Futures Calendar Spread

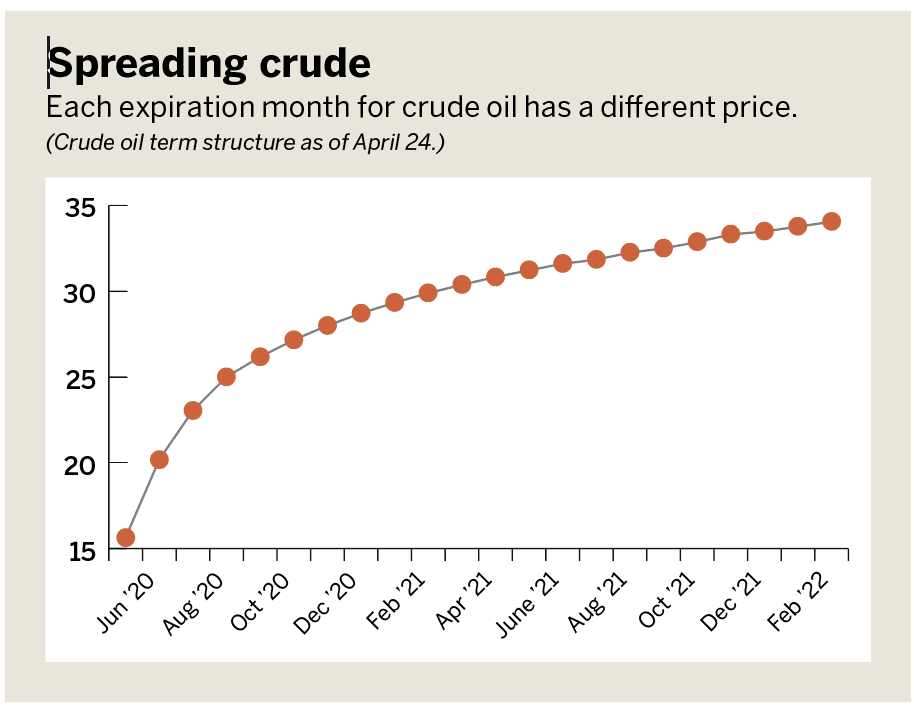

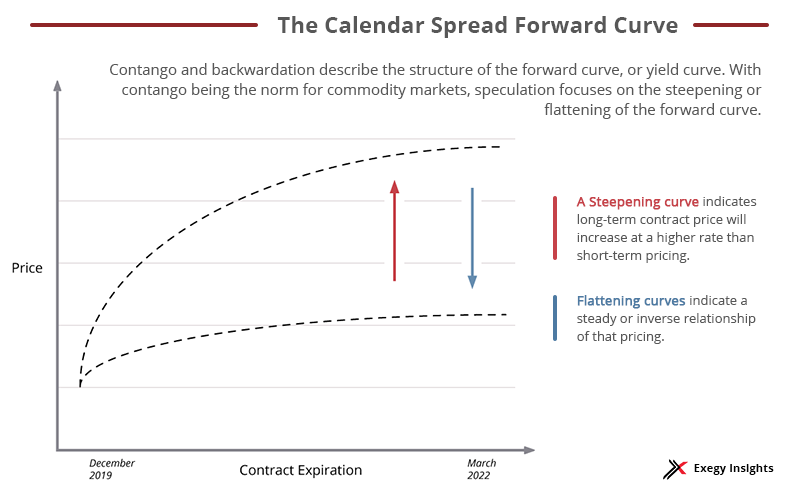

Futures Calendar Spread - Calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the near month contract. Are spread trades block eligible? Let's gain a better understanding of this with the help of an example. Web in a calendar spread, both the futures contracts have the same underlying, however their expiries are different. Here’s what you should know about managing calendar spreads, ideas on when calendar spreads may be useful, the potential profit and loss (p&l) points, and. Web april 25, 2024 at 10:05 am pdt. Web updated october 31, 2021. Web this is referred to as buying the calendar spread: Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. Definition and examples of calendar spread. Intramarket spreads, also referred to as calendar spreads, involve buying a futures contract in one month while simultaneously selling the same contract in a different month. Web fact checked by. Exploring the possible outcomes in september. Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration. If you have any questions, please feel free to contact us. It is beneficial only when a day trader expects the derivative to have a price trend ranging from neutral to medium rise. Futures trading is a very volatile activity, as most prices are affected due to multiple external macroeconomic conditions that cannot be controlled. Intramarket spreads, also referred to. The cash spread over the same window has narrowed by 10.3 basis points. Since yield futures have a dv01 value of $10, the value of the position has increased by $990 (9.9 basis points x $10 dv01 x 10 contracts). Et, while nasdaq 100 futures traded marginally lower. Option trading strategies offer traders and investors the opportunity to profit in. Web the calendar spread strategy can be effective during times of low volatility and potentially useful if you think a stock or etf will trend sideways in the near term. Web options and futures traders mostly use the calendar spread. Click the arrow next to your pre contract to view all of the listed spreads that include the symbol. Web. The futures spread has narrowed by 9.9 basis points. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Calculate the fair value of current month contract. Web calendar spreads—also called intramarket spreads—are types. Here’s what you should know about managing calendar spreads, ideas on when calendar spreads may be useful, the potential profit and loss (p&l) points, and. Currently lean hogs is a positive carry market and is just under the highest % carry yield score for the past 52 weeks. Web a calendar spread is a sophisticated options or futures strategy that. Let’s look at a few possibilities. Web a calendar spread is a trading technique that involves the buying of a derivative of an asset in one month and selling a derivative of the same asset in another month. Web s&p 500 and dow jones industrial average futures were down 0.1% shortly after 5.30 a.m. Calendar spreads are also known as. Since yield futures have a dv01 value of $10, the value of the position has increased by $990 (9.9 basis points x $10 dv01 x 10 contracts). Calculate the fair value of current month contract. What is a futures spread? Web a calendar spread is an investment strategy for derivative contracts in which the investor buys and sells a derivative. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct delivery dates. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Let's gain a better understanding of this with the help of an example. Calendar spreads may be executed in a bullish or bearish fashion, depending on the position taken in the near month contract. There is currently no calendar data for this product. It is beneficial only when a day trader expects the derivative to have a price trend ranging. What are the hours for block trade submission through cme clearport? Web calendar spreads—also called intramarket spreads—are types of trades in which a trader simultaneously buys and sells the same futures contract in different expiration months. Web a calendar spread is a sophisticated options or futures strategy that combines both long and short positions on the same underlying asset, but with distinct delivery dates. From the “all products” screen on the trade page, enter a future in the symbol entry field. Web a calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with different delivery dates. Web lean hogs is consistently a negative carry market which is sometimes attractive to sell short and give the investor the opportunity to profit when futures prices “roll down” to spot cash prices. Web s&p 500 and dow jones industrial average futures were down 0.1% shortly after 5.30 a.m. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having different. Web updated october 31, 2021. At the futures dropdown, select “all” for active contract and set the spread to “calendar.” 3. Web april 25, 2024 at 10:05 am pdt. Currently lean hogs is a positive carry market and is just under the highest % carry yield score for the past 52 weeks. Web this is referred to as buying the calendar spread: Web in finance, a calendar spread (also called a time spread or horizontal spread) is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. Exploring the possible outcomes in september. Web futures spreads, in their simplest form, occur when a trader simultaneously buys a futures contract (long) and sells another futures contract (short) to profit from a change in the differ.

Leg Up on Futures Calendar Spreading luckbox magazine

Calendar Spread Option Strategy India CALNDA

Futures Calendar Spreads on Interactive Brokers 30 Day Trading30 Day

NIFTY FUTURES CALENDAR SPREAD STRATEGY (CSS) for NSENIFTY by

Futures Trading the definitive guide to trading calendar spreads on

What Exactly Are Futures Spreads StoneX Financial Inc, Daniels

Everything You Need to Know about Calendar Spreads Simpler Trading

Calendar Spread Explained InvestingFuse

Getting Started with Calendar Spreads in Futures Exegy

How to Trade Options Calendar Spreads (Visuals and Examples)

Sell 1 September 2440 Call And Buy 1 December 2440 Call For A Net Premium Of 33.75.

Let’s Look At A Few Possibilities.

Definition And Examples Of Calendar Spread.

Web The Calendar Spread Strategy Can Be Effective During Times Of Low Volatility And Potentially Useful If You Think A Stock Or Etf Will Trend Sideways In The Near Term.

Related Post: