Wacc Excel Template

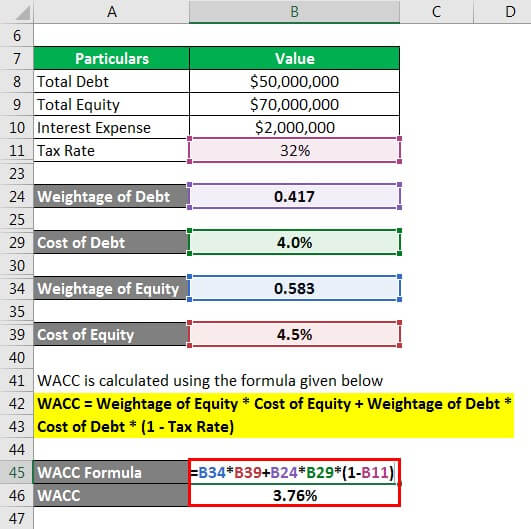

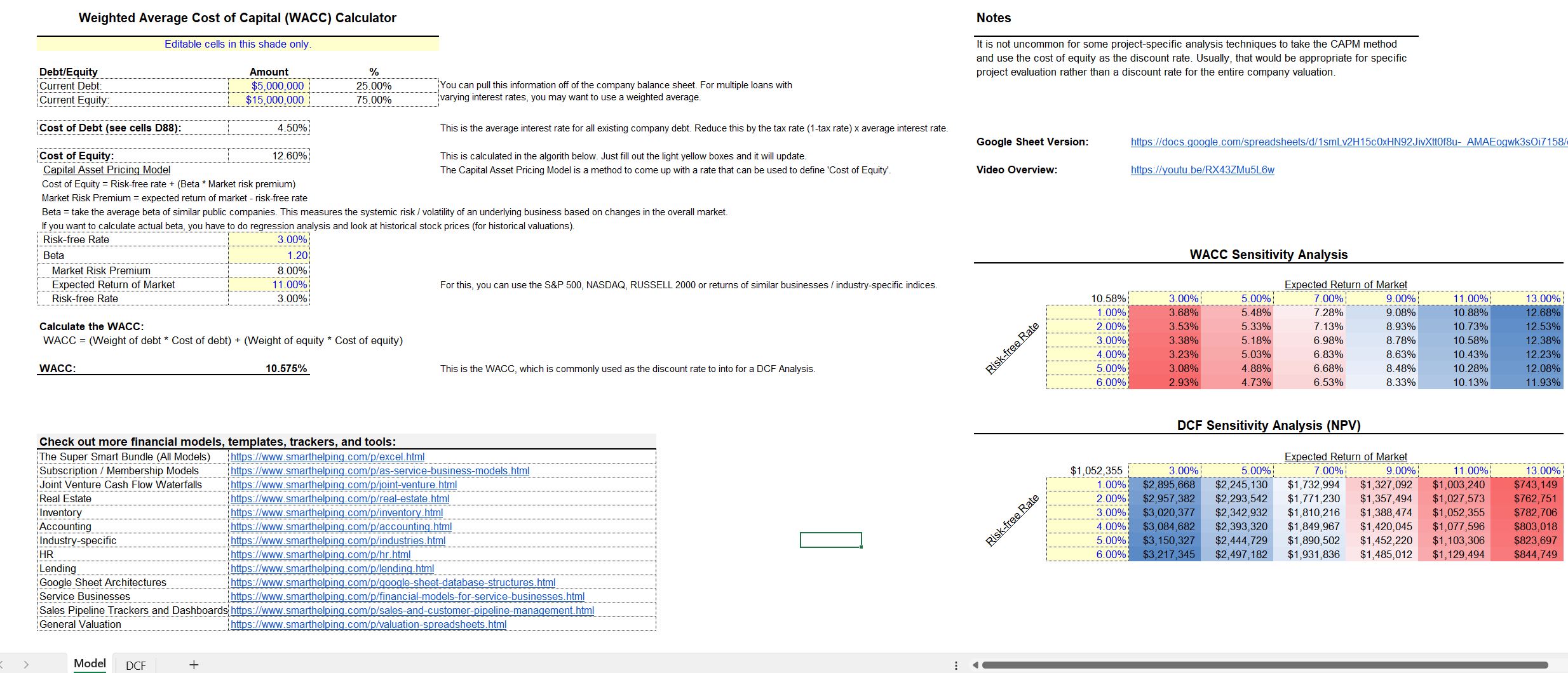

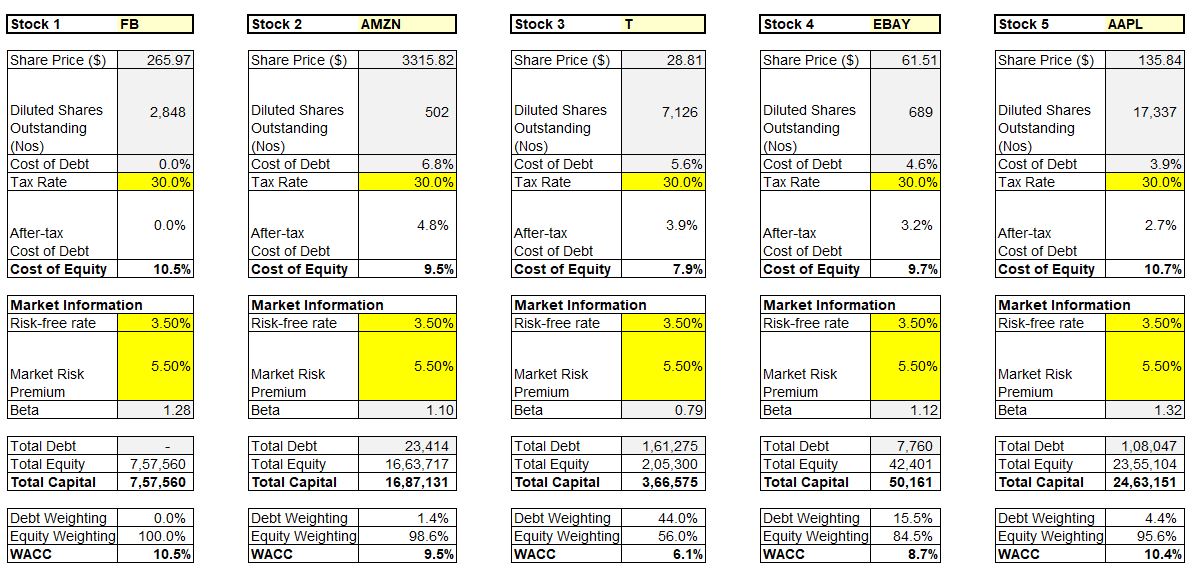

Wacc Excel Template - We use it as a discount rate when calculating the net present value of an investment. Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of a company, which effectively is the weighted mix of the cost of debt and the cost of equity of a company. Wacc stands for the weighted average cost of capital. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps calculate a firm’s cost of financing by combining the cost of debt and the cost of equity structure. Here is a preview of the wacc calculator: Use this easy to use template to save time and effort when calculating wacc. Our weighted average cost of capital template is free to download with clear explanation. Before you begin the wacc calculation on excel, you will need to gather some essential information. 88k views 6 years ago excel tutorials. The spreadsheet shoppe has got you covered! Web cost of equity. Web factset's weighted average cost of capital excel template provides an overview of a company's wacc. Web download 76.00 kb 2282 downloads. Wacc stands for the weighted average cost of capital. Use this easy to use template to save time and effort when calculating wacc. Web updated july 3, 2023. Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of a company, which effectively is the weighted mix of the cost of debt and the cost of equity of a company. What is the wacc formula? Delve into the realm of financial analysis as we guide you. The template returns wacc calculations for a company using the company's beta and beta derived from comparable companies as well as wacc from broker estimates. Web here are the steps to calculate wacc on excel: Web download 76.00 kb 2282 downloads. The weighted average cost of capital (wacc) is the average rate that a firm is expected to pay to. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. Calculate wacc based on capital structure and cost of various sources of funds. Our weighted average cost of capital template is free to download with clear explanation. Web steps to calculate wacc in excel. The term “wacc” is the acronym for a weighted. The wacc calculator excel template is a sophisticated and versatile tool for estimating the weighted average cost of capital. The significance of wacc investment decision making. Web excel financial modeling templates. Wacc stands for the weighted average cost of capital. What is the wacc formula? The weighted average cost of capital (wacc) is a financial metric that. Web excel financial modeling templates. We use it as a discount rate when calculating the net present value of an investment. All industries, financial model, general excel financial models. The wacc is also regarded as the rate at which the organization has to pay its stakeholders. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. All industries, financial model, general excel financial models. Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. Web there are many interactive calculators and excel templates. On october 23, 2015 / accounting, analysis, audit, business tools, calculator, downloads, financial statements. Web updated july 3, 2023. Delve into the realm of financial analysis as we guide you through the intricate process of calculating the weighted average cost of capital (wacc) in excel. The spreadsheet shoppe has got you covered! Web cost of equity. Web here are the steps to calculate wacc on excel: Web factset's weighted average cost of capital excel template provides an overview of a company's wacc. Web this excel template helps you to calculate the weighted average cost of capital (wacc) of your company. The wacc is also regarded as the rate at which the organization has to pay its. The above term has two major parts to decipher; The wacc is also regarded as the rate at which the organization has to pay its stakeholders. Web weighted average cost of capital (or wacc) is an excel tool that calculates the discount rate of a company, which effectively is the weighted mix of the cost of debt and the cost. Weighted average and the cost of capital. Calculate wacc based on capital structure and cost of various sources of funds. The weighted average cost of capital (wacc) indicates a firm’s average cost of capital from all components, and different types of stocks like preferred stock, common stock, bonds, and other types of debt. The term “wacc” is the acronym for a weighted average cost of capital (wacc), a financial metric that helps calculate a firm’s cost of financing by combining the cost of debt and the cost of equity structure. The significance of wacc investment decision making. Web steps to calculate wacc in excel. Wacc stands for the weighted average cost of capital. Download wso's free wacc calculator model template below! The wacc is also regarded as the rate at which the organization has to pay its stakeholders. The weighted average cost of capital (wacc) is the average rate that a firm is expected to pay to all creditors, owners, and other capital providers. Web excel financial modeling templates. Web the wacc calculator spreadsheet uses the formula above to calculate the weighted average cost of capital. The template returns wacc calculations for a company using the company's beta and beta derived from comparable companies as well as wacc from broker estimates. Web updated july 3, 2023. Web the investopedia team. All industries, financial model, general excel financial models.

Wacc Excel Template

Weighted Average Cost of Capital (WACC) Excel Template • 365

Wacc Excel Template Web Sheet1 4estimating The Weighted Average Cost Of

Wacc Excel Template

How to Calculate WACC in Excel Sheetaki

업데이트 Wacc Calculator 모두 무료

Excel Template Weighted Average Cost of Capital Calculator WACC

Weighted Average Cost of Capital Excel Template Ryan O'Connell, CFA

Stock Wacc Analysis Excel Example (Marketxls Template) MarketXLS

Excel WACC example 1 YouTube

Web Factset's Weighted Average Cost Of Capital Excel Template Provides An Overview Of A Company's Wacc.

Before You Begin The Wacc Calculation On Excel, You Will Need To Gather Some Essential Information.

Web Download 76.00 Kb 2282 Downloads.

We Use It As A Discount Rate When Calculating The Net Present Value Of An Investment.

Related Post: