable and can be customized to include important details regarding the donation. The irs requires a donation receipt if the donation made is more than $250 regardless of whether the donation was in cash, bank transfer, or credit card. The irs requires a donation receipt in the following cases: Lovetoknow editable donation receipt template. The. A donation receipt is used to claim a tax deduction for clothing and household property itemized on an individual’s taxes. 5 types of donation receipts. Registered charities and other qualified donees can use these samples to prepare official donation receipts that meet the requirements of the income tax act and its regulations. Registered nonprofit organizations can issue both “official donation. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. This can include cash donations, personal property, or a vehicle. If a donor receives goods or services in exchange for a donation over $75 ( calculate your donation receipt value for such transactions. Authorized signature _____ representative’s name _____. Use this donation receipt template for donors who have not received any merchandise in exchange for a donation. Web email template for charitable donation receipt. Web donation receipts, also called donation tax receipts, are a form of written proof that provide official documentation of a contribution made by a donor. Use a cash donation. Authorized signature _____ representative’s name _____. Lovetoknow editable donation receipt template. Web updated april 24, 2024. A donor is responsible for valuing the donated items, and it’s important not to abuse or overvalue such items in the event of a tax audit. In this article, you’ll discover some do’s and don’ts to keep in mind as you create receipts that are irs (and donor) approved—plus a series of receipt templates that you can download for free! An opportunity to engage with donors. Not all donations are monetary, and it's good to have a special receipt template to acknowledge and document donations of goods. Donors should first confirm with 501 (c) (3) charity list to verify if the charity is eligible for tax deductions under the irs guidelines. In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable organization keep good internal records of gifts. What are the best donation receipt templates for nonprofits? The irs requires a donation receipt in the following cases: It is typically provided by the organization that received the donation and serves as. Web a donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. This type of receipt should also include information about the value of the good received. Web official donation receipts must include the name and website address of the canada revenue agency (cra). Web in the us, it is required that an organization gives a donation receipt for any contribution that is $250 or more.

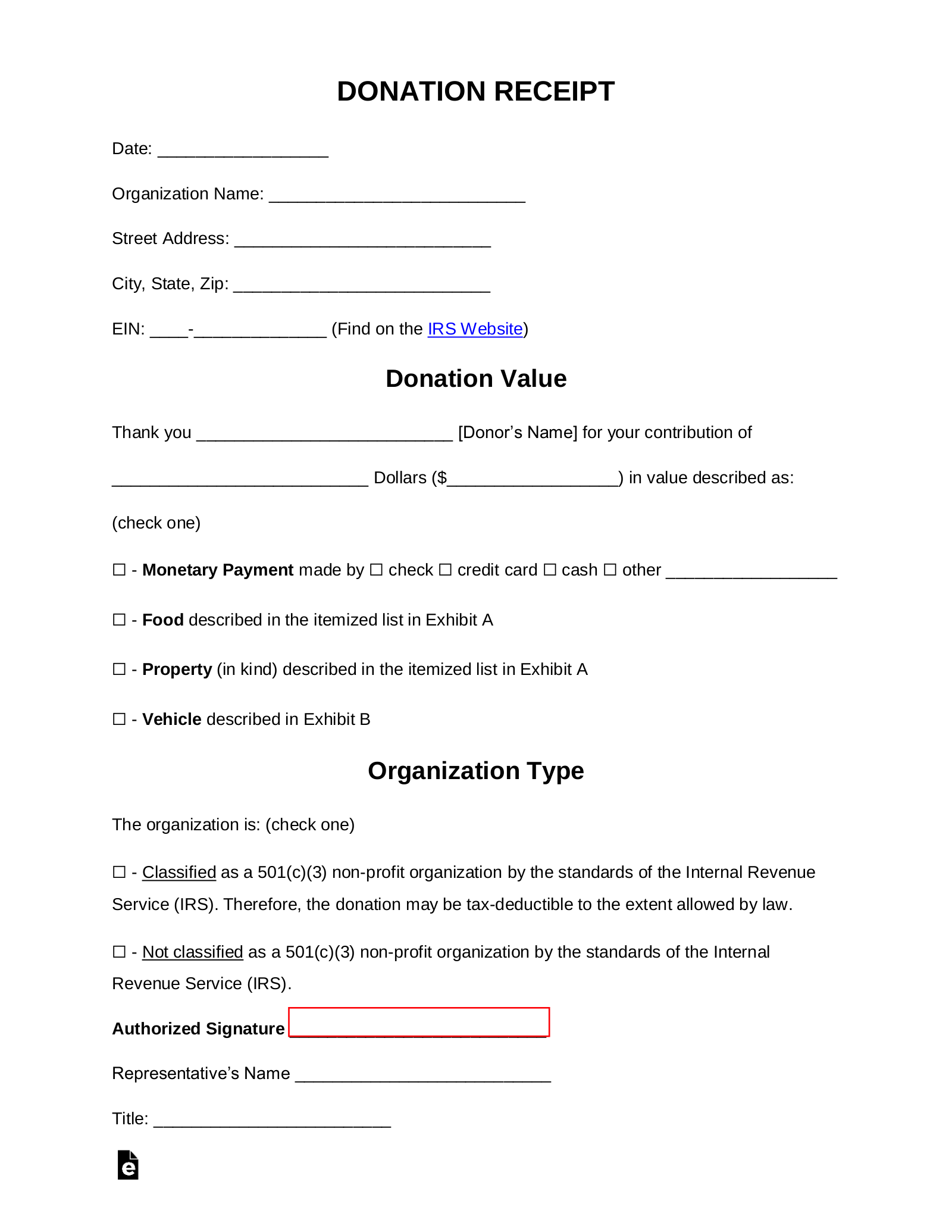

Tax Receipt For Donation Template DocTemplates

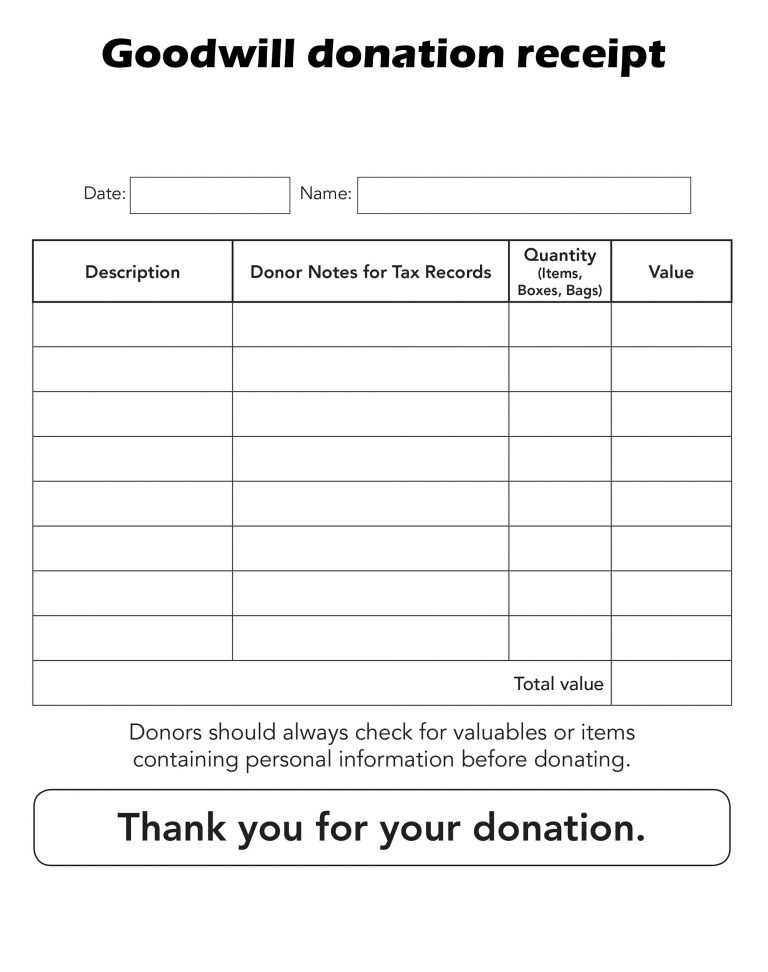

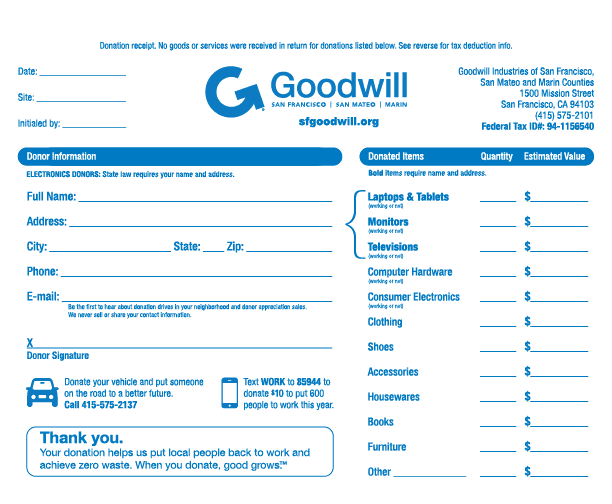

Free Goodwill Donation Receipt Template PDF eForms

Printable Donation Receipt Letter Template Printable Templates

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

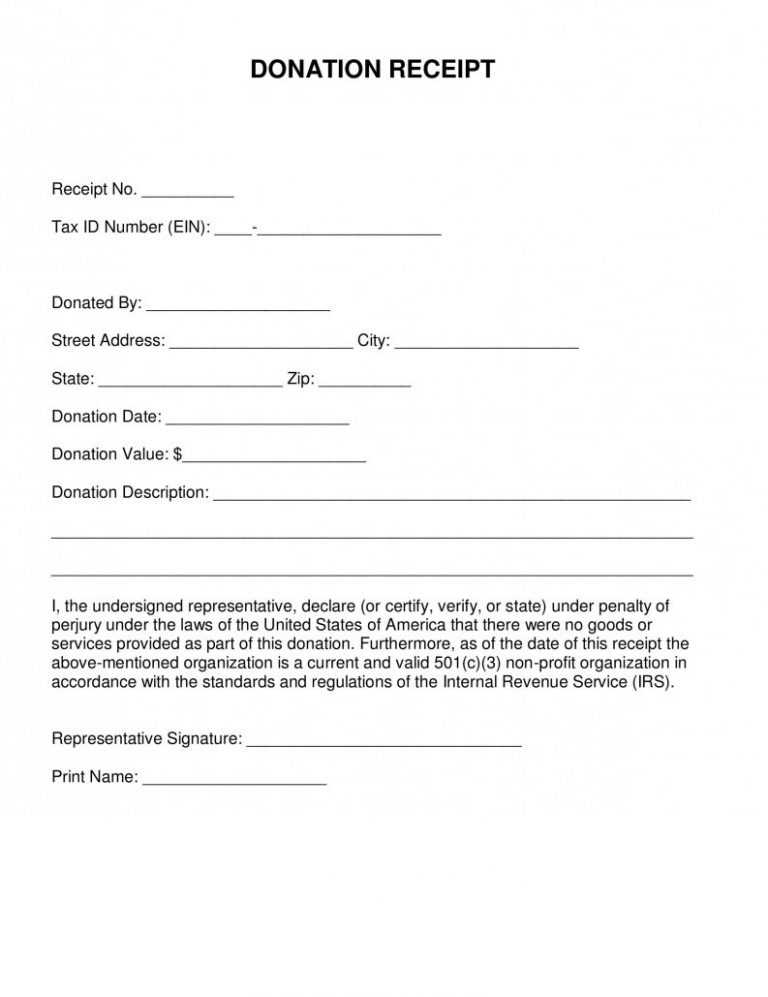

Free Sample Printable Donation Receipt Template Form

Tax Receipt For Donation Template DocTemplates

9+ Tax Donation Receipt Templates Excel Templates

9+ Tax Donation Receipt Templates Excel Templates

Free Sample Printable Donation Receipt Template Form

Blank Printable Donation Form Template Printable World Holiday

5 Types Of Donation Receipts.

Registered Nonprofit Organizations Can Issue Both “Official Donation Tax Receipts” And More Informal Receipts.

Web Sample 501(C)(3) Donation Receipt (Free Template) All Of These Rules And Regulations Can Be Confusing.

Donation Receipts Are Quite Simply The Act Of Providing A Donor With A Receipt For Their Monetary Contribution To An Organization, Such As A Charity Or Foundation.

Related Post: