Printable 1098 Form

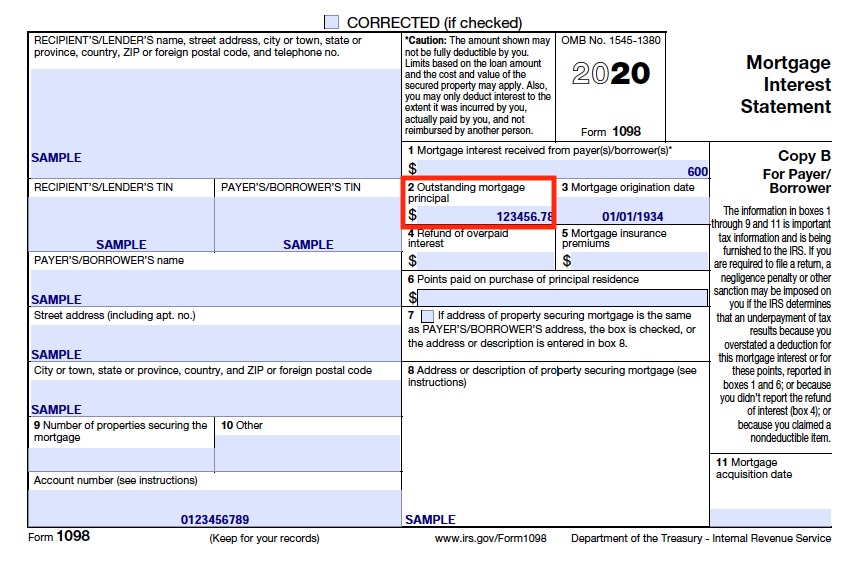

Printable 1098 Form - Any gambling winnings subject to federal income tax withholding. Web box 2 on irs form 1098 displays the principal balance of your loan as of january 1, 2023 or when chase acquired or originated the loan in 2023. If you have an escrow account, your. Web learn how to use the printable 1098 form to report your mortgage interest payments to the irs and claim tax deductions. Form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amou… If you have not received them by february 15, please. Web what is the mortgage interest statement or form 1098? Find out how to access, print, and. Web learn how to fill out and file irs form 1098, a document that reports interest paid on a mortgage of $600 or more. Download or fill out the blank form online, and get. Form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amou… Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as. Download a printable. Any gambling winnings subject to federal income tax withholding. Web irs form 1098 (mortgage interest statement) can help to show the amount of interest, points or mortgage insurance premiums you paid on your mortgage loan. Web learn how to use the printable 1098 form to report your mortgage interest payments to the irs and claim tax deductions. Lenders file a. Know your irs tax deadlines (pdf) review the 2023 tax planning guide. Welcome to your tax center. Download a printable or fillable pdf version of the form from. For any interest income of $10 or more that you received in 2006, you’ll get a form. Educational institutions that receive the. Web box 2 on irs form 1098 displays the principal balance of your loan as of january 1, 2023 or when chase acquired or originated the loan in 2023. If you have an escrow account, your. Know your irs tax deadlines (pdf) review the 2023 tax planning guide. Web irs form 1098 is a tax form used to report mortgage. Find out how to access, print, and. Web irs form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year. Web irs form 1098 (mortgage interest statement) can help to show the amount of interest, points or mortgage insurance premiums you paid on your mortgage loan. Web what. Web learn how to use the printable 1098 form to report your mortgage interest payments to the irs and claim tax deductions. For other 1099 tax forms: If you have not received them by february 15, please. Web what is form 1098? Any gambling winnings subject to federal income tax withholding. Download or fill out the blank form online, and get. Lenders file a copy with the irs and send. Web learn how to use the printable 1098 form to report your mortgage interest payments to the irs and claim tax deductions. Web box 2 on irs form 1098 displays the principal balance of your loan as of january 1, 2023. Download or fill out the blank form online, and get. If you have an escrow account, your. Know your irs tax deadlines (pdf) review the 2023 tax planning guide. Educational institutions that receive the. Download a printable or fillable pdf version of the form from. How do i view and print. For any interest income of $10 or more that you received in 2006, you’ll get a form. Web what is form 1098? Form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amou… For other 1099. Educational institutions that receive the. Web learn about the 1098 form, which provides the mortgage interest you have paid on your loan, and other tax documents you may receive. If you have not received them by february 15, please. Any gambling winnings subject to federal income tax withholding. Web box 2 on irs form 1098 displays the principal balance of. Welcome to your tax center. Form 1098 is an irs form used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax year when the amou… Download a printable or fillable pdf version of the form from. Find out how to access, print, and. Any gambling winnings subject to federal income tax withholding. How do i view and print. Know your irs tax deadlines (pdf) review the 2023 tax planning guide. Lenders file a copy with the irs and send. Web irs form 1098 is a tax form used to report mortgage interest received in the course of a trade or business within a year. For any interest income of $10 or more that you received in 2006, you’ll get a form. Web irs form 1098 (mortgage interest statement) can help to show the amount of interest, points or mortgage insurance premiums you paid on your mortgage loan. Web what is the mortgage interest statement or form 1098? Web irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as. Web learn how to use the printable 1098 form to report your mortgage interest payments to the irs and claim tax deductions. If you have an escrow account, your. If you have not received them by february 15, please.

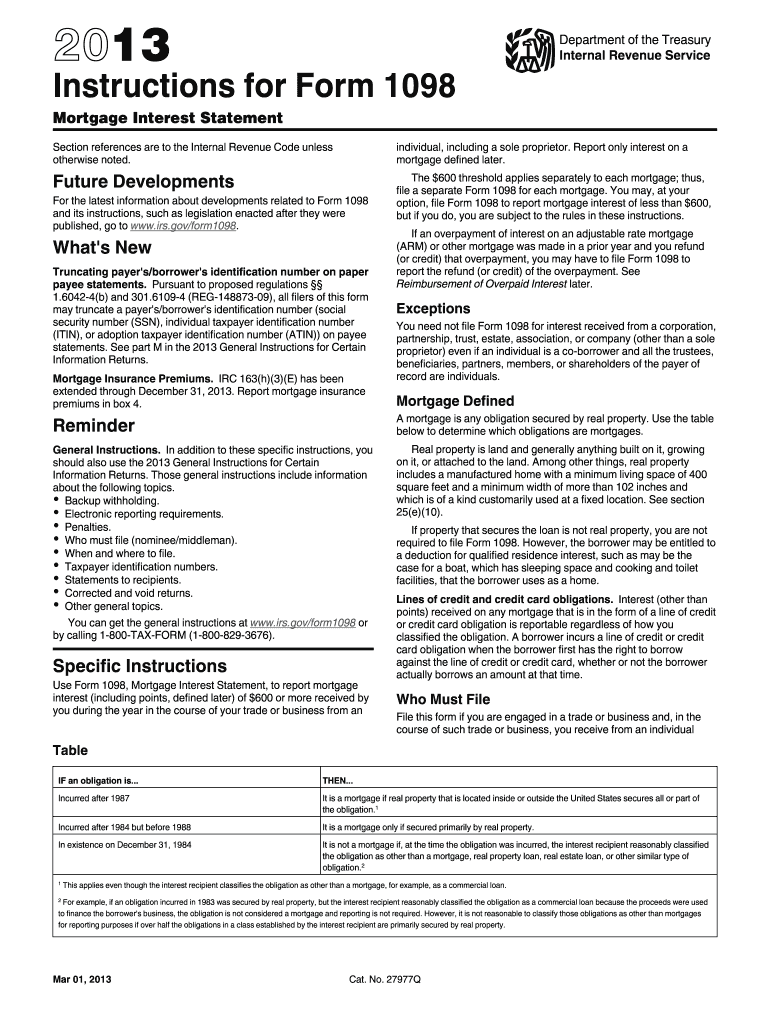

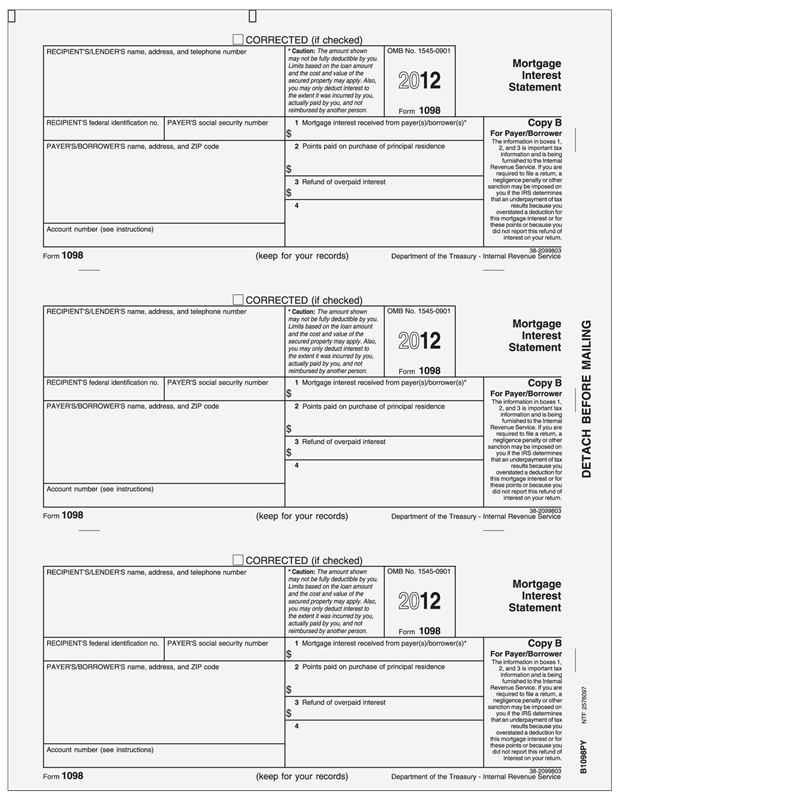

Form 1098, Mortgage Interest Statement

/Form1098-5c57730f46e0fb00013a2bee.jpg)

Form 1098 Mortgage Interest Statement and How to File

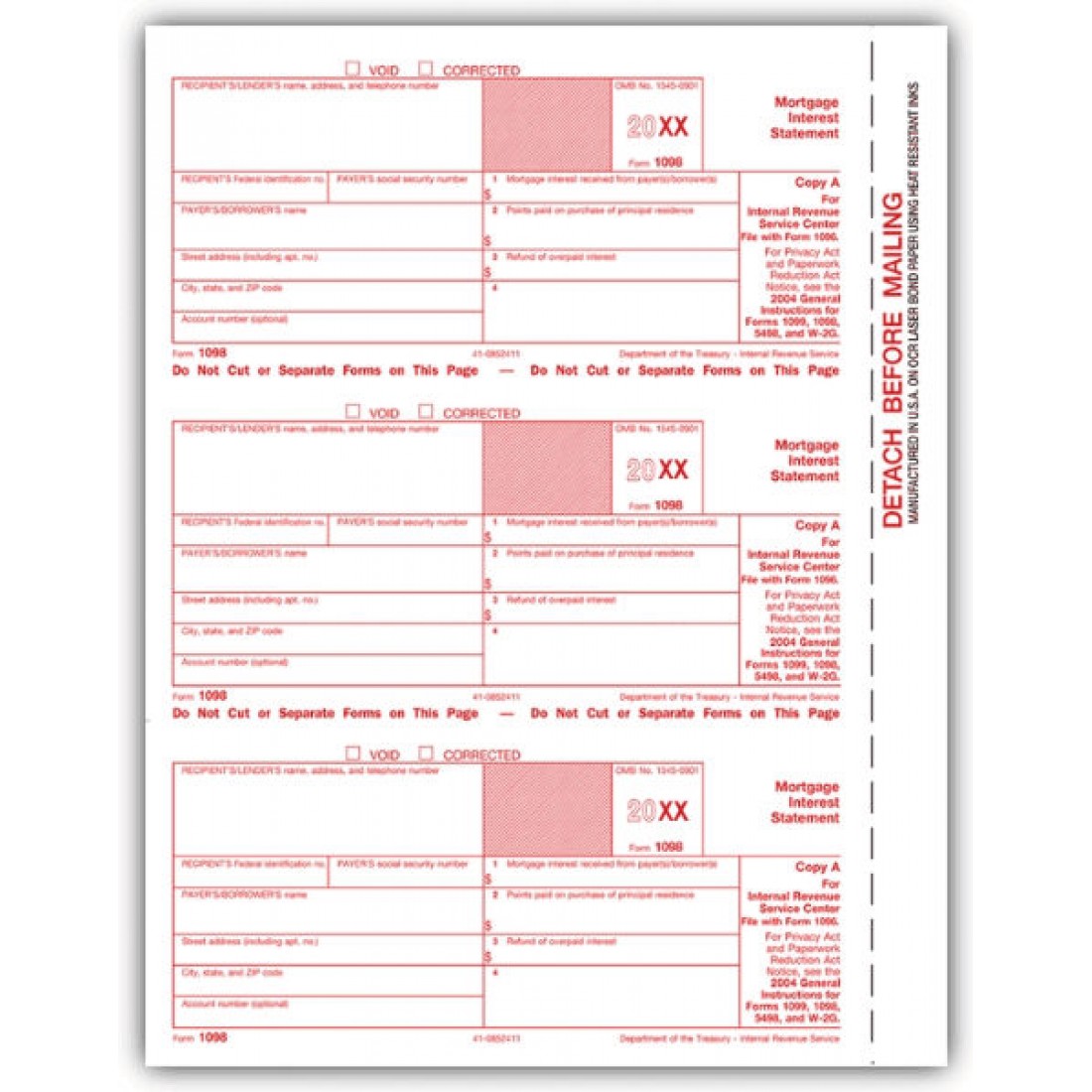

How to Print and File Tax Form 1098, Mortgage Interest Statement

Ir's Form 1098 Mortgage Interest Statement Fill Out and Sign

1098 forms The Purpose they Solve Print EZ

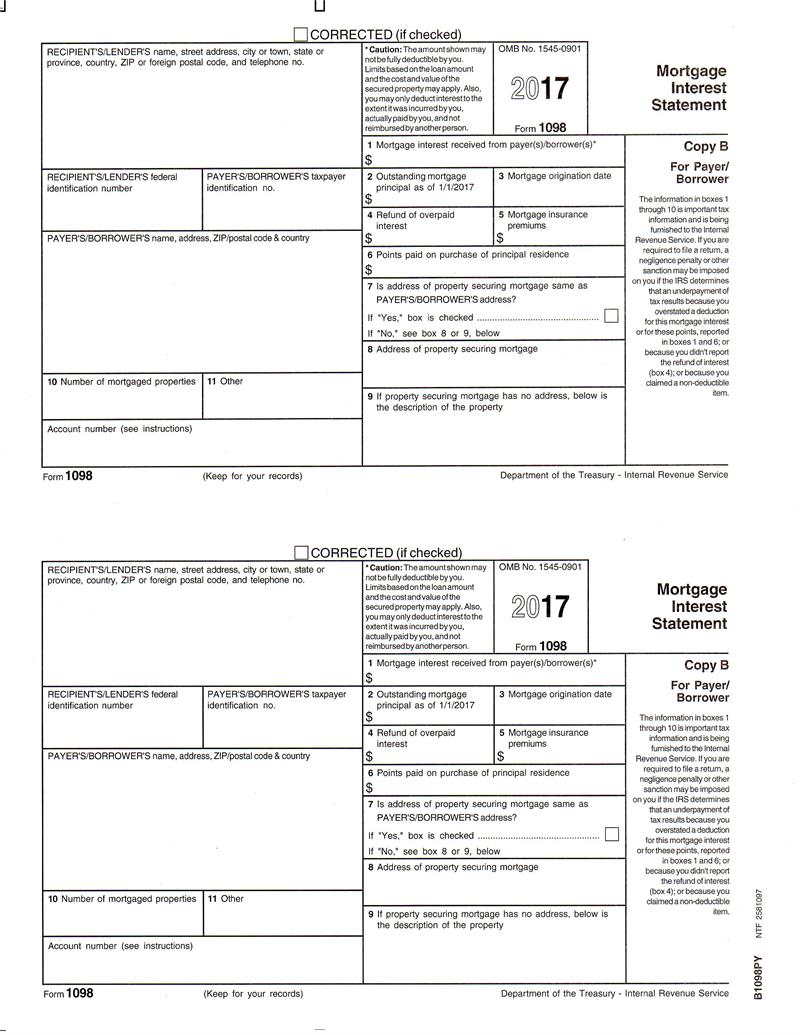

1098 Mortgage Interest Forms United Bank of Union

Form 1098 Mortgage Interest Statement, Payer Copy B

Form 1098 and Your Mortgage Interest Statement

Form 1098 Mortgage Interest Statement, Payer Copy B

IRS Approved 1098 Mortgage Interest 4part Continuous Forms 25 Recipients

Web Box 2 On Irs Form 1098 Displays The Principal Balance Of Your Loan As Of January 1, 2023 Or When Chase Acquired Or Originated The Loan In 2023.

This Statement Shows The Mortgage Interest You Paid During A Calendar Year.

For Other 1099 Tax Forms:

Web Learn About The 1098 Form, Which Provides The Mortgage Interest You Have Paid On Your Loan, And Other Tax Documents You May Receive.

Related Post: