Tax Year Vs Calendar Year

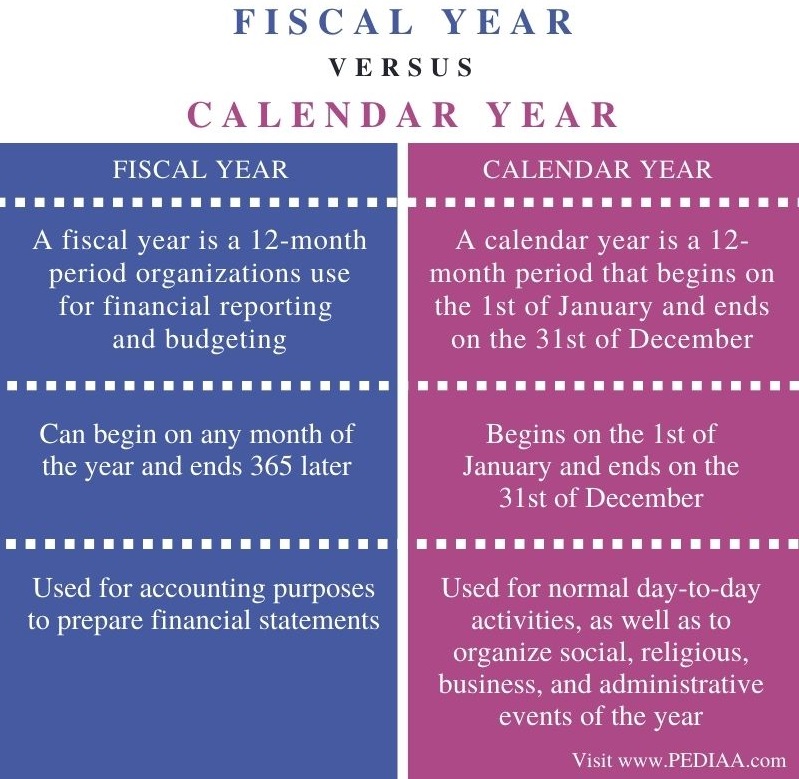

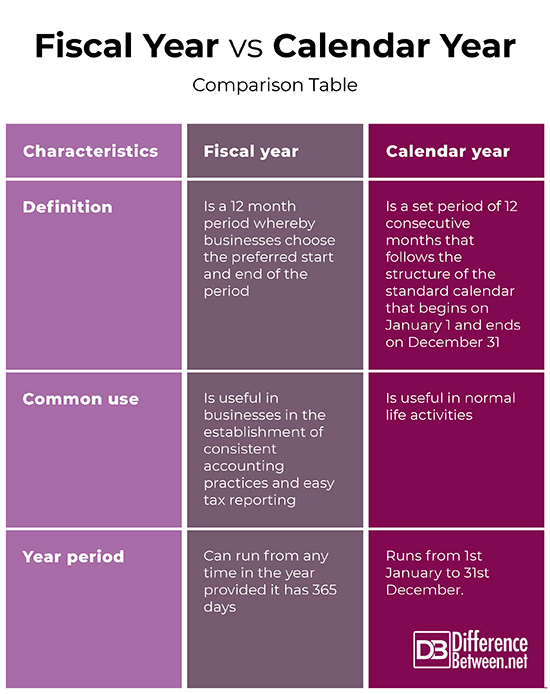

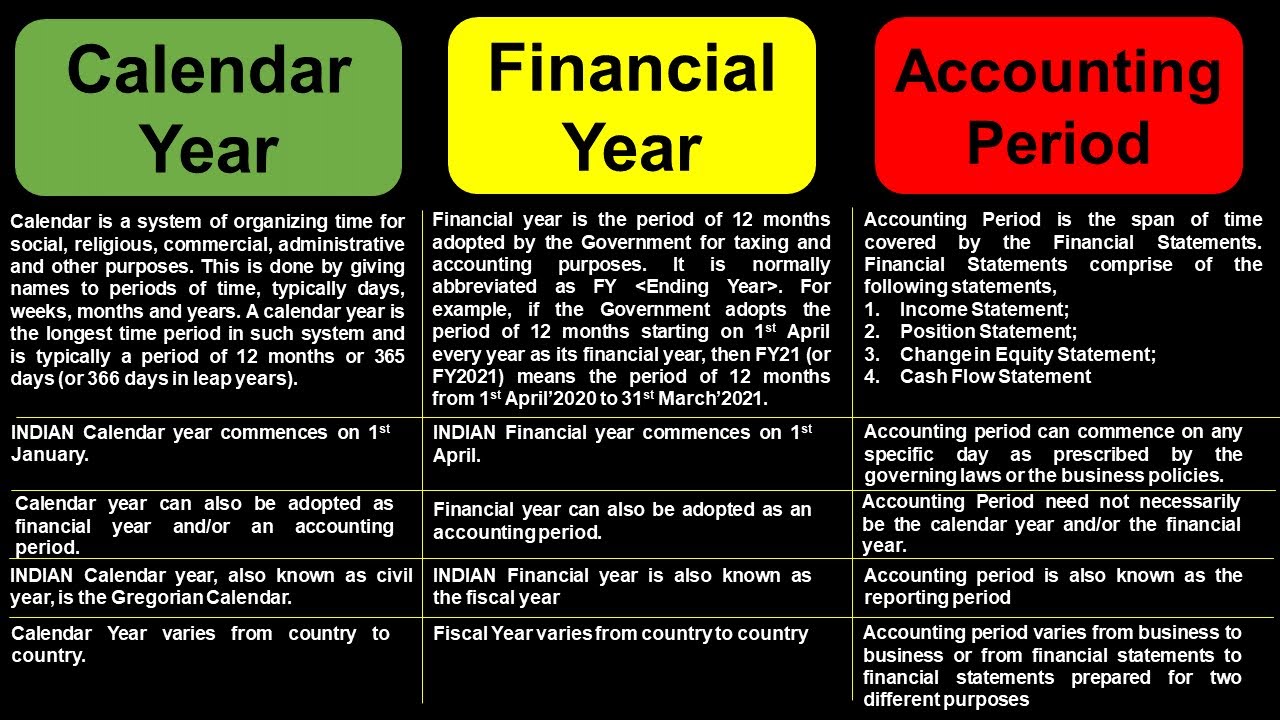

Tax Year Vs Calendar Year - 31, or a fiscal year, which is either a period of 12 consecutive months. As mentioned earlier, the calendar year tax period runs from january 1st to december 31st and is the most common type used by individual. Web a tax year is a calendar year, but a calendar year isn't necessarily a fiscal year. In this article, we define a fiscal and calendar year, list the. Web generally, taxpayers filing a version of form 1040 use the calendar year. Fiscal years allow you to reduce your tax burden. Web definition and tips. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. Due to seasonal sales volumes, some industries benefit from a fiscal accounting year. Web the case for early tax planning. Web the case for early tax planning. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Due to seasonal sales volumes, some industries benefit from a fiscal accounting year. The internal revenue service (irs) defines a fiscal year as 12 consecutive months ending on the. The tax years you can. Web difference between fiscal year and calendar year, calendar year is the period from january 1st to december 31st. Fiscal years allow you to reduce your tax burden. Web calendar tax year: The only difference between these terms i.e. You must figure your taxable income on the basis of a tax year. Web the internal revenue services (irs) defines a calendar year as the period that starts on january 1 and ends on december 31. An individual can adopt a fiscal year if the individual maintains his or her books and records on the basis. Web a tax year is a calendar year, but a calendar year isn't necessarily a fiscal year.. A calendar year always begins on new year’s day and. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. Web a tax year is a calendar year, but a calendar year isn't necessarily a fiscal year. The only difference between these terms. Web the case for early tax planning. Web definition and tips. An annual accounting period does not include a short tax year. • under the tax or company law of different countries the start. However, the fiscal year is. Web a calendar year ends on december 31st, whereas the fiscal year begins on the day of the individual’s death and ends on the last day of the month before the one. However, the fiscal year is. Learn more about the differences with this helpful guide. Web generally, taxpayers filing a version of form 1040 use the calendar year. The. A calendar year always begins on new year’s day and. Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. Due to seasonal sales volumes, some industries benefit from a fiscal accounting year. As mentioned earlier, the calendar year tax period runs from january 1st to december 31st and. In this article, we define a fiscal and calendar year, list the. When does the tax year end? Web difference between fiscal year and calendar year, calendar year is the period from january 1st to december 31st. Web calendar tax year: Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some. Web definition and tips. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive. Web a tax. Web the case for early tax planning. Businesses follow a calendar tax year that runs from january 1 to december 31, but some prefer using a “fiscal tax year,” a period of 12 consecutive. Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. Web a tax year is. An annual accounting period does not include a short tax year. Due to seasonal sales volumes, some industries benefit from a fiscal accounting year. Web the irs defines a tax year as “an annual accounting period for keeping records and reporting income and expenses.” most folks understand that part but. Every taxpayer (individuals, business entities, etc.) must figure taxable income for an annual accounting period called a tax year. Learn more about the differences with this helpful guide. A calendar year always begins on new year’s day and. Web what is the difference between a fiscal year and calendar year? Web a tax year may be either a calendar year, which is a period of 12 consecutive months ending on dec. Web although many businesses have the option to choose between a calendar and fiscal year, the irs requires some to adopt the calendar year for their taxes. However, the fiscal year is. Web a calendar year ends on december 31st, whereas the fiscal year begins on the day of the individual’s death and ends on the last day of the month before the one. Employees should max out their hsa contributions wellable, a year of benefits coverage under an individual health insurance. The tax year can end at different times depending on how a business files taxes. You must figure your taxable income on the basis of a tax year. Web a tax year is a calendar year, but a calendar year isn't necessarily a fiscal year. The only difference between these terms i.e.

Fiscal Year vs. Calendar Year Which to choose? Moose Creek

What is the Difference Between Fiscal Year and Calendar Year

What is a Fiscal Year? Your GoTo Guide

Calendar Year vs Fiscal Year Top 6 Differences You Should Know

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

Difference Between Fiscal Year and Calendar Year

Difference Between Fiscal Year and Calendar Year Difference Between

Fiscal Year vs Calendar Year What's The Difference?

Fiscal Year vs Calendar Year What’s Right for Your Business?

What is Calendar Year What is Financial Year What is Accounting

Starting Tax Planning Early In The Year Gives You Ample Time To Maximize Tax Deductions And.

Web A Calendar Year, Obviously, Runs From January 1 To December 31, Just Like The Calendar On Your Wall.

Web The Case For Early Tax Planning.

Web Calendar Tax Year:

Related Post: