W4V Form Printable

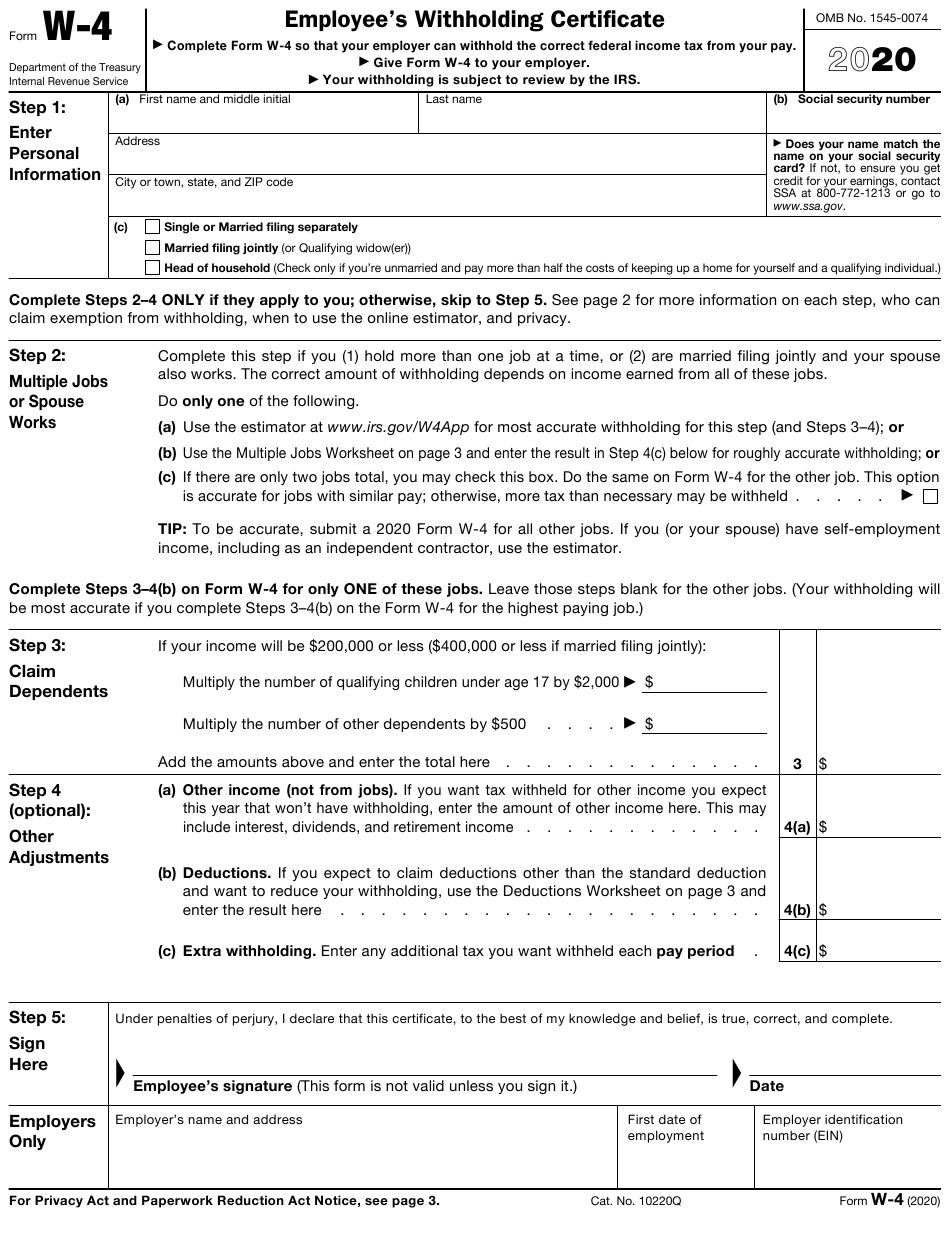

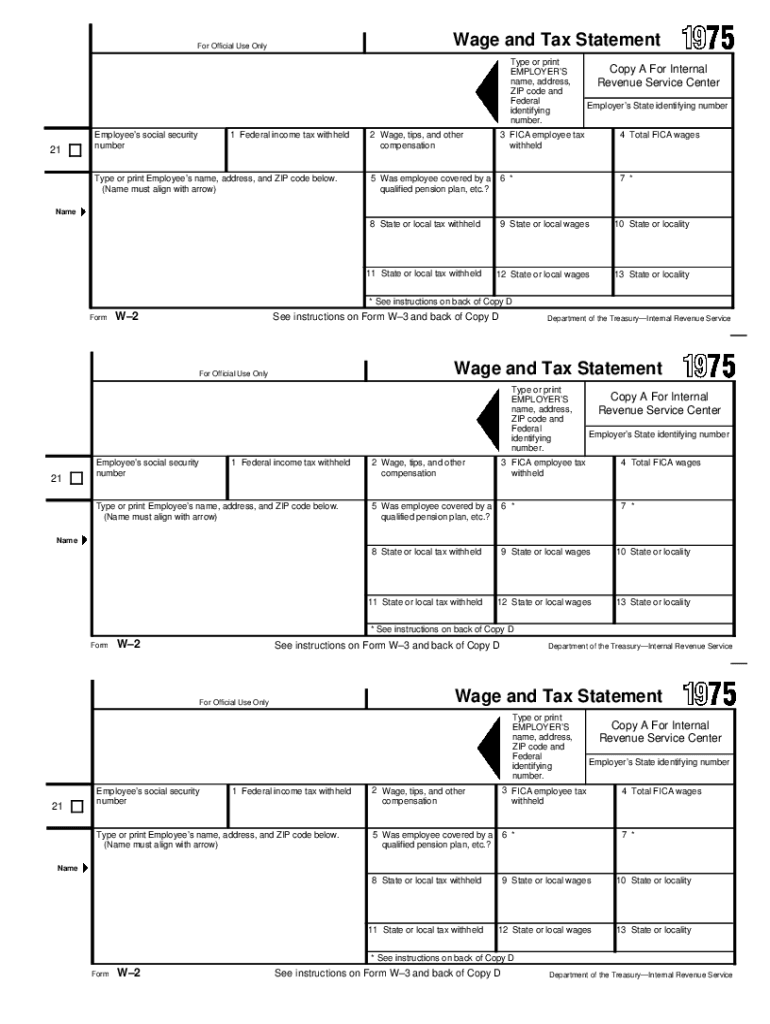

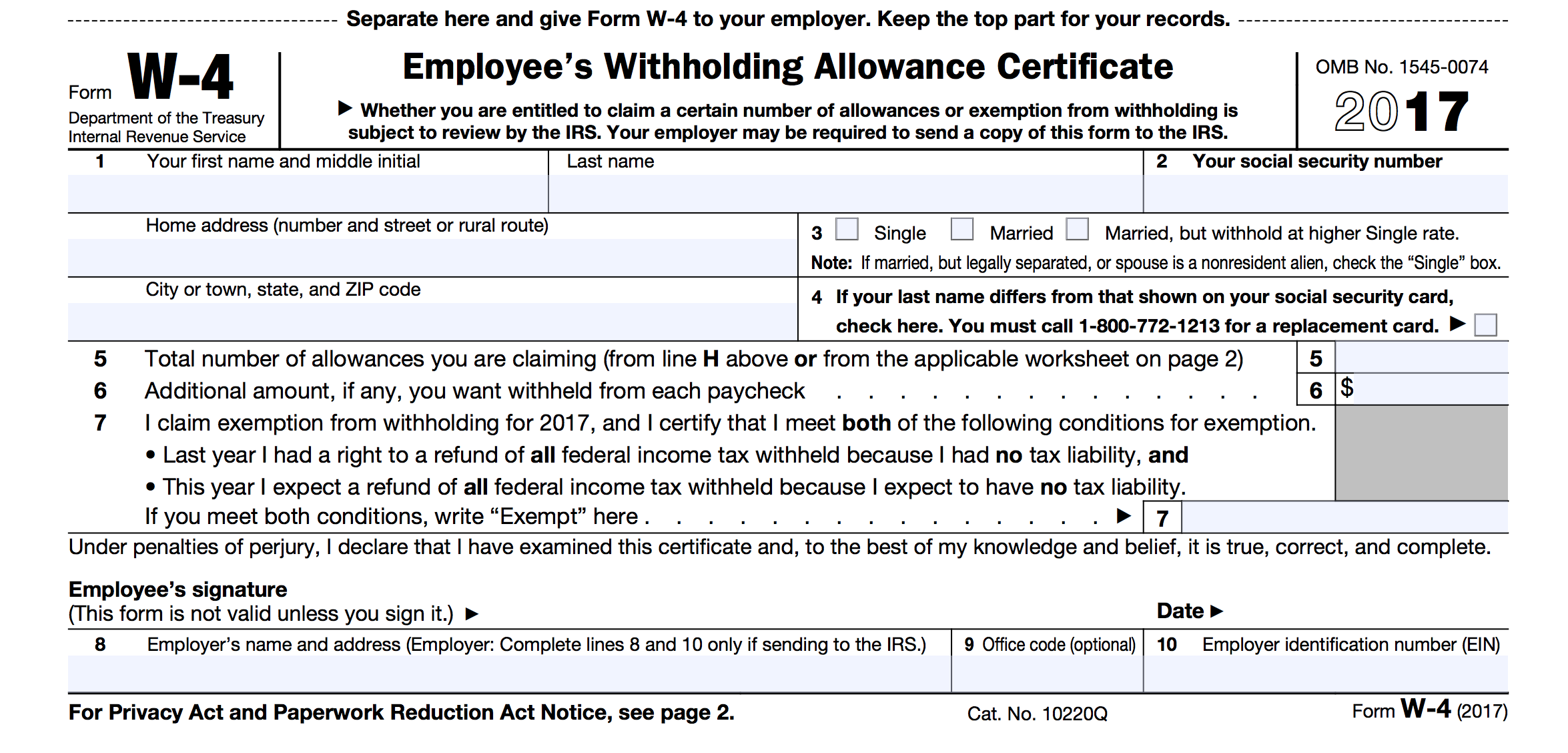

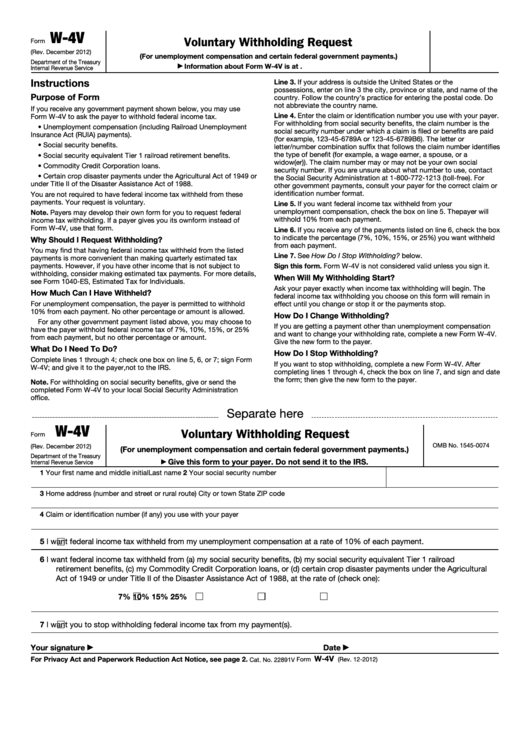

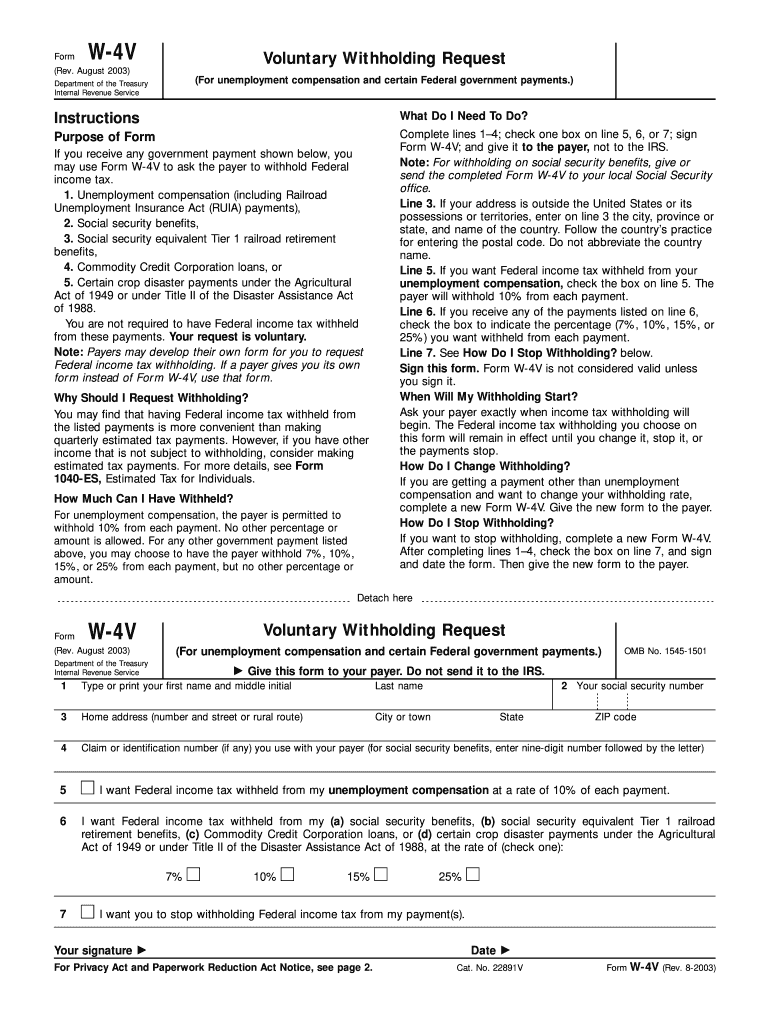

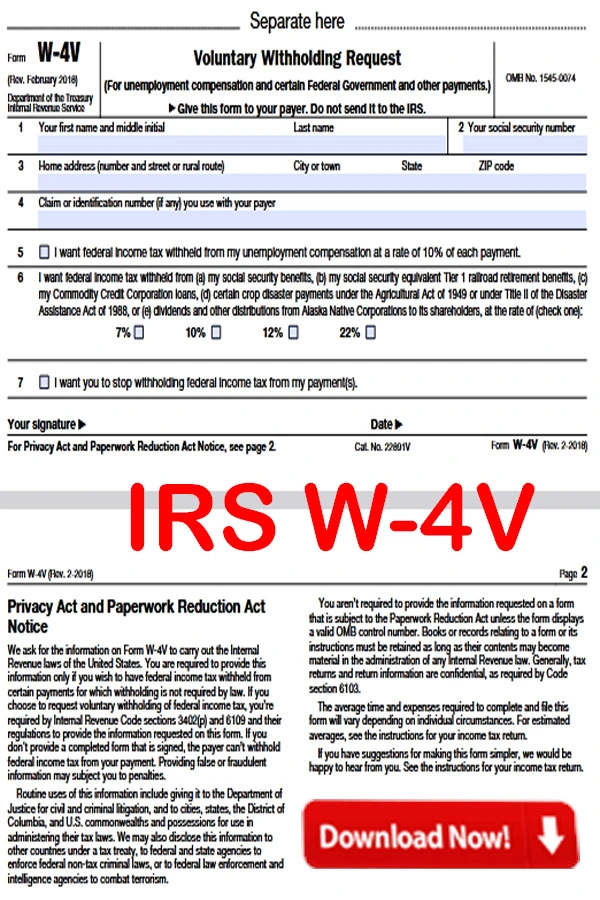

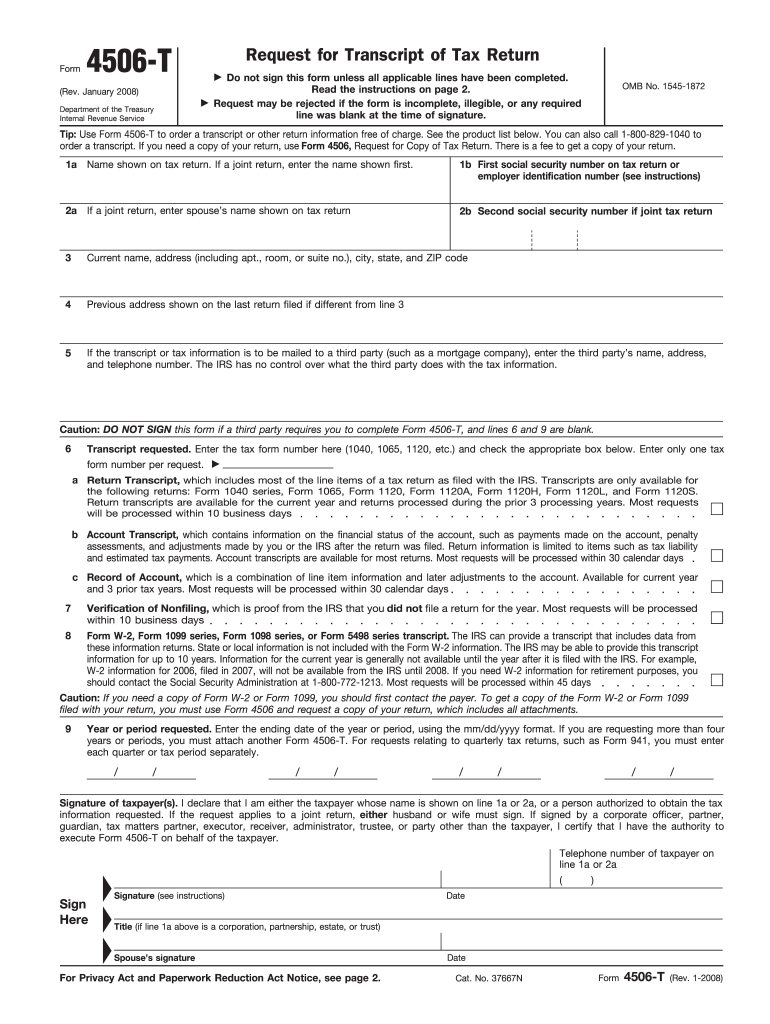

W4V Form Printable - Otherwise, skip to step 5. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. Department of the treasury internal revenue service. Otherwise, skip to step 5. And give it to the payer, not to the irs. Check one box on either line 5, 6, or 7; If too little is withheld, you will generally owe tax when. If you’ve recently started receiving government benefits, such as social security benefits or unemployment compensation,. See page 2 for more information on each step, who can claim exemption from. Then, find the social security office closest to your home and mail or fax us the completed form. See page 2 for more information on each step, who can claim exemption from. Department of the treasury internal revenue service. If you’ve recently started receiving government benefits, such as social security benefits or unemployment compensation,. Without registration or credit card. Not all forms are listed. And give it to the payer, not to the irs. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. Otherwise, skip to step 5. Otherwise, skip to step 5. If too little is withheld, you will generally owe tax when. Fill out online for free. If you’ve recently started receiving government benefits, such as social security benefits or unemployment compensation,. Without registration or credit card. Line 3.— if your address is outside. Otherwise, skip to step 5. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. And give it to the payer, not to the irs. Fill out online for free. Department of the treasury internal revenue service. Check one box on either line 5, 6, or 7; Line 3.— if your address is outside. Then, find the social security office closest to your home and mail or fax us the completed form. (for unemployment compensation and certain federal government payments.) internal revenue service. This form is provided and used for the request of voluntary withholdings regarding. See page 2 for more information on each step, who can. See page 2 for more information on each step, who can claim exemption from. If you’ve recently started receiving government benefits, such as social security benefits or unemployment compensation,. Then, find the social security office closest to your home and mail or fax us the completed form. Without registration or credit card. And give it to the payer, not to. Otherwise, skip to step 5. Not all forms are listed. See page 2 for more information on each step, who can claim exemption from. Department of the treasury internal revenue service. Check one box on either line 5, 6, or 7; And give it to the payer, not to the irs. See page 2 for more information on each step, who can claim exemption from. If you’ve recently started receiving government benefits, such as social security benefits or unemployment compensation,. Then, find the social security office closest to your home and mail or fax us the completed form. This form is. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. Otherwise, skip to step 5. If too little is withheld, you will generally owe tax when. Without registration or credit card. Then, find the social security office closest to your home and mail or fax us the completed form. Fill out online for free. And give it to the payer, not to the irs. See page 2 for more information on each step, who can claim exemption from. Not all forms are listed. Otherwise, skip to step 5. Then, find the social security office closest to your home and mail or fax us the completed form. Voluntary withholding request from the irs' website. (for unemployment compensation and certain federal government payments.) internal revenue service. If too little is withheld, you will generally owe tax when. See page 2 for more information on each step, who can claim exemption from. Department of the treasury internal revenue service. See page 2 for more information on each step, who can claim exemption from. Department of the treasury internal revenue service. And give it to the payer, not to the irs. Check one box on either line 5, 6, or 7; Line 3.— if your address is outside. Not all forms are listed. This form is for income earned in tax year 2023, with tax returns due in april 2024. Fill out online for free. February 2018) (for unemployment compensation and certain federal government and other payments.) department of the. Without registration or credit card.

Federal Withholding Tax Form W4v

Irs Form W4V Printable Fillable W 4v Form Fill Online, Printable

Irs Form W 4V Printable

Irs Form W 4V Printable

Fillable Form W4v Voluntary Withholding Request printable pdf download

Irs Form W 4V Printable

Irs Form W 4V Printable

IRS W4V Form 2024 PDF Download How To Fill IRS W4V Form PDF

Irs Form W4V Printable W4v Printable 2019 cptcode.se

Irs Form W4V Printable Printable W4v Form Master of

Otherwise, Skip To Step 5.

Otherwise, Skip To Step 5.

If You’ve Recently Started Receiving Government Benefits, Such As Social Security Benefits Or Unemployment Compensation,.

This Form Is Provided And Used For The Request Of Voluntary Withholdings Regarding.

Related Post: